Get the free principal 401k rollover form

Show details

Mailing Address: P.O. Box 9351 Des Moines, IA 50306-9351 800-672-3343 Fax: 1-866-431-8410 Contribution/Rollover Submission Form Important Note: This form should accompany all contribution/rollover

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your principal 401k rollover form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your principal 401k rollover form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing principal 401k rollover form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit principal direct rollover form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

How to fill out principal 401k rollover form

How to fill out principal direct rollover form:

01

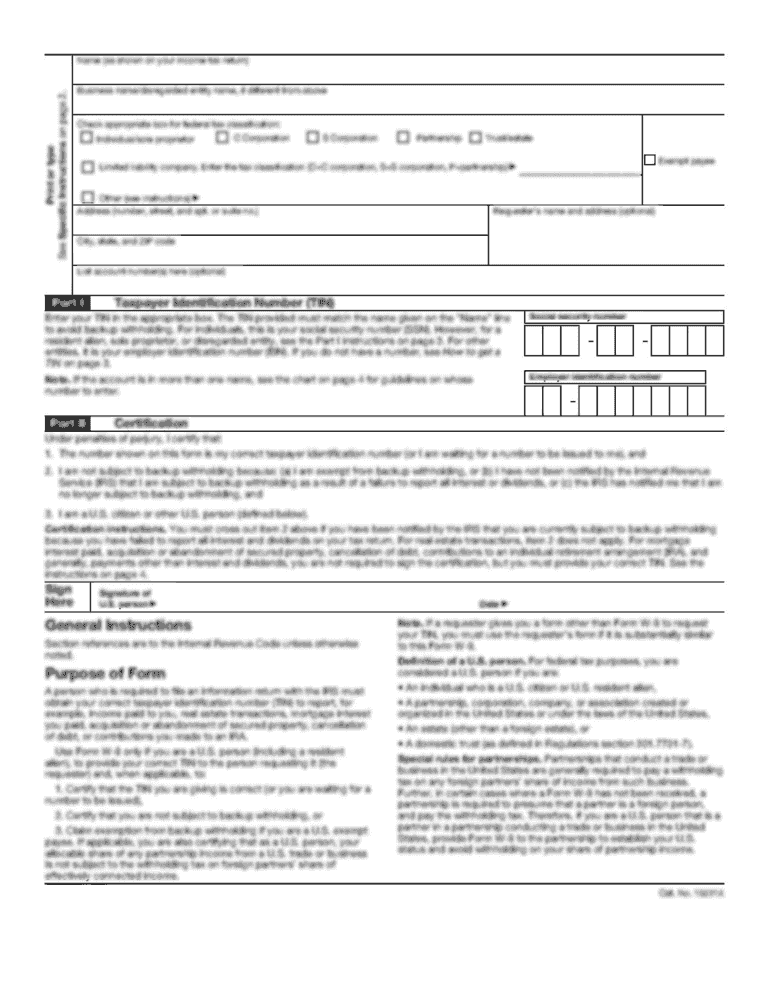

Gather necessary information: You will need to provide your personal details such as your name, address, and social security number. Additionally, you will need information about your retirement account, including the account number and the name of the plan administrator.

02

Indicate the reason for the rollover: On the form, you will need to specify that you are requesting a direct rollover of funds from your current retirement account to a new account, such as an individual retirement account (IRA).

03

Complete the rollover instructions: Provide the details of the receiving financial institution where you want the funds to be transferred. This includes the name of the institution, the account number, and any other necessary information as required by the form.

04

Choose the investment options: If you have specific investment preferences, indicate them on the form. This could include selecting certain mutual funds or specifying the investment allocation for the rollover funds.

05

Signature and date: Sign and date the form to confirm that the information provided is accurate and that you understand the terms and conditions of the direct rollover.

Who needs principal direct rollover form:

01

Individuals changing jobs or retiring: If you are leaving your current employer and want to transfer the funds from your employer-sponsored retirement plan to an individual retirement account (IRA) or a new employer's retirement plan, you will need to fill out the principal direct rollover form.

02

Individuals consolidating retirement accounts: If you have multiple retirement accounts and want to consolidate them into a single account, you may need to fill out the principal direct rollover form to initiate the transfer of funds.

03

Individuals who inherit retirement accounts: If you have inherited a retirement account and wish to transfer the funds to your own retirement account, you will likely need to complete the principal direct rollover form.

It is important to note that the exact circumstances and requirements for using a principal direct rollover form may vary depending on the specific retirement plan and financial institution involved. It is advisable to consult with the plan administrator or a financial advisor for guidance on completing the form correctly.

Fill principal 401k transfer form : Try Risk Free

People Also Ask about principal 401k rollover form

How long do you have to rollover a 401k to a new employer?

How do I request a rollover from my principal 401K?

How much does principal financial charge for rollover?

How do I roll over my 401K to a new employer's plan?

Is it a good idea to rollover 401k to new employer?

Is there a fee to rollover 401K principal?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is principal 401k rollover form?

The Principal 401k Rollover Form is a document provided by Principal Financial Group, a financial services company, that allows individuals to transfer their retirement savings from a previous employer's 401k plan into a new retirement account. This form typically requires the account holder to provide personal information, details about the previous 401k account, and instructions on where the funds should be deposited. The purpose of a 401k rollover is to consolidate retirement savings and potentially have more control over investment options.

Who is required to file principal 401k rollover form?

The individual who wishes to roll over funds from their principal 401(k) account into another eligible retirement account is required to file the principal 401(k) rollover form. This form typically needs to be completed and submitted by the account holder to initiate the rollover process.

How to fill out principal 401k rollover form?

Filling out a Principal 401k rollover form involves providing essential information about the account holder and the receiving institution. Here are the steps to complete the form:

1. Obtain the rollover form: Contact Principal or visit their website to download the rollover form. This form may also be available through your employer's HR department or retirement plan administrator.

2. Personal Information: Enter your personal details, such as your full name, Social Security number, date of birth, address, and contact information. Ensure accuracy, as any mistakes may cause delays or errors.

3. Account Information: Provide the necessary details about your Principal 401k account, such as the account number and the current balance. You may also need to include your employer's information, plan name, and plan number.

4. Rollover Destination: Indicate where you want to transfer the funds by providing the receiving institution's name, address, and account information. This could be another retirement plan, an individual retirement account (IRA), or a financial institution offering rollover services.

5. Rollover Type: Decide the type of rollover you want to initiate:

a. Direct Rollover: The funds are transferred directly from your Principal 401k account to the receiving institution, without passing through your hands.

b. Indirect Rollover: The funds are distributed to you, and you have 60 days to deposit the money into another qualified retirement account. Keep in mind that this method involves potential tax consequences, including taxes and penalties, if the funds are not deposited within the specified time.

6. Signature: Read the terms and conditions carefully, and sign the form as required by Principal. Ensure the signature matches the name provided earlier.

7. Submit the form: Once completed, send the rollover form to the designated address provided by Principal. You may choose to mail it or submit it electronically, depending on the instructions given.

It is essential to contact Principal or consult a financial advisor if you have any questions or concerns while filling out the form. They can guide you through the process and provide assistance specific to your situation.

What is the purpose of principal 401k rollover form?

The purpose of a Principal 401k rollover form is to initiate the process of transferring funds from a former employer's 401k plan to a new retirement account, such as an Individual Retirement Account (IRA) or a new employer's 401k plan. This form serves as a request to Principal, the financial institution, to facilitate the rollover and transfer the funds from the existing 401k account to the designated new account.

What information must be reported on principal 401k rollover form?

When rolling over a 401(k), the following information is generally required to be reported on the rollover form:

1. Personal Information: This includes the participant's full name, Social Security number, address, date of birth, and contact details.

2. Employer Information: The name and address of the employer sponsoring the 401(k) plan.

3. Account Details: The account number, plan name, and type of account (401(k)) that is being rolled over.

4. Transfer Details: Information about the receiving financial institution, such as the name, address, and account number of the receiving IRA or retirement account.

5. Rollover Request: The date and amount or percentage of assets the participant intends to roll over from the 401(k) to the new IRA or retirement account.

6. Tax Withholding: If the participant opts for tax withholding, the rollover form may require them to specify the amount or percentage they want to have withheld for federal and state taxes.

7. Signature and Date: The participant must sign and date the rollover form, indicating that the information provided is accurate and authorizing the transfer.

It's important to note that specific forms and requirements may vary depending on the financial institution or employer's plan administrator. Participants should consult their plan administrator or financial advisor for the correct form and any additional information needed for a smooth rollover process.

What is the penalty for the late filing of principal 401k rollover form?

The penalty for late filing of a principal 401k rollover form can vary depending on the specific circumstances and regulations set by the Internal Revenue Service (IRS). Generally, individuals must complete and file the 401k rollover form within 60 days of receiving a distribution from their 401k account.

If the form is filed late, the distribution may be treated as a taxable event, and the individual may be required to pay income taxes on the funds withdrawn from the 401k. Additionally, if the individual is under the age of 59 ½, they may also be subject to a 10% early withdrawal penalty.

It is important to note that there may be options available to correct the late filing, such as utilizing the IRS's self-certification process for late rollovers due to certain circumstances, like an error or delay from a financial institution. It is recommended to consult with a tax professional or financial advisor to get specific advice based on your situation.

How do I edit principal 401k rollover form straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing principal direct rollover form, you need to install and log in to the app.

How do I edit principal rollover form on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign principal financial rollover form right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

Can I edit principal 401k direct rollover form on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as principal financial address for rollover form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your principal 401k rollover form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Principal Rollover Form is not the form you're looking for?Search for another form here.

Keywords relevant to principal 401k rollover to ira form

Related to principal financial 401k rollover

If you believe that this page should be taken down, please follow our DMCA take down process

here

.