Get the free company llc form

Show details

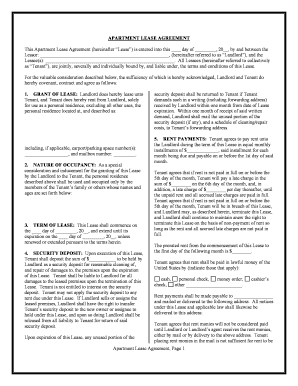

Prepared by U.S. Legal Forms, Inc. Copyright U.S. Legal Forms, Inc. LIMITED LIABILITY COMPANY FORMATION PACKAGE STATE OF TEXAS Control Number: TX00LLCThe contents of this package are as follows:1.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

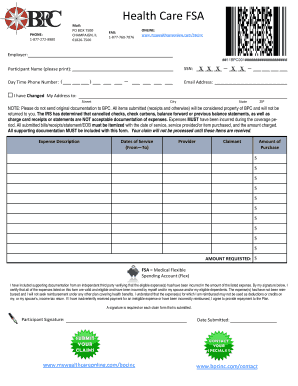

Edit your company llc form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your company llc form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit company llc online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit company llc create form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

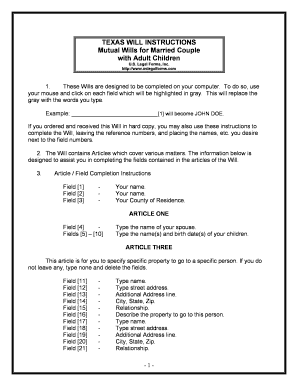

How to fill out company llc form

How to fill out company LLC:

01

Research the requirements: Start by researching the specific requirements for forming an LLC in your state. This may include filing fees, required documents, and any additional steps that need to be taken.

02

Choose a name for your company: Select a unique and appropriate name for your LLC that complies with the naming guidelines set by your state. Ensure that the name is not already registered by another business entity.

03

File the necessary paperwork: Prepare and file the required paperwork with the appropriate government agency in your state. This typically involves filling out the Articles of Organization or Certificate of Formation, which outlines essential information about your LLC.

04

Determine the management structure: Decide whether your LLC will be member-managed or manager-managed. In member-managed LLCs, all members actively participate in the business's operation. In manager-managed LLCs, designated managers handle the day-to-day operations.

05

Obtain an Employer Identification Number (EIN): Apply for an EIN from the Internal Revenue Service (IRS). This unique nine-digit number is used for federal tax purposes and is required for opening a business bank account, hiring employees, and filing taxes.

06

Create an operating agreement: Although not always required, it is highly recommended to create an operating agreement that outlines the LLC's ownership structure, decision-making processes, and distribution of profits and losses. This document helps prevent disputes among members and provides a clear understanding of the company's operating procedures.

07

Register for state and local taxes: Depending on your state and local regulations, you may need to register for various taxes, such as sales tax or employment tax, and obtain the necessary permits or licenses.

Who needs a company LLC:

01

Entrepreneurs starting a new business: Forming an LLC provides entrepreneurs with limited liability protection, separating personal assets from business liabilities. It also offers flexibility in terms of ownership structure and taxation options.

02

Small business owners: Small business owners can benefit from forming an LLC as it provides liability protection and potential tax advantages, such as the ability to pass through business profits and losses to personal tax returns.

03

Real estate investors: Many real estate investors choose to hold and manage their properties through an LLC to protect their personal assets from potential legal claims or property-related issues.

04

Professional service providers: Professionals like doctors, lawyers, and consultants often form LLCs to protect their personal assets from malpractice claims or other professional liabilities.

In conclusion, anyone looking for liability protection, flexible ownership structure, and potential tax advantages can consider forming an LLC. However, it is essential to consult with an attorney or accountant to understand the specific legal and financial implications based on individual circumstances.

Fill texas limited : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get company llc?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific company llc create form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I edit texas formation online?

The editing procedure is simple with pdfFiller. Open your texas company formation in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out texas formation form using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign tx llc form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Fill out your company llc form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Formation is not the form you're looking for?Search for another form here.

Keywords relevant to texas llc form

Related to texas llc create

If you believe that this page should be taken down, please follow our DMCA take down process

here

.