Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Tax filing is the process of submitting tax returns to the Internal Revenue Service (IRS) or other governmental tax authority. This process involves filing income tax returns, calculating taxes owed or refunds due, and providing the necessary supporting documentation.

Who is required to file tax filing?

In the United States, anyone who meets the minimum income requirements set by the IRS must file a tax return. This includes individuals, businesses, and organizations. Generally, individuals must file a tax return if their gross income is more than the standard deduction amount for their filing status.

What information must be reported on tax filing?

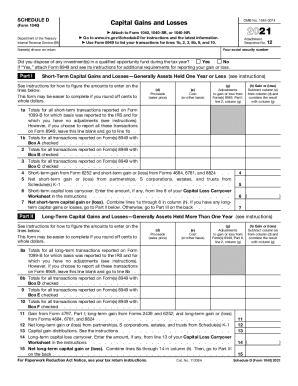

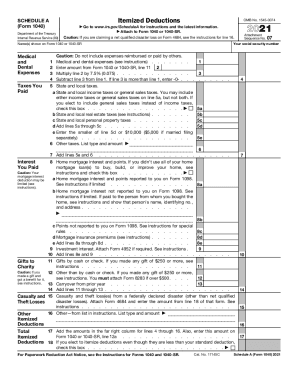

The information that must be reported on tax filing includes income, deductions, credits, and any payments made throughout the year. Additionally, additional forms may need to be submitted depending on the taxpayer's individual situation, such as those related to self-employment, investments, or foreign income.

When is the deadline to file tax filing in 2023?

The deadline to file taxes in 2023 is April 15th, 2023.

How to fill out tax filing?

Filling out tax filing can vary depending on your specific situation, but here are some general steps to help you get started:

1. Gather all necessary documents: Collect your W-2 forms, 1099 forms, receipts for expenses, and any other relevant documents for income, deductions, and credits.

2. Determine your filing status: Determine whether you will file as single, married filing jointly, married filing separately, head of household, or qualifying widow(er). Your filing status affects your tax rates and deductions.

3. Calculate your income: Add up all your sources of income, including wages, dividends, interest, self-employment earnings, and other taxable income. If you have multiple forms or sources, ensure you report them correctly.

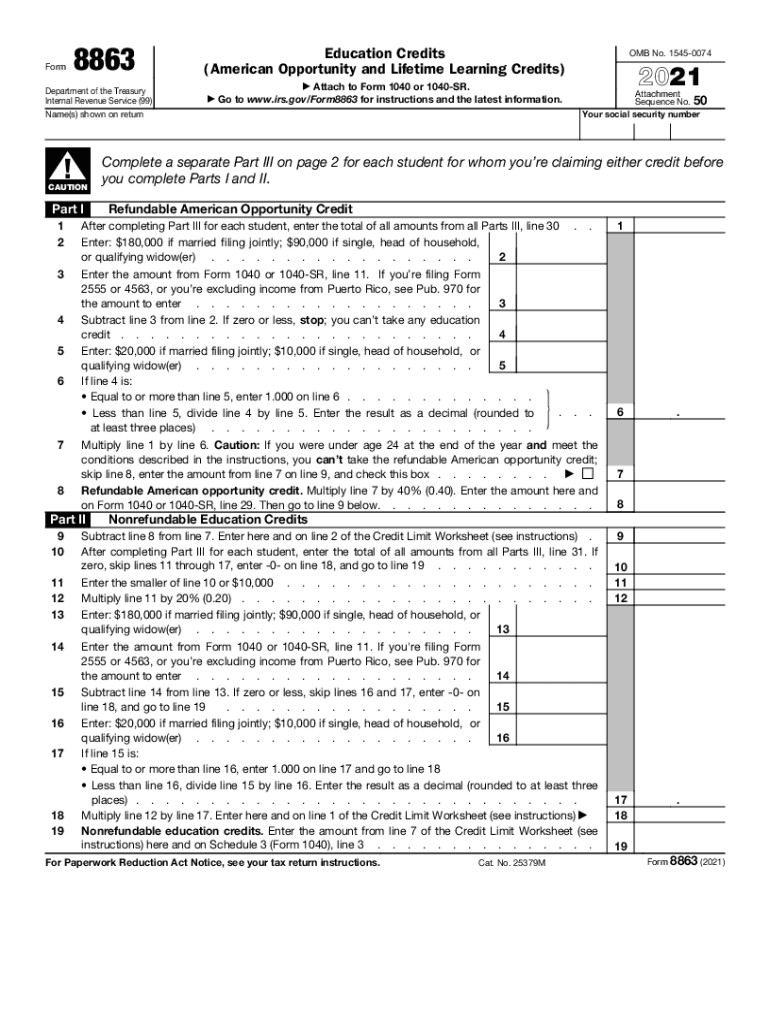

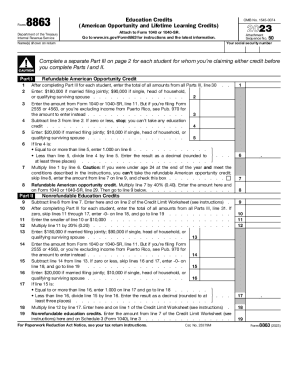

4. Take deductions and credits: Identify which deductions (such as student loan interest, mortgage interest, or state and local taxes) and credits (such as child tax credit or education credits) you may be eligible for. Deductions and credits reduce your taxable income and potentially decrease your tax liability.

5. Fill out the forms: Use the appropriate tax forms, such as Form 1040, 1040A, or 1040EZ, to enter your personal information, income, deductions, credits, and any other required information. Be accurate and careful when filling out the forms.

6. Perform the calculations: Calculate your taxable income, taking into account deductions and credits. Make sure to follow the instructions provided on the forms or use tax software to avoid mistakes.

7. Sign and submit: Once you have completed the forms and double-checked for errors, sign and date your tax return. If filing electronically, follow the instructions given by the tax software to submit your return. If mailing a paper return, include any required supporting documents and send it to the appropriate address.

8. Payment or refund: If you have a balance due, submit your payment along with your tax return. If you are expecting a refund, have it deposited electronically into your bank account or receive a paper check, depending on your preference.

It's important to note that these steps provide general guidance and may not cover all possible tax situations. For more complex filings or if you have specific questions, consider consulting a tax professional or using tax software that can provide personalized help.

What is the purpose of tax filing?

The purpose of tax filing is to report and declare one's income, deductions, and credits to the government, specifically to the tax authority, such as the Internal Revenue Service (IRS) in the United States. By filing taxes, individuals and businesses fulfill their legal obligation to contribute a portion of their earnings to fund public services and government operations. Tax filing allows the government to calculate the amount of tax owed or refund due, enforce compliance with tax laws, and maintain a transparent record of individuals and businesses' financial activities. It also provides a platform for taxpayers to claim deductions, exemptions, and credits that may reduce their overall tax liability.

What is the penalty for the late filing of tax filing?

The penalty for late filing of taxes varies depending on the jurisdiction and the specific circumstances. In the United States, for example, the penalty is typically calculated as a percentage of the unpaid tax amount. The penalty for late filing is generally 5% of the unpaid tax for each month or partial month that the return is late, up to a maximum of 25% of the unpaid tax. However, if a tax return is more than 60 days late, the minimum penalty is the lesser of $435 or 100% of the unpaid tax. It's important to note that these penalties can be subject to change and may have different regulations in different jurisdictions, so it is advisable to consult with a tax professional or refer to the tax authority's guidelines for the most accurate and up-to-date information.

Can I create an electronic signature for signing my tax filing in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your irs form 8863 for and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out irs form 8863 using my mobile device?

Use the pdfFiller mobile app to fill out and sign form 8863. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I fill out tax form 8863 on an Android device?

On Android, use the pdfFiller mobile app to finish your irs form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.