CA RI-PR038 - County of Riverside 2018-2024 free printable template

Show details

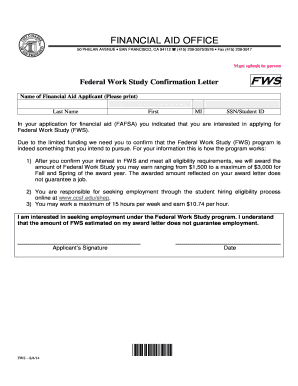

Optional TELEPHONE NO. E-MAIL ADDRESS Optional ATTORNEY FOR Name IN THE MATTER OF CASE NUMBER NOTICE TO FRANCHISE TAX BOARD Probate Code 9202 c You are hereby given notice of administration of the estate of the following person a. Decedent s Name b. SUPERIOR COURT OF CALIFORNIA COUNTY OF RIVERSIDE PALM SPRINGS 3255 E* Tahquitz Canyon Wy. Palm Springs CA 92262 RIVERSIDE 4050 Main St* Riverside CA 92501 TEMECULA 41002 County Center Dr. Ste. 100 Temecula CA 92591 RI-PR038 ATTORNEY OR PARTY...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your notice to franchise tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice to franchise tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice to franchise tax board probate code 9202 c online

Follow the steps down below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit probate code 9202 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out notice to franchise tax

To fill out the notice to franchise tax, do the following:

01

Obtain the necessary form from the relevant government agency or website.

02

Carefully read the instructions provided with the form to understand the requirements and ensure accurate completion.

03

Fill in all the required fields, including your personal or business information, such as name, address, and taxpayer identification number.

04

Provide the necessary financial information, such as income, expenses, and deductions, as specified on the form.

05

Double-check all the entries for accuracy and completeness before submitting the notice.

06

Make copies of the completed notice for your records.

As for who needs to file a notice to franchise tax, it depends on the specific tax laws and regulations of the jurisdiction in question. Generally, businesses that operate as franchises or are subject to franchise taxes may be required to file this notice. It is advisable to consult with a qualified tax professional or the appropriate government agency to determine if you or your business needs to file the notice to franchise tax.

Fill form : Try Risk Free

People Also Ask about notice to franchise tax board probate code 9202 c

What is the probate code for beneficiary notice?

How long does the executor have to pay the beneficiaries?

How long does an executor have to settle an estate in California?

What are California probate codes?

Who gets probate notice in California?

How long does an executor have to distribute funds in California?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file notice to franchise tax?

In most states, any business entity that is required to pay franchise taxes must file a notice with the appropriate state agency. This includes corporations, limited liability companies (LLCs), and limited partnerships. In some cases, other types of business entities may be required to file a notice as well.

When is the deadline to file notice to franchise tax in 2023?

The deadline to file notice to franchise tax in 2023 is March 15th.

What is notice to franchise tax?

A notice to franchise tax is a communication sent by a tax authority to a franchise business, informing them of their obligation to pay a specific amount of franchise tax. This notice typically includes details such as the amount due, due date, and instructions on how to make the payment. Franchise tax is a type of tax that some states impose on businesses operating under a franchise or doing business within their jurisdiction.

How to fill out notice to franchise tax?

Filling out a notice to franchise tax will vary depending on the specific requirements of your jurisdiction. However, here are some general steps you can follow:

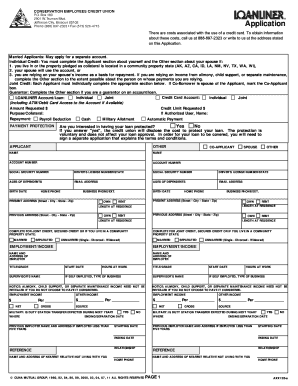

1. Download the appropriate form: Visit the website of your state's franchise tax board or regulatory agency and locate the form for the notice to franchise tax. Download and save it to your computer.

2. Read the instructions: Go through the instructions accompanying the form carefully. This will help you understand what information is required and how to fill out the form correctly.

3. Enter your business information: Provide the required information about your business, such as the legal name, address, contact details, and federal employer identification number (EIN) or state identification number.

4. Indicate the filing period: Identify the specific period for which you are filing the notice. This could be a fiscal year or a specific date range.

5. Calculate and enter your tax liability: Determine your franchise tax liability based on the formula specified in the form or instructions. Ensure you accurately calculate the tax due and enter the amount in the appropriate field.

6. Attach supporting documents: Review the form and instructions to determine if any supporting documents, such as financial statements or income reports, need to be attached. Make copies of these documents and securely attach them to the notice, if required.

7. Verify and sign: Recheck all the information you have provided on the form for accuracy and completeness. Sign and date the notice as required.

8. Submit the notice: Once you have completed the form, follow the instructions to submit it to the relevant tax authority. This may include mailing the notice, submitting it through an online portal, or hand-delivering it to a designated office.

Remember, it is essential to consult with a tax professional or attorney if you are uncertain about any aspect of completing the notice to franchise tax.

What is the purpose of notice to franchise tax?

The purpose of a notice to franchise tax is to inform a business or individual that they owe a franchise tax to the government. This notice serves as a reminder to the taxpayer to pay the required franchise tax by the due date. It may also include important information such as the amount owed, payment instructions, and contacts for further assistance. The franchise tax is a fee imposed by some states on certain types of businesses for the privilege of operating within their jurisdiction.

What information must be reported on notice to franchise tax?

The specific information required to be reported on a notice to franchise tax may vary depending on the jurisdiction. However, some common information that may need to be included is:

1. Legal name and registered address of the entity to which the notice is being sent.

2. Identification number or unique identifier of the entity (such as the state or federal tax identification number).

3. Date of notice.

4. Period for which the franchise tax is being assessed.

5. Amount of franchise tax being assessed.

6. Calculation or basis on which the franchise tax is being assessed.

7. Deadline or due date for payment or response to the notice.

8. Contact information for further inquiries or clarification.

9. Any specific instructions or documentation required to be submitted with the notice.

10. Any penalties or consequences for non-compliance or late payment.

11. Details on how to appeal or dispute the franchise tax assessment if applicable.

It is important to consult the relevant laws and regulations of the specific jurisdiction where the franchise tax applies to obtain accurate and up-to-date information on the requirements for reporting on a notice to franchise tax.

What is the penalty for the late filing of notice to franchise tax?

The penalty for the late filing of notice to franchise tax varies depending on the jurisdiction. In many cases, there is a fixed penalty fee or a percentage-based penalty on the amount of tax owed. It is best to consult the specific regulations and guidelines from the relevant tax authority or seek professional advice to determine the exact penalty for late filing of notice to franchise tax in a particular jurisdiction.

How can I edit notice to franchise tax board probate code 9202 c from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including probate code 9202 form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit california notice franchise tax board online?

With pdfFiller, the editing process is straightforward. Open your ca notice franchise tax board in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out notice franchise tax board on an Android device?

Complete your notice to franchise tax board probate form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your notice to franchise tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Notice Franchise Tax Board is not the form you're looking for?Search for another form here.

Keywords relevant to notice to franchise tax board probate code 9202 c form

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.