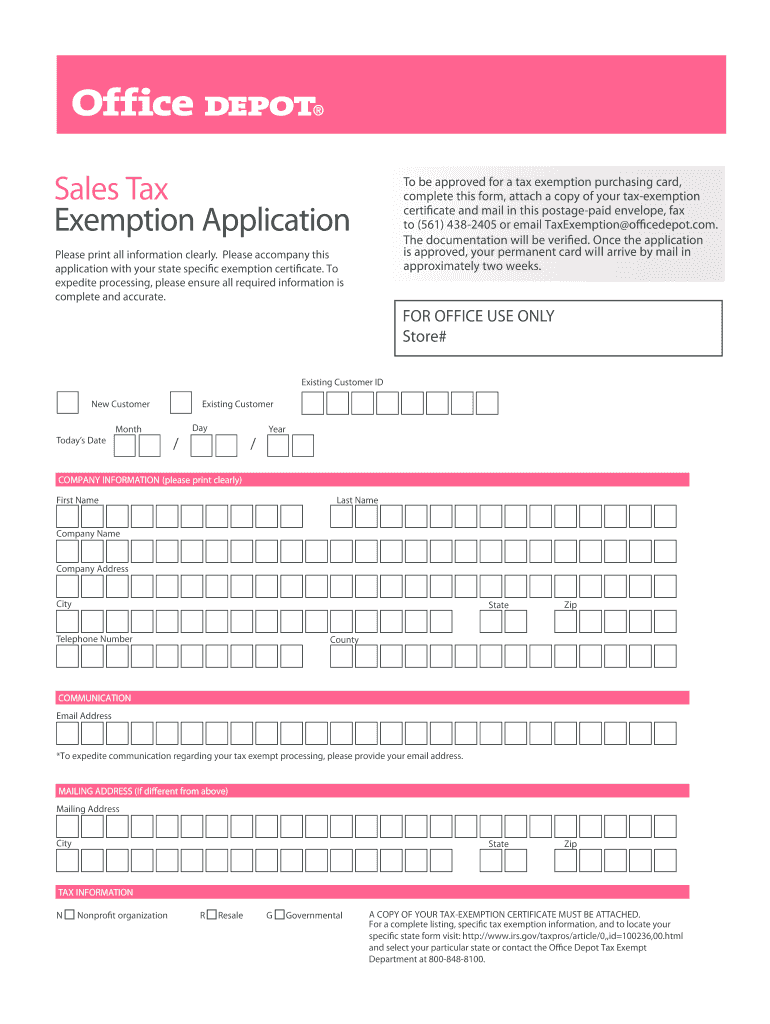

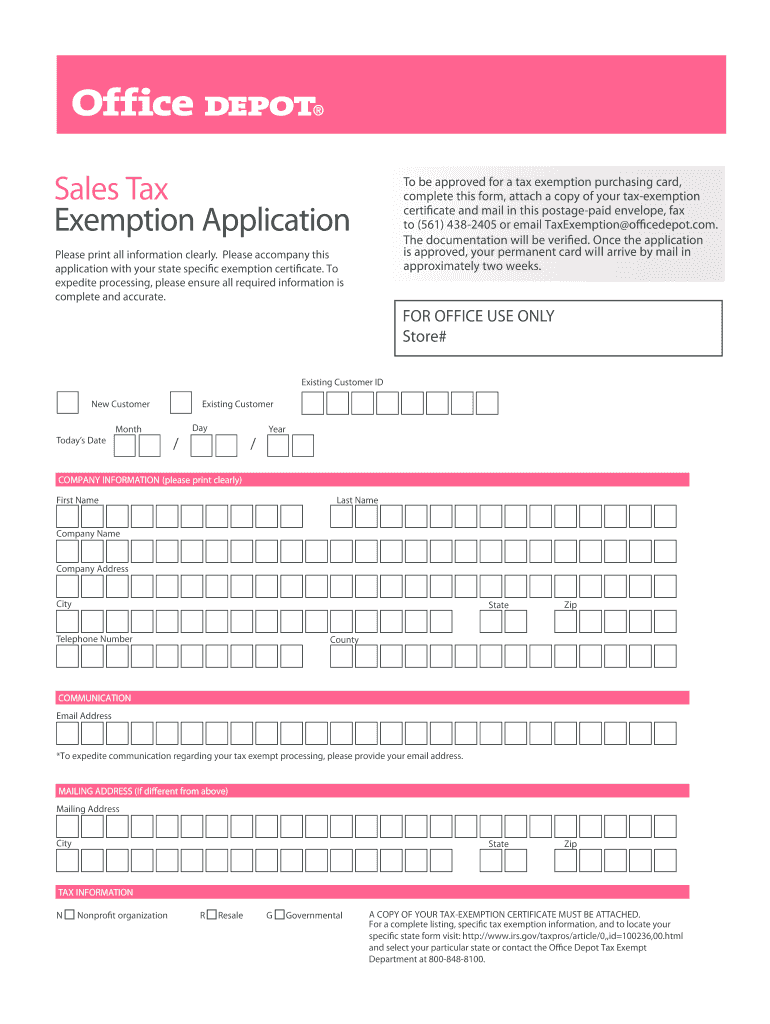

Get the free tax exemption form

Get, Create, Make and Sign

Editing tax exemption online

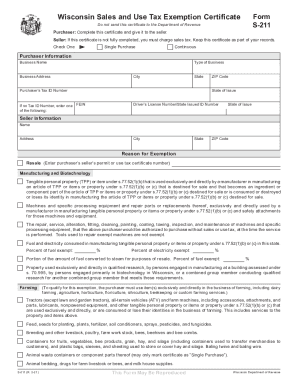

How to fill out tax exemption form

How to fill out exemptions tax:

Who needs exemptions tax:

Video instructions and help with filling out and completing tax exemption

Instructions and Help about exemption exempt tax form

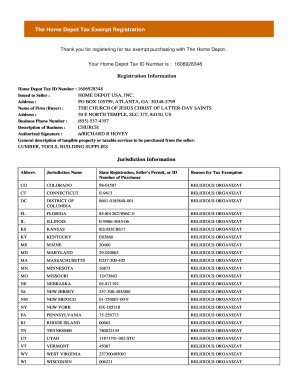

As the clock ticks down to the launch of the HST in July one thing has become very clear about taxes in this province British Colombians are not happy about paying more than they have to so imagine the reaction to the news that one of the biggest retailers in the province has been charging provincial sales tax on things that should be tax-free, and it's the kind of store where lots of people spend lots of money it's been going on for at least a year now and the company tonight is scrambling to win back its customers goodwill and to pay back all that extra tax hey news reporter Sachs curl has details the Home Depot tells its customers you can do it we can help but how much is the retail giant hindered its relationship with buyers by collecting tax when it shouldn't have for at least 18 months a Home Depot is charged PST on items that were tax-exempt everything from caulking to weather stripping to Energy Star appliances items snapped up when homeowners took advantage of the federal home renovation tax credit and be seized live smart program the news has caught shoppers off guard that's sort of a scam actually I don't know whether it's just an honest mistake or whether they're trying to rip the public offering up no one from the company would speak to us on camera today but we did receive a statement saying in part we apologize to all customers that may have been impacted by these PST exemption airs we encourage customers to visit their local Home Depot store with their receipt to see if they are eligible for a refund the Home Depot in no way benefited from this error all PST collected has been remitted to the bc government what the company doesn't explain is how or why the mistakes happened well now that the word is out it appears Home Depot has fixed the problem we went in today and bought some caulking and weatherstripping and no PST was charged, but we'll Home Depot be able to fix problems with customers do you think they should have known better yes absolutely it may be asking customers to come back in with their receipts but how many people do you think hold on to their receipts nobody is they ever this marketing expert says the Home Depot has some making up to do they may want to consider something like we pay the GST you know for a particular day or a period of time so that all their customers feel that they've acted in a way that they feel real truly sorry about this and what of the provincial government which took in all that ill charged tax we will reimburse any amounts over it if it's under ten dollars then we don't put anything over ten dollars we will provide reimbursement for them oh and by the way all that stuff the Home Depot wasn't supposed to charge provincial sales tax on will be subject to harmonized sales tax come July first stretch the field joins us now with more on the story shot you what happens do you have until the HST kicks in to get the old PST refunded or is there a time limit as far as we know Hudson right now the...

Fill officedepottaxformhelp : Try Risk Free

People Also Ask about tax exemption

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your tax exemption form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.