CA FL-196 2020-2024 free printable template

Show details

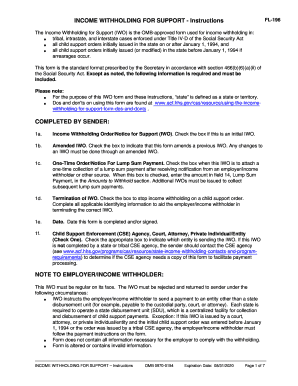

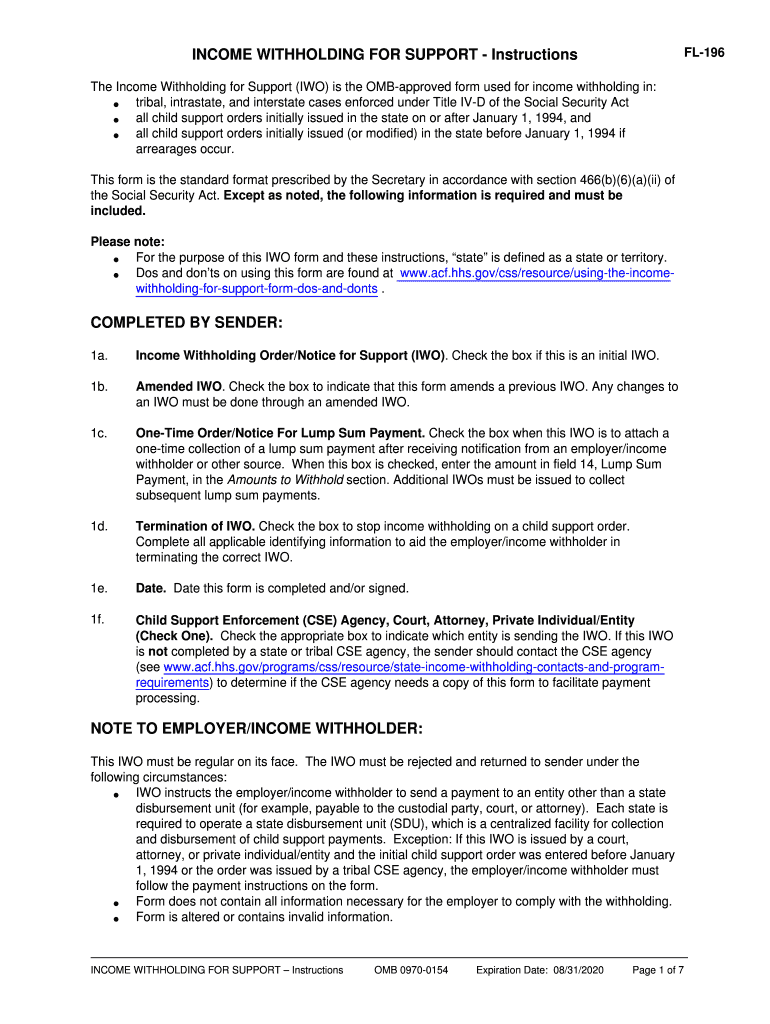

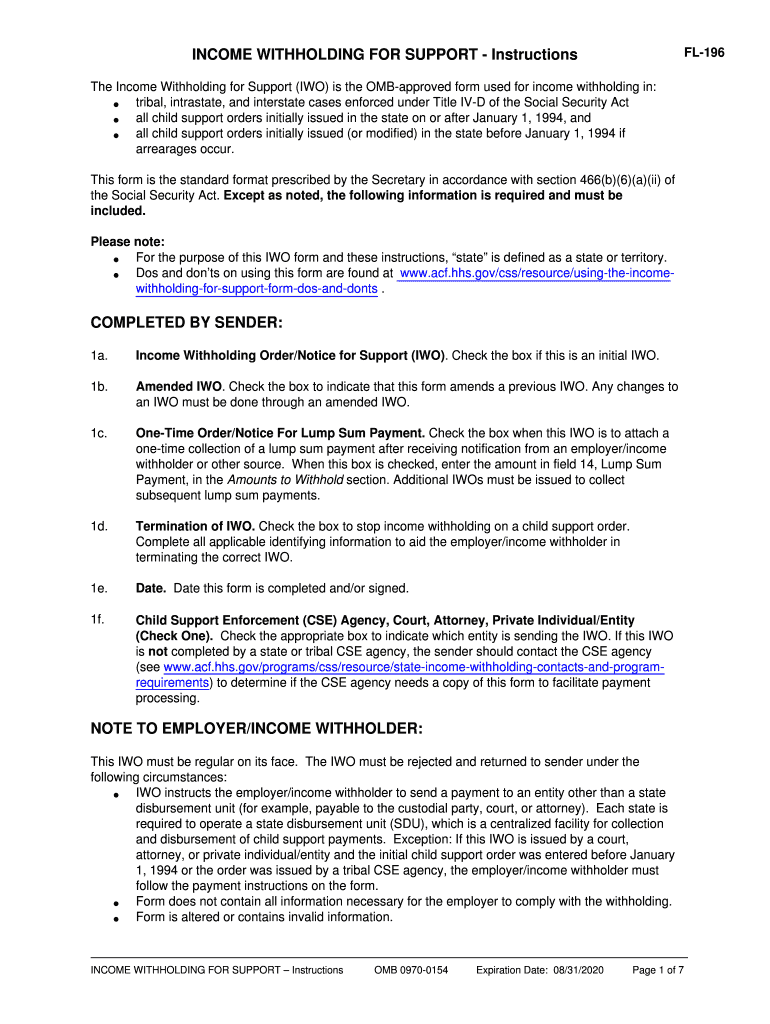

FL-196 INCOME WITHHOLDING FOR SUPPORT - Instructions The Income Withholding for Support IWO is the OMB-approved form used for income withholding in Tribal intrastate and interstate cases as well as all child support orders which are initially issued in the State on or after January 1 1994 and all child support orders which are initially issued or modified in the State before January 1 1994 if arrearages occur. This form is the standard format prescribed by the Secretary in accordance with USC...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your california withholding support 2020-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california withholding support 2020-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit california withholding support online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit support instructions form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

CA FL-196 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out california withholding support 2020-2024

How to fill out California withholding support:

01

Gather all necessary information and forms: You will need your personal information, including name, Social Security number, and contact details. Additionally, make sure to have your employer's information and earnin statements.

02

Complete the required forms: The main form you need to fill out is the California Employee's Withholding Allowance Certificate (Form DE 4). This form will determine the amount of taxes to be withheld from your paycheck. Carefully follow the instructions provided on the form to fill it out correctly.

03

Consider additional forms if applicable: Depending on your situation, you may need to fill out other forms related to specific circumstances. For example, if you are claiming exemptions or have multiple jobs, you may need to complete additional forms such as the Multiple Worksite Report (Form DE 34) or the Nonresident Withholding Waiver Request (Form 588).

04

Submit the completed forms: Once you have filled out all the necessary forms, make copies for your records and submit the originals to your employer. They will use this information to calculate the correct withholding amount for your paycheck.

Who needs California withholding support:

01

Employees in California: Any individual who is employed in the state of California and earns income is required to have California withholding support. This ensures that the correct amount of state taxes is withheld from their paychecks.

02

Self-employed individuals: Even if you are self-employed, you may still need to have California withholding support. In this case, you would need to make estimated tax payments throughout the year to cover your state tax obligations.

03

Individuals with multiple jobs or income sources: If you have multiple jobs or receive income from various sources, you may need to adjust your withholding allowances accordingly. This will help ensure that enough taxes are withheld to cover your overall tax liability.

Note: It is always recommended to consult with a tax professional or the California Franchise Tax Board for personalized advice regarding your specific tax situation.

Video instructions and help with filling out and completing california withholding support

Instructions and Help about ca income withholding form

Fill fl196 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is california withholding support?

California withholding support is a tax taken out of an employee's paycheck for state taxes. This tax is used to fund the state government's various services, like public schools, roads, and health care.

Who is required to file california withholding support?

The California withholding tax is imposed on employers who are required to withhold and remit state income tax from their employees' wages. Employers must register with the California Employment Development Department (EDD) to obtain a State Employer Identification Number (SEIN) and must file withholding forms accordingly.

What is the purpose of california withholding support?

California withholding support is a program set up by the State of California to withhold a percentage of an employee's pay to cover state taxes. The purpose of this program is to ensure that employees pay their taxes in a timely manner, as well as to help the state collect the necessary revenue to fund public services.

What information must be reported on california withholding support?

California state income tax withholding must be reported on the California Employee's Withholding Allowance Certificate (DE 4) form. This form must include the employee's name, address, social security number, number of withholding allowances claimed, marital status, and signature. The employer must also include their name, address, and the number of withholding allowances claimed by the employee.

What is the penalty for the late filing of california withholding support?

In California, the penalty for late filing of withholding support depends on the specific circumstances. Generally, if an employer fails to report and remit the amounts withheld for child support within the required timeframes, they may be subject to penalties as follows:

1. Late Filing Penalty: Failure to file the required report may result in a penalty of $20 for each day the report is late, up to a maximum of $1,000.

2. Late Payment Penalty: Failure to remit the withheld amounts in a timely manner may incur a penalty of 10% of the amount owed.

Additionally, the employer may be held liable for any damages caused to the custodial parent or child due to their failure to comply with withholding support requirements.

It is important to note that these penalties are subject to change and may vary depending on the specific circumstances and the discretion of the relevant authorities. It is advisable to consult the appropriate government agency, such as the California Franchise Tax Board or the California Department of Child Support Services, for the most accurate and up-to-date information.

How to fill out california withholding support?

To fill out the California withholding support form, also known as the DE-4, follow these steps:

1. Download the DE-4 form from the California Employment Development Department (EDD) website or obtain a copy from your employer.

2. Begin by providing your personal information in Section 1, including your full name, Social Security number, and current address.

3. In Section 2, you will declare your marital status by checking the appropriate box (single, married, head of household, or registered domestic partner). If you are married and both spouses work, refer to the instructions on the form to determine which type of marital status should be selected.

4. Section 3 requires you to claim allowances, which determine the amount of income tax to be withheld from your paycheck. To calculate this accurately, you can follow the instructions included with the form or use the DE-4 worksheet provided by the EDD. The worksheet will help you determine the number of allowances you are eligible to claim based on your filing status, dependents, and other applicable factors.

5. If you have any additional amount you would like to withhold from each paycheck to cover extra taxes or deductions, you can enter this amount in Section 4.

6. Section 5 should only be completed if you wish to claim exemption from withholding altogether. To qualify for exemption, you must meet certain criteria outlined on the form and consult the instructions or refer to the IRS Publication 505 to ensure your eligibility.

7. After completing the necessary sections, sign and date the form in Section 6.

8. Submit the completed and signed DE-4 form to your employer for processing. Keep a copy for your records.

Note: If you have complex tax situations, it is advisable to consult a tax professional or refer to the instructions provided with the DE-4 form to ensure accurate completion.

How can I send california withholding support for eSignature?

Once your support instructions form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make edits in california income withholding support form without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your fl 196 form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I complete fl 196 on an Android device?

Complete support instructions pdf form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your california withholding support 2020-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

California Income Withholding Support Form is not the form you're looking for?Search for another form here.

Keywords relevant to california fl 196 form

Related to fl196 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.