Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

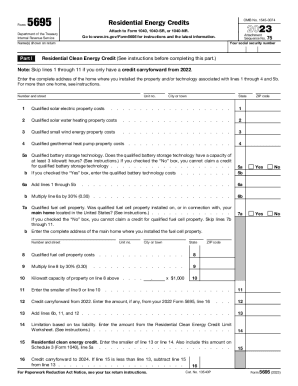

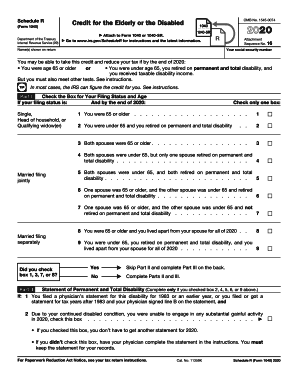

IRS credits are tax credits given to taxpayers for reducing the amount of taxes owed. Credits are usually provided for things such as childcare expenses, education expenses, or energy-efficient home improvements. Some credits can be refunded if the amount of the credit is greater than the amount of taxes owed.

What is the purpose of irs credits?

IRS credits are tax credits that reduce the amount of taxes a person or business has to pay. They are designed to incentivize people to engage in certain activities or to help those in need. Examples of credits include the earned income tax credit, the child tax credit, the American opportunity credit, and the energy efficient home credit.

What is the penalty for the late filing of irs credits?

The penalty for filing taxes late is usually 5% of the unpaid taxes for each month or part of a month that a return is late, up to a maximum of 25% of the unpaid taxes. In addition, if taxes are not paid by the due date, a failure-to-pay penalty of 0.5% of the unpaid taxes may be added for each month or part of a month after the due date, up to 25%.

Who is required to file irs credits?

Taxpayers who meet the eligibility criteria for various tax credits offered by the Internal Revenue Service (IRS) are required to file for those credits. The specific tax credits and their requirements can change each year, but some common credits that may require filing include:

1. Earned Income Tax Credit (EITC): Individuals with lower incomes who meet specific criteria may qualify for the EITC. They must file a tax return and complete Schedule EIC to claim this credit.

2. Child Tax Credit (CTC): Parents or legal guardians with qualifying dependent children may be eligible for the CTC. They must file a tax return and complete Schedule 8812 to claim this credit.

3. Additional Child Tax Credit (ACTC): If the amount of CTC exceeds your tax liability, you may be eligible for the ACTC. It requires filing a tax return and completing Schedule 8812.

4. American Opportunity Tax Credit (AOTC): Eligible students or their parents may claim the AOTC for qualified education expenses. They must file a tax return and complete Form 8863.

5. Child and Dependent Care Credit: Taxpayers who paid for child or dependent care services to enable them to work or look for work may qualify for this credit. They must file a tax return and complete Form 2441.

6. Premium Tax Credit: Individuals who purchased health insurance through the Health Insurance Marketplace may be eligible for this credit. They must file a tax return and complete Form 8962.

These are just a few examples, and there are many other tax credits available. It's important for taxpayers to review the eligibility requirements for each credit and determine if they need to file to claim them. It is advisable to consult a tax professional or refer to the IRS website for specific instructions related to each credit.

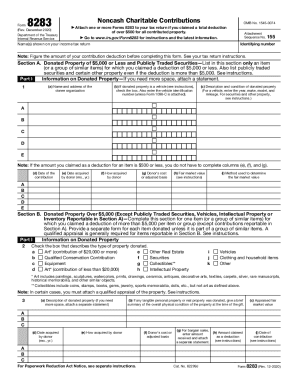

How to fill out irs credits?

To properly fill out IRS credits, you need to follow these steps:

1. Obtain the necessary forms: Determine which IRS credits you are eligible for and obtain the appropriate forms. You can usually find these forms on the IRS website.

2. Review the eligibility requirements: Read the instructions and eligibility criteria for each credit you plan to claim. Make sure you meet all the requirements, as each credit has specific criteria that must be met.

3. Gather supporting documents: Collect any required supporting documents, such as receipts, invoices, or proof of expenses, that may be needed to claim the credit. Ensure you have all the necessary documentation to substantiate your claim.

4. Fill out the forms: Carefully complete each section of the forms, providing accurate and detailed information. Double-check your entries to avoid errors.

5. Calculate the credit: If the credit involves calculations, make sure you compute them accurately. Use the instructions provided on the form or seek professional assistance if needed.

6. Attach additional forms or schedules: Some credits may require additional forms or schedules to be completed and attached to the main form. Follow the instructions provided to ensure you include any necessary supporting documents.

7. Double-check your work: Review all the information you entered on the forms before submitting them. Mistakes or omissions may result in delays or rejection of your claim.

8. Sign and file the forms: Sign the completed forms and file them by mail or electronically, depending on the instructions provided by the IRS. Be sure to file within the specified deadline for the particular credit.

9. Keep copies of everything: Make copies of all the documents you submitted, including the forms and supporting materials. Retain them for your records in case of any future inquiries or audits.

It is worth noting that IRS credits can be complicated, and it may be beneficial to seek assistance from a tax professional or utilize reputable tax software to ensure accuracy and maximize your eligible credits.

What information must be reported on irs credits?

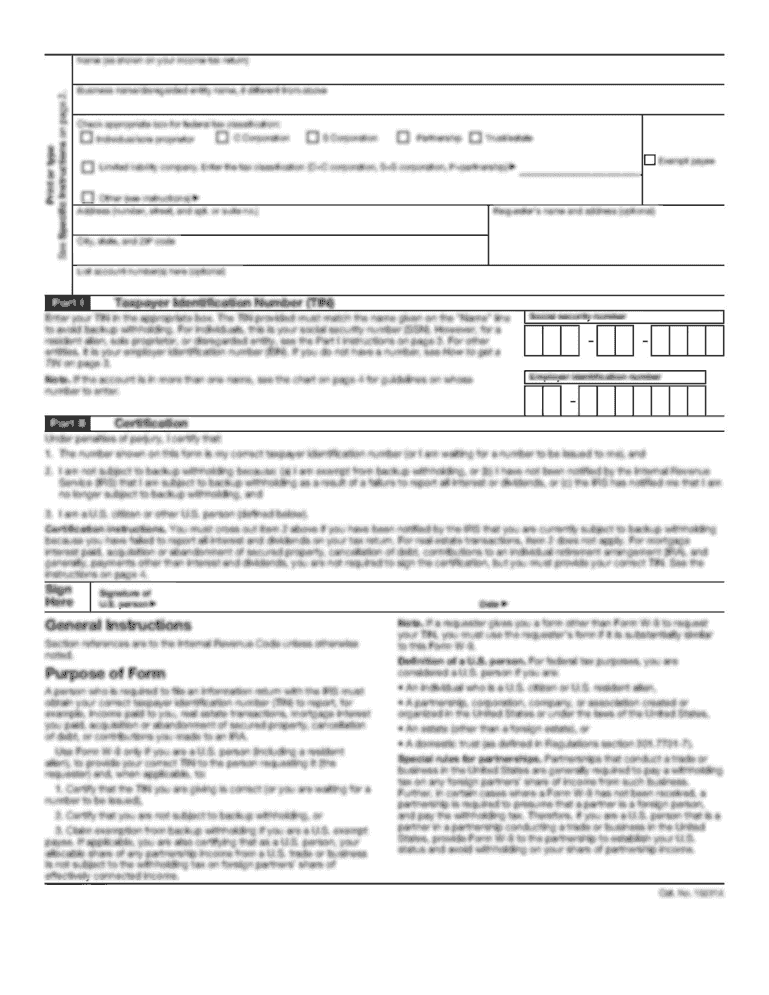

When reporting IRS credits on your tax return, you will generally have to provide the following information:

1. Name and social security number (or individual taxpayer identification number) of the taxpayer claiming the credit.

2. Type of credit claimed (such as Child Tax Credit, Earned Income Tax Credit, Education Credits, etc.).

3. The amount of credit you are eligible to claim based on eligibility criteria.

4. Any excess or partially refundable credits that need to be reported.

5. Supporting documentation and proof of eligibility for the credit, which may include various documents like Form 1098-T for education credits, Schedule EIC for Earned Income Tax Credit, or other relevant forms and receipts.

It's essential to review the specific requirements for each credit you are claiming and consult the IRS guidelines, instructions, or publications related to each credit to ensure accurate reporting.

When is the deadline to file irs credits in 2023?

The IRS has not yet announced the specific deadline for filing credits in 2023. Typically, the deadline for filing federal income tax returns, including any associated tax credits, is April 15th of each year. However, this date may vary slightly depending on weekends and holidays. It is always recommended to check with the IRS or a tax professional for the most up-to-date information on filing deadlines.

How do I make edits in irs credits without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your credits form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit 2020 residential energy straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing 2020 residential credits.

How do I complete 2020 irs pdf on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your 2020 irs fillable form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.