TX TREC 32-2 2008-2024 free printable template

Show details

PROMULGATED BY THE TEXAS REAL ESTATE COMMISSION (TREE) 06-30-08 CONDOMINIUM RESALE CERTIFICATE EQUAL HOUSING OPPORTUNITY (Section 82.157, Texas Property Code) Condominium Certificate concerning Condominium

pdfFiller is not affiliated with any government organization

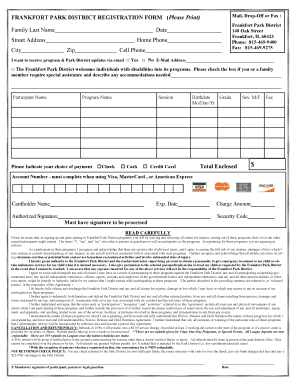

Get, Create, Make and Sign

Edit your how to texas resale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to texas resale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how to texas resale online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit blank resale certificate texas form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out how to texas resale

How to fill out printable Texas tax exempt:

01

Obtain the printable Texas tax exempt form from the official Texas state tax website or from a local tax office.

02

Carefully read and understand the instructions provided with the form to ensure accurate completion.

03

Fill in the required personal information, such as your name, address, and Social Security number.

04

Indicate the reason for claiming the tax exemption by selecting the appropriate category on the form.

05

If necessary, provide supporting documents or explanations to substantiate your claim for tax exemption.

06

Double-check all the information you have entered on the form to ensure accuracy and completeness.

07

Sign and date the form before submitting it to the appropriate tax authority.

Who needs printable Texas tax exempt:

01

Individuals or businesses that qualify for tax exemption in Texas.

02

Organizations recognized as tax-exempt under section 501(c) of the Internal Revenue Code.

03

Nonprofit organizations, religious institutions, and certain government agencies are some examples of entities that may need a printable Texas tax exempt form to claim their exemption.

Fill printable texas tax exempt form : Try Risk Free

People Also Ask about how to texas resale

Does Texas have a tax exemption certificate?

How do I get a tax exempt form in Texas?

Does Texas require a tax exempt number?

How do I get a tax exempt resale certificate in Texas?

What is the form for 30 day hotel tax exemption in Texas?

How do you qualify for tax exemption in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out printable texas tax exempt?

To fill out a printable Texas Tax Exempt Form, you will need to provide the following information:

1. Your name, address, and contact information

2. The type of tax exemption you are claiming

3. Your Social Security Number or Federal Tax ID Number

4. A signed and dated affidavit affirming your eligibility for the exemption

5. Any supporting documentation required to prove your eligibility

6. A copy of the completed form for your records.

Once you have gathered all of the necessary information and documents, you can fill out the form. Once you have completed the form, you can mail it in to the Texas Comptroller of Public Accounts.

What is the purpose of printable texas tax exempt?

Printable Texas tax exempt forms are used by Texas residents to claim exemption from sales and use tax on purchases of items intended for resale, leasing, or rental. The forms also can be used to claim exemption from hotel occupancy tax and mixed beverage tax.

What information must be reported on printable texas tax exempt?

The information that must be reported on a printable Texas tax exempt form includes the name of the exempt organization, the organization's tax identification number, the reason for the exemption, and the name and signature of the authorized representative.

When is the deadline to file printable texas tax exempt in 2023?

The deadline to file printable Texas tax exempt forms in 2023 is April 15, 2023.

What is printable texas tax exempt?

Printable Texas tax exempt refers to tax exemption certificates or forms that can be downloaded from the Texas Comptroller's website and printed by individuals or businesses to claim exemption from paying sales and use taxes on certain purchases in the state of Texas. These certificates are used to establish exemption from sales tax when buying items for resale, manufacturing equipment, raw materials, agricultural products, and more, as allowed by Texas tax laws.

Who is required to file printable texas tax exempt?

In Texas, certain entities and individuals may be required to file a Texas Tax Exempt form, also known as the Texas Sales and Use Tax Exemption Certificate. This form is used to claim exemption from the state's sales and use tax when purchasing taxable items.

The following entities typically need to file a Texas Tax Exempt form:

1. Nonprofit organizations: Nonprofit organizations, such as charitable, educational, and religious organizations, that qualify for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code may be eligible for a sales tax exemption.

2. Government entities: Federal, state, and local government entities are generally exempt from sales and use tax for purchases made in the course of official business.

3. Agricultural and timber producers: Farmers, ranchers, and timber producers engaged in the production of agricultural or timber products may qualify for a tax exemption on specified items used in their operations.

4. Manufacturing and processing plants: Manufacturers and processors engaged in certain activities defined by Texas law may be eligible for sales tax exemptions on certain machinery, equipment, and raw materials used in their production processes.

5. Certain institutions of higher education: Texas colleges, universities, and other higher education institutions may be exempt from sales tax for purchases made in the course of educational, research, or public service activities.

It is important to note that specific eligibility requirements and exemption categories may vary. It is recommended to consult the Texas Comptroller of Public Accounts or a tax professional to determine if you or your organization qualifies for tax-exempt status and to understand the necessary filing requirements.

What is the penalty for the late filing of printable texas tax exempt?

The penalty for the late filing of a printable Texas tax exempt form depends on the specific circumstances and the type of tax exemption being filed for. Generally, the penalty for late filing of tax forms in Texas is a percentage of the tax due per month, capped at a maximum percentage.

For example, if the late filing penalty is assessed at 5% per month, and the maximum penalty is 25%, then if the tax due is $1,000, the penalty for late filing after one month would be $50 (5% of $1,000), and if the late filing continues for five months, the penalty would be capped at $250 (25% of $1,000).

It is important to note that these penalty rates and maximums can vary depending on the specific tax and exemption form being filed. It is recommended to consult the Texas Comptroller of Public Accounts or a tax professional for the most accurate and up-to-date information regarding penalties for late filing of printable Texas tax exempt forms.

How can I get how to texas resale?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific blank resale certificate texas form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I make changes in fillable resale certificate texas?

The editing procedure is simple with pdfFiller. Open your texas resale tax certificate in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit texas resale blank straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing texas sales tax resale certificate form right away.

Fill out your how to texas resale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fillable Resale Certificate Texas is not the form you're looking for?Search for another form here.

Keywords relevant to texas sales and resale certificate form

Related to certificate resale tx

If you believe that this page should be taken down, please follow our DMCA take down process

here

.