IRS 1040 - Schedule 3 2020 free printable template

Show details

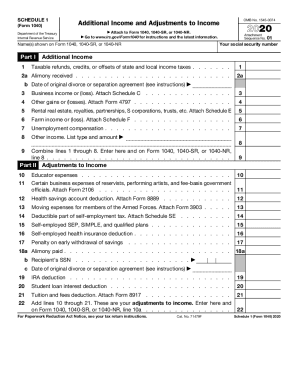

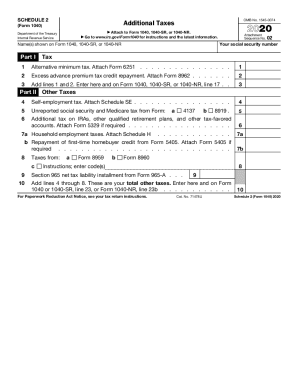

SCHEDULE 3

Department of the Treasury

Internal Revenue Service Go2020 Attach to Form 1040, 1040SR, or 1040NR.

To www.irs.gov/Form1040 for instructions and the latest information. Attachment

Sequence

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

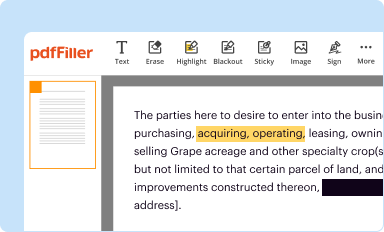

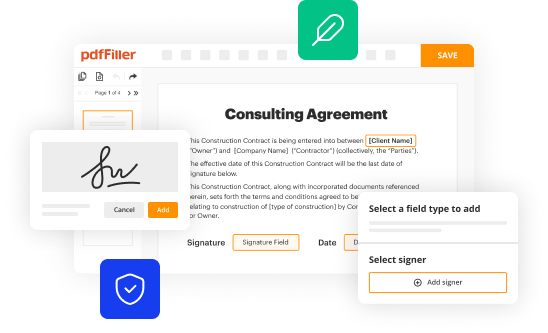

Edit your form 1040 schedule 3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

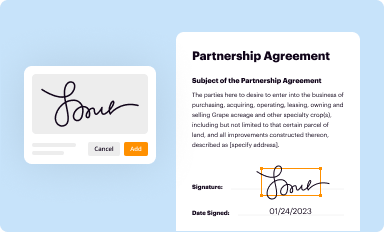

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

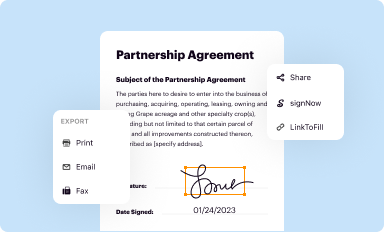

Share your form instantly

Email, fax, or share your form 1040 schedule 3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2020 form 1040 schedule 3 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit schedule 3 tax form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

IRS 1040 - Schedule 3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 1040 schedule 3

How to fill out schedule 3?

01

Begin by reviewing the instructions provided with schedule 3 to ensure you understand the purpose and requirements of this form.

02

Gather all necessary information and documentation related to the items or activities that need to be reported on schedule 3.

03

Fill in your personal details, such as your name, address, and taxpayer identification number, at the top of the form.

04

Follow the instructions on the form to report the specific details requested for each item or activity.

05

Double-check your entries for accuracy and completeness before submitting the form.

Who needs schedule 3?

01

Individuals or businesses who engage in certain types of activities or have specific financial transactions may be required to complete schedule 3.

02

Examples of situations that may require the filing of schedule 3 include reporting rental income, claiming certain deductions, or reporting additional taxes owed.

03

It is important to consult the relevant tax laws or a qualified tax professional to determine if schedule 3 is required in your specific situation.

Fill 2020 schedule 3 : Try Risk Free

People Also Ask about 2020 form 1040 schedule 3

How to fill out Schedule 3 for principal residence?

What is Schedule 3 capital gains and losses?

How do you use Schedule 3?

How do I fill out Schedule 3 for stocks?

Who fills out a schedule 3?

How do I fill out a Schedule 3?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is schedule 3?

Schedule 3 is a classification of drugs in the United States under the Controlled Substances Act. These drugs have a lower potential for abuse than those classified in Schedules 1 and 2, but have a higher potential for abuse than those in Schedules 4 and 5. Examples of drugs classified as Schedule 3 include some opiate analgesics, stimulants, depressants, and hallucinogens.

Who is required to file schedule 3?

Schedule 3 is required to be filed by individuals who have claimed a refundable tax credit — such as the Working Income Tax Benefit (WITB) or the Canada Child Benefit (CCB) — in the previous tax year.

What information must be reported on schedule 3?

Schedule 3 is used to report a variety of information, including:

1. Capital gains or losses from the disposition of capital assets.

2. Non-business income, such as interest, dividends, royalties, and rents.

3. Net income or loss from a business or profession.

4. Net income or loss from a rental property.

5. Net income or loss from farming or fishing.

6. Net income or loss from a limited partnership.

7. Net income or loss from a trust or estate.

8. Pension, annuity, or other income.

9. Social security and other income.

10. Alimony received.

11. Other income, such as prizes and awards.

When is the deadline to file schedule 3 in 2023?

The deadline to file Schedule 3 in 2023 is April 15, 2023.

How to fill out schedule 3?

Schedule 3 is a form used by individuals to report certain types of income and deductions. To fill out Schedule 3, follow these steps:

1. Identify if you need to file Schedule 3: Schedule 3 is required if you have any of the following:

- Income from sources such as self-employment, alimony, partnerships, rental real estate, royalties, and certain other types of income.

- Deductions such as educator expenses, health savings account deductions, certain business expenses, and other allowable deductions.

2. Obtain the necessary forms: You will need Form 1040 or 1040-SR, the main tax return form, in addition to Schedule 3. These forms can be obtained from the IRS website or by visiting a local IRS office.

3. Gather relevant documents: Collect all the necessary documents and records related to the income and deductions you plan to report on Schedule 3. This may include receipts, documents showing proof of income, records of business expenses, and any other supporting documents required.

4. Complete the form: Fill out the relevant sections of Schedule 3 based on the specific income or deductions you have. Each section will have instructions on what information needs to be entered. Make sure to double-check your entries for accuracy.

5. Transfer information to the main tax form: Once you have completed Schedule 3, transfer the final figures onto the appropriate lines on Form 1040 or 1040-SR. These figures will be used to calculate your overall tax liability or refund.

6. Review and submit: Review your completed Schedule 3 and the rest of your tax return for any mistakes or omissions. Ensure that all calculations are accurate. Once satisfied, sign and date your tax return, attach any necessary schedules or forms, and submit it to the IRS according to their guidelines.

Remember, the instructions for Schedule 3 provide detailed explanations for each line item. It's important to read and understand these instructions to ensure accurate completion. If you feel unsure or overwhelmed, consider seeking assistance from a qualified tax professional.

What is the purpose of schedule 3?

Schedule 3 refers to a specific section of a legal document or law, and its purpose can vary depending on the context. In general, the purpose of Schedule 3 is to provide additional details, requirements, or specifications that are related to the main document or law. It may include lists, forms, tables, or other supplemental information that is necessary for the proper understanding, implementation, or interpretation of the main document. The contents of Schedule 3 usually complement or support the provisions mentioned in the main body of the document, and their inclusion helps in organizing and categorizing various aspects for ease of reference and clarity.

What is the penalty for the late filing of schedule 3?

The penalty for late filing of Schedule 3 depends on the jurisdiction and the specific tax regulations in place. In general, late filing penalties can include fines, interest charges, or both. It is recommended to consult the tax regulations specific to your jurisdiction or consult a tax professional to determine the exact penalty for late filing of Schedule 3 in your situation.

How do I complete 2020 form 1040 schedule 3 online?

Easy online schedule 3 tax form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I edit schedule 3 2020 tax form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign schedule 3 2020 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit 2020 schedule 3 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute schedule 3 form from anywhere with an internet connection. Take use of the app's mobile capabilities.

Fill out your form 1040 schedule 3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule 3 2020 Tax Form is not the form you're looking for?Search for another form here.

Keywords relevant to form 1040 schedule 3

Related to 1040 schedule 3

If you believe that this page should be taken down, please follow our DMCA take down process

here

.