Get the free texas sales tax exemption form

Show details

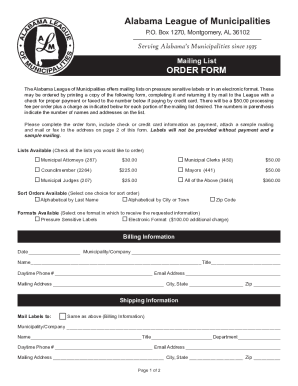

Www. texpoenergy. com 1-877-839-7657 FAX 713-358-8507 Texas Sales Tax Exemption Certificate for Electricity Usage Account Name Service Address City State Zip code Account No. For Multiple Accounts staple additional listing signed by the customer to this form Texas State Sales and Use Tax Permit Taxpayer No. Federal Employer Identification No. PLEASE COMPLETE SECTION A or B AS APPLICABLE and SECTION C page 2 Section A. Utility Study not required for Tax Exempt Usage also complete SECTION C...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your texas sales tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas sales tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas sales tax exemption form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit texas sales tax exemption form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out texas sales tax exemption

How to fill out Texas sales tax exemption:

01

Determine if you are eligible for the exemption. In general, businesses engaged in manufacturing, fabricating, or processing goods for sale are eligible for the exemption. Non-profit organizations and governmental entities may also qualify.

02

Obtain the Texas Sales and Use Tax Exemption Certification (Form 01-339). This form can be downloaded from the Texas Comptroller's website or obtained from their office.

03

Fill out the form accurately and completely. Provide your business information, including the legal name, address, and tax identification number. Make sure to indicate the type of exemption you are claiming (e.g., manufacturing, non-profit, governmental).

04

Gather supporting documentation. Depending on the type of exemption you are claiming, you may need to provide additional documentation. For example, manufacturers may need to include their NAICS codes or Standard Industrial Classifications (SIC) codes.

05

Review the completed form for any errors or missing information. Ensure that all necessary signatures are obtained.

06

Submit the completed form to the Texas Comptroller's office. You can file the form electronically through their website or mail it to the address specified on the form.

07

Keep a copy of the completed form and any supporting documentation for your records. You may be asked to provide these documents for verification if audited.

Who needs Texas sales tax exemption:

01

Businesses engaged in manufacturing, fabricating, or processing goods for sale are required to have a Texas sales tax exemption if they want to claim exemption from sales and use tax on their purchases.

02

Non-profit organizations, such as charities, religious organizations, or educational institutions, may also need a Texas sales tax exemption to avoid paying sales tax on their purchases.

03

Governmental entities, including federal, state, and local government agencies, are eligible for a Texas sales tax exemption to exempt them from paying sales tax on their purchases.

Fill form : Try Risk Free

People Also Ask about texas sales tax exemption form

What are reasons for sales tax exemption in Texas?

How do I claim tax-exempt?

How do I qualify for sales tax exemption in Texas?

How do I get sales tax exemption in Texas?

What is the Texas tax exempt form?

Does Texas have a sales tax exemption form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is texas sales tax exemption?

Texas Sales Tax Exemption is a form of exemption from the state sales tax on certain items. In Texas, certain items are exempt from the state sales tax, such as prescription drugs, food and beverages intended for human consumption, and most medical devices.

Who is required to file texas sales tax exemption?

Businesses that make taxable sales in Texas are typically required to file a Texas Sales and Use Tax Exemption Certificate. Depending on the type of business, exemptions may apply to purchases of tangible personal property and certain services.

How to fill out texas sales tax exemption?

To claim a Texas sales tax exemption, you must complete Form 01-339, Texas Sales and Use Tax Exemption Certification. This form must be completed and signed by the purchaser. The form can be obtained from the Texas Comptroller of Public Accounts website.

On the form, you will need to provide your name, address, and the type of exemption you are claiming. You will also need to provide a description of the items being purchased and the reason for the exemption. Finally, you will need to sign the form and provide your signature and date.

Once completed, you will need to present the form to the seller at the time of purchase. The seller will then review the form and decide if the exemption is valid. If accepted, the seller will provide you with an exemption certificate that you must keep on file for your records.

What is the purpose of texas sales tax exemption?

The Texas sales tax exemption is designed to provide relief from sales taxes for certain organizations, individuals, and businesses. This exemption is available to organizations and individuals who are tax-exempt under federal law, and also includes certain types of businesses, such as some agricultural producers and certain non-profit organizations. The exemption can help reduce the cost of goods or services purchased by the exempt entity.

What information must be reported on texas sales tax exemption?

Texas Sales Tax Exemption must include the buyer's name, address, and Texas Sales Tax Exemption Number. The buyer must also provide a description of the item being purchased that is eligible for exemption. The seller must also provide a description of the item being purchased that is eligible for exemption, as well as the date of purchase and the total purchase price.

What is the penalty for the late filing of texas sales tax exemption?

The penalty for the late filing of Texas sales tax exemption depends on the amount of tax due and the number of days late. Here are the penalties according to the Texas Comptroller of Public Accounts website:

- If the tax is less than $1,000, the penalty is $50.

- If the tax is between $1,001 and $10,000, the penalty is $200.

- If the tax is more than $10,000, the penalty is 10% of the tax due.

In addition to the penalties, interest may also be charged on the late payment of the tax. The interest rate is determined annually by the Texas Comptroller and is currently set at 5% per year.

Can I create an eSignature for the texas sales tax exemption form in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your texas sales tax exemption form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit tx sales tax exemption on an Android device?

You can edit, sign, and distribute texas sales tax exemption certificate on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I fill out texas sales tax exemption printable on an Android device?

Complete texas sales tax exemption pdf form and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your texas sales tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tx Sales Tax Exemption is not the form you're looking for?Search for another form here.

Keywords relevant to texas sales tax exemption certificate download form

Related to tx sales tax exemption certificate

If you believe that this page should be taken down, please follow our DMCA take down process

here

.