Get the free publication 523 worksheet form

Show details

Department of the Treasury Internal Revenue Service Publication 523 Contents Introduction ........................................................ 2 Chapter 1. Main Home .......................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your publication 523 worksheet form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 523 worksheet form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing publication 523 worksheet online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sale of home worksheet pdf form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out publication 523 worksheet form

How to fill out publication 523 pdf?

01

Begin by downloading the publication 523 pdf from a reliable source or the official website of the organization.

02

Open the downloaded file using a pdf reader or editor.

03

Carefully read the instructions and explanations provided in the publication. Take note of any specific requirements or guidelines mentioned.

04

Enter your personal information, such as your name, address, and social security number, in the designated sections of the form.

05

Review the form to identify any sections or fields that require additional documentation or supporting materials. Collect and attach these documents to the form as necessary.

06

Follow the step-by-step instructions provided to complete each section of the publication. Some sections may require you to provide detailed information about your income, expenses, deductions, or credits.

07

Double-check all the information you have entered to ensure accuracy and completeness. Mistakes or omissions may lead to delays or issues with your submission.

08

Once you have filled out all the required sections of the publication, save your progress or print a copy for your records. It is always recommended to keep a copy of your completed form for future reference.

09

If required, sign and date the form as indicated. Some sections may require additional signatures from certain parties, such as a spouse or tax preparer.

10

Submit the completed publication 523 pdf, along with any necessary attachments or supporting documents, as instructed by the organization or agency to which you are submitting the form.

Who needs publication 523 pdf?

01

Individuals who have sold or are planning to sell their primary residence.

02

Individuals who have experienced a loss due to a casualty or theft of their property.

03

Individuals who are claiming deductions for home mortgage interest or real estate taxes.

04

Individuals who are seeking to understand the tax implications and benefits associated with homeownership.

05

Individuals who are engaged in a like-kind exchange or involuntary conversion of property.

06

Individuals who are eligible for the exclusion of gain from the sale of a main home but have special circumstances.

07

Tax professionals or preparers who assist clients with tax planning or filing requirements related to homeownership or property transactions.

Fill irs publication 523 for 2020 : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

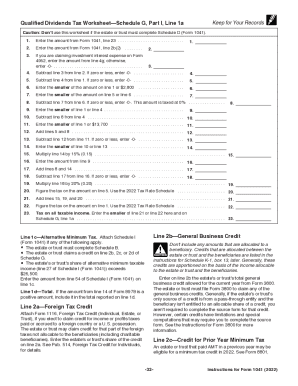

How to fill out publication 523 worksheet?

1. Go to the IRS website and download the Publication 523 worksheet.

2. Read through the instructions on the worksheet and gather the necessary information, such as purchase price, date of purchase, and improvements made to the home.

3. Enter the information into the appropriate fields on the worksheet.

4. Calculate your deduction.

5. Record the deduction amount on your return for Line 13 of Form 1040 or Line 6 of Form 1040A.

6. Attach a copy of the completed worksheet to your tax return.

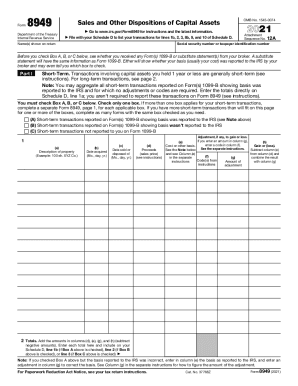

What is the purpose of publication 523 worksheet?

The Publication 523 Worksheet is used to calculate the taxable gain or loss from the sale or exchange of a taxpayer's principal residence. It is also used to determine if any of the gain is excluded from taxation.

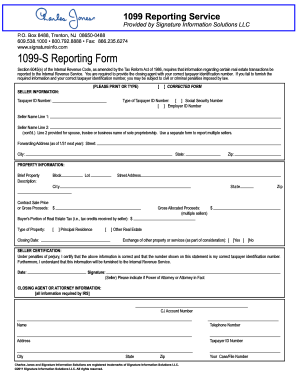

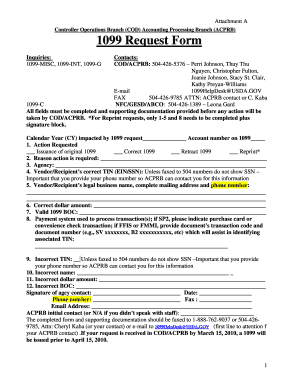

What information must be reported on publication 523 worksheet?

The Publication 523 worksheet requires information about the home you are selling, including its address, purchase price, purchase date, and any improvements made to the home. It also requires information about any expenses related to the sale, such as real estate commissions, title and escrow fees, and any capital gains taxes paid. You must also provide details about any exclusions, deductions, or credits you are claiming related to the sale. Finally, you must calculate the net gain or loss on the sale.

What is the penalty for the late filing of publication 523 worksheet?

The penalty for late filing of Publication 523 worksheet is a fine of up to $50,000.

What is publication 523 worksheet?

Publication 523 is a document published by the Internal Revenue Service (IRS) in the United States. It provides information regarding the rules and regulations for selling a home and how to report any capital gains or losses on the sale.

The worksheet referred to in Publication 523 is a series of questions and calculations designed to help individuals determine the amount of taxable gain or loss from the sale of their home. It helps calculate the adjusted basis, which is used to determine the taxable gain.

It is important to consult the most recent version of Publication 523 and follow the instructions provided by the IRS for accurate reporting and understanding of any tax implications related to the sale of a home.

Who is required to file publication 523 worksheet?

Publication 523 worksheet is typically used by homeowners who have sold or plan to sell their home and want to determine if they qualify for tax exclusion on the capital gains from the sale. It is not required to file the worksheet itself, but it can be helpful in calculating and reporting the capital gains exclusion on the individual's tax return.

How can I manage my publication 523 worksheet directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your sale of home worksheet pdf form and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I execute publication 523 pdf online?

Completing and signing irs 523 publication online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I edit irs 523 worksheet in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your irs publication 523 form, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Fill out your publication 523 worksheet form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Publication 523 Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to publication 523 form

Related to publication 523 worksheet 2

If you believe that this page should be taken down, please follow our DMCA take down process

here

.