Get the free 1099 s form

Get, Create, Make and Sign

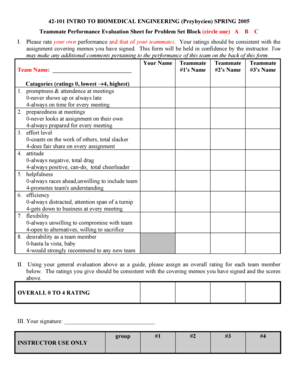

How to edit 1099 s form online

How to fill out 1099 s form

How to fill out 1099 s form?

Who needs 1099 s form?

Video instructions and help with filling out and completing 1099 s form

Instructions and Help about irs form 1099

All right welcome everybody my name is Doug and this is webinar Steiner business solutions is putting on a guide to 1099s and explain a little what they're for who has to file them who doesn't, and then they go into how you can actually file them through QuickBooks, so there's a list of structural stuff and basic general knowledge about the 1099 themselves, but I'm also the knight billions of the QuickBooks there's a lot of different ways to file them what QuickBooks is one way you can actually print them right out of there and if you're already doing the bookkeeping in QuickBooks and that makes it really simple for you so let's go ahead and pull up a 1099 here alright, so the purpose of a 1099 form is basically for companies to report what they've paid to other subcontractors but other individuals or companies that subcontracted services to and this is basically a double check for the IRS to make sure that those companies are reporting their income so similar to the w2 how the w2's are sent off for employees of companies this is what you do in pretending as you do these four sub contractors subcontractors can then use these 1099 to help repair their own personal tax returns and like I said you're sending copies of these to dial s as well so the IRS and old what you've paid them subs basically the rules are this these are who would qualify for a 1099 if you're looking at your vendors at least $10 and oil teams will pay to them broker payments in lieu of dividends or tax-exempt interest not one that's used a lot these are used a little more at least if you paid your vendor at least six hundred dollars in rents that's a very important one services performed by some whose not an employee again that could be a business, or it could be an individual prizes and awards now there's another income payment category which includes a bunch of little things of nineties very much another one in medical and health care payments now this is not health care premiums these are the payments directly to doctors physician offices hospitals that kind of thing for specific services not for insurance health insurance premiums over six hundred dollars in crop insurance proceeds and another one not used very much cash payments or fish another one not used for it much and finally payments to an attorney so if you paid an attorney over six hundred dollars you need to file a ten on the line for them, so that's if you have any of those if any of the vendors paid $600 or more to the year if fall into one of those categories you're probably going to have to deal with 1099 for them now let's go over some exclusions to those examples generally a payment to a corporation which would include an LLC that filed as an S corp Laura Second you would not have to file for so if you happen to know that the company is incorporated there Escapes C Corp or if you know the Derna LLC business, but they file as an S corp receipt book then you do not have to do a 1099 now I warn you off the top...

Fill 1099 s form download : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 1099 s form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.