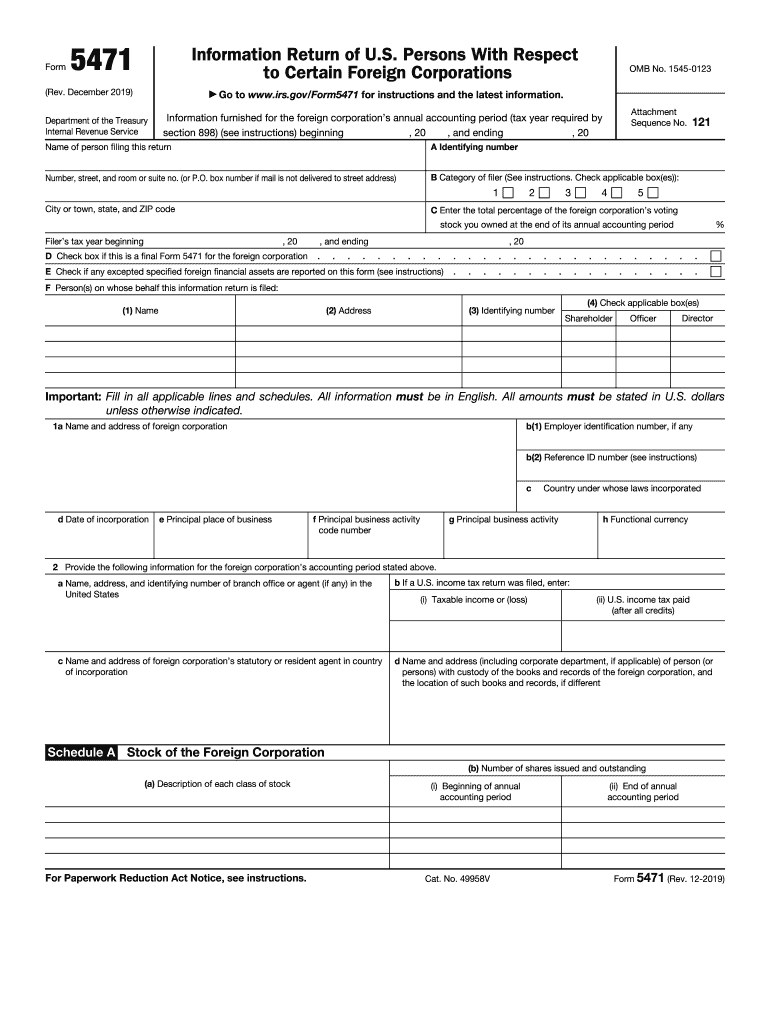

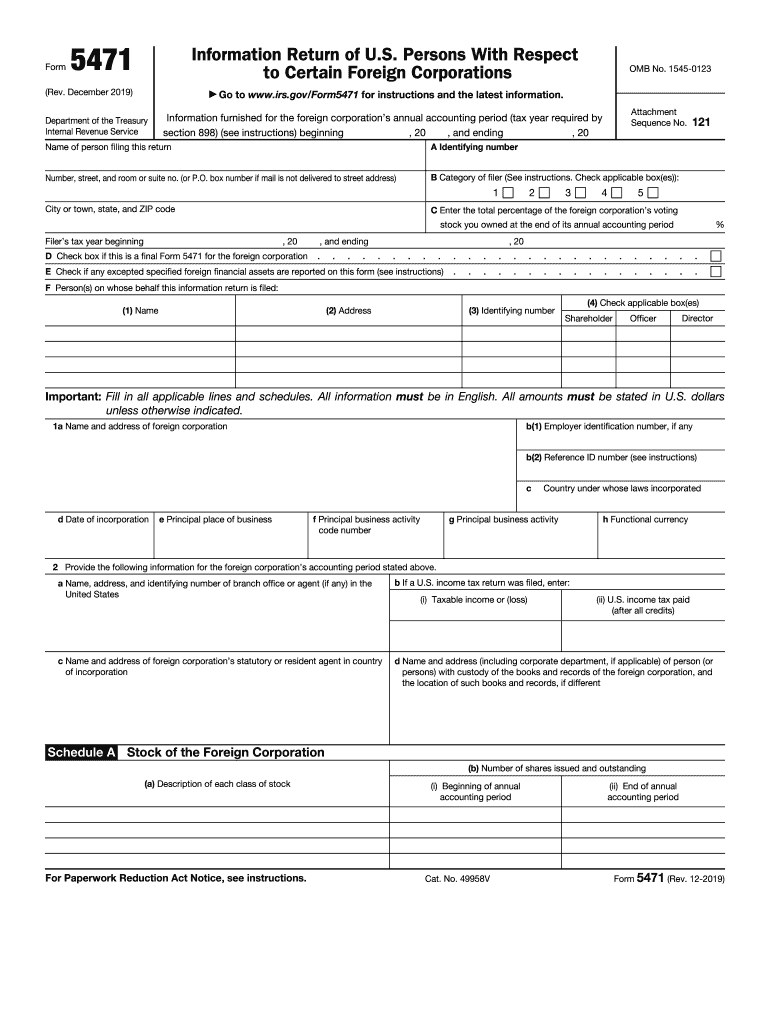

IRS 5471 2019 free printable template

Get, Create, Make and Sign

How to edit form 5471 online

IRS 5471 Form Versions

How to fill out form 5471 2019

How to fill out form 5471:

Who needs form 5471:

Video instructions and help with filling out and completing form 5471

Instructions and Help about 2016 form 5471

Today were talking about forum 54 71 mm-hm, but if were going to talk about that forum the first thing we need to talk about is CFC's great or controlled foreign corporations right controlled foreign corporations and this is where you know this is I'm going to go over some terms that the first time I heard him I definitely my eyes glazed over and maybe the tenth time I heard of my eyes glazed over, so it takes a while to break things down okay so lets back off a little well just say controlled foreign corporations those are three words we can put together without too much confusion right so what is a know what's a corporation well it's a corporation actually MMM that know that lets just say entity foreign means offshore and controlled means foe controlled by 50 percent or more of a US person okay, so there's a controlled foreign corporation now why the heck is it important I think is the real question to ask what does it mean why would you care why do you want to avoid it, and it all comes down and if were going to talk about and were talking about international taxation and if were going to talk about international taxation we shouldn't go any further if were not going to talk about deferral okay, so this is one of the terms that may cause you to glaze over as it did to me the first time I heard about this and so many years ago, so deferral is the game of all international tax planning that's what you're trying to do when you move things off short typically okay for a tax planning for tax planning purposes trying to reduce your tax if you're looking to avoid taxes the whole thing you do it is to defer taxes so that whatever grows overseas grows tax-free just like a 401k exactly and so then the question is look why don't you just use a 401k and then stead of going through all these things well because you make too much money you don't qualify so for a lot or and the investment might not be what you're really looking to do to then you know the 401k is only going to be in certain things you're not going to be able to do you know a smaller medium-sized business that you know the business really well exactly, so that's what you're trying to do deferring your income means it can grow tax and just some basic calculations on the differences of it so lets just say that you have an 8 return a year, and it's allowed to grow tax-free, and you start with 100000 okay at the end you'd have three hundred forty thousand dollars and that's after thirty years that's after thirty years now of course what if now and its when you repatriate the money bring it back to the US is what it becomes taxable okay, so that three forty there would be tax due on the principle if you were bringing the whole thing back in one year which most people wouldn't do right to the US compare that if is you were now that eight percent is only yielding you 5 after-tax which is a pretty fair assumption at the end you'll have to you have two hundred fifty thousand dollars okay but at least...

Fill irs fillin forms 5471 : Try Risk Free

People Also Ask about form 5471

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 5471 2019 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.