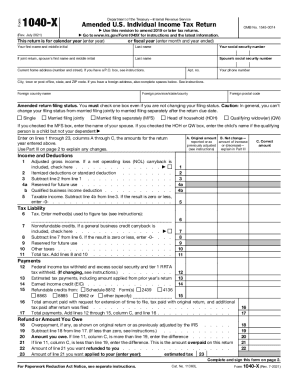

Get the free recovery rebate credit worksheet pdf form

Show details

Credit Recovery Teacher Recommendation Form Student: Course: Teacher: Date: Term 1 Grade Term 2 Grade Term 3 Grade Term 4 Grade Final Exam Grade Final Grade for Course Teacher Recommendation: I recommend

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your recovery rebate credit worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your recovery rebate credit worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit recovery rebate credit worksheet pdf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit recovery rebate credit worksheet 2021 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

How to fill out recovery rebate credit worksheet

How to fill out recovery rebate credit worksheet:

01

Gather all necessary documents such as your tax return for the year you are claiming the credit, any stimulus payment notices, and other relevant financial records.

02

Begin by carefully reading the instructions on the recovery rebate credit worksheet provided by the IRS. These instructions will guide you through the process.

03

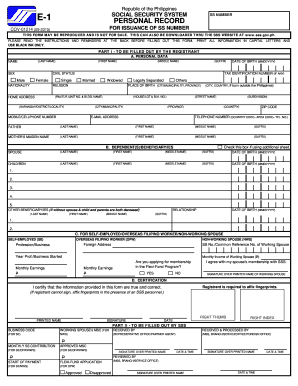

Fill out your personal information accurately, including your name, Social Security number, and filing status.

04

Determine the amount of your recovery rebate credit by referring to the instructions and guidelines provided. This will depend on various factors such as your filing status, income level, and eligibility for stimulus payments.

05

Calculate any stimulus payments you have already received and subtract this amount from your total recovery rebate credit.

06

Complete the worksheet step by step, following the instructions provided. This may involve filling in income information, tax liability, and any additional information required to determine your eligibility for the credit.

07

Double-check all calculations and ensure the accuracy of your entries.

08

Transfer the final recovery rebate credit amount to the appropriate line on your tax return form.

09

Keep a copy of the completed worksheet for your records.

Who needs recovery rebate credit worksheet:

01

Individuals who did not receive the full amount of the stimulus payments they were eligible for.

02

Individuals who are eligible for the recovery rebate credit based on changes in their income, filing status, or other qualifying factors.

03

Individuals who want to claim the recovery rebate credit for the tax year specified by the IRS.

04

Taxpayers who are required to file a tax return and meet the eligibility criteria for the recovery rebate credit.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is recovery rebate credit worksheet?

The Recovery Rebate Credit Worksheet is a document provided by the Internal Revenue Service (IRS) in the United States. It is used to determine the amount of the Recovery Rebate Credit that taxpayers may be eligible for when filing their federal income tax return.

The Recovery Rebate Credit is a refundable tax credit designed to provide financial assistance to individuals who did not receive the full amount of the Economic Impact Payments (stimulus checks) they were entitled to receive in previous years. This credit is available for eligible taxpayers who did not receive the full amount of the first and/or second Economic Impact Payment.

The worksheet helps taxpayers calculate the amount of their Recovery Rebate Credit based on the information they provide, such as the amount they received for the first and second Economic Impact Payments, any additional amount they may be eligible for, and any adjustments based on their income and filing status.

By filling out the Recovery Rebate Credit Worksheet, taxpayers can determine the precise amount they can claim as a credit on their tax return, which can potentially increase their refund or reduce the balance they owe. It is recommended that individuals consult the instructions provided by the IRS or seek assistance from a tax professional to accurately complete the worksheet and claim the credit.

Who is required to file recovery rebate credit worksheet?

Individuals who did not receive the full amount of the Economic Impact Payment (stimulus check) they were eligible for can file a Recovery Rebate Credit Worksheet with their tax return. This includes individuals who:

1. Did not receive any Economic Impact Payment.

2. Did not receive the full amount of the Economic Impact Payment.

3. Did not receive the additional $500 per qualifying child.

The worksheet helps determine if the individual is eligible for any additional credit based on their 2020 tax return information.

How to fill out recovery rebate credit worksheet?

To fill out the Recovery Rebate Credit (RRC) Worksheet, follow these steps:

1. Obtain the worksheet: You can find the RRC Worksheet in the instructions for Form 1040 or Form 1040-SR.

2. Gather information: Collect the necessary documents such as your 2020 tax return, IRS Notice 1444 (Economic Impact Payment Notice), and any other relevant records.

3. Complete the Personal Information section: Fill in your name, Social Security number, and filing status at the top of the worksheet.

4. Calculate your first and second Economic Impact Payments (EIPs): Take note of the amount you received for each EIP. If you did not receive an EIP, leave the fields blank.

5. Enter the Recovery Rebate Credit amounts: The worksheet will guide you through calculating the total amount of RRC you are eligible for based on your situation. This includes any additional credit for qualifying dependents.

6. Compare RRC with EIPs: Compare the total RRC calculated with the total amount of EIPs you received. If your RRC is higher, you may be eligible for a credit on your tax return. If your EIPs were higher, you will not be eligible for any additional credit.

7. Fill out the Worksheet calculations: Follow the instructions on the worksheet to determine the correct amounts for each line.

8. Transfer amounts to your tax return: Once you have completed the worksheet, transfer the calculated amounts to the appropriate lines on your Form 1040 or Form 1040-SR.

9. Review and file your tax return: Ensure that all information is accurate and complete before filing your tax return.

Note: If you use tax software to prepare your taxes, it may automatically generate the RRC Worksheet and calculate the credit for you.

What is the purpose of recovery rebate credit worksheet?

The purpose of the Recovery Rebate Credit Worksheet is to help individuals calculate and determine if they are eligible for the Recovery Rebate Credit. The Recovery Rebate Credit is a tax credit provided by the government to eligible individuals who did not receive the full amount of the Economic Impact Payments (stimulus checks) they were entitled to in previous years. The worksheet guides individuals through a series of questions and calculations to determine the amount of credit they may be eligible to claim on their tax return.

What information must be reported on recovery rebate credit worksheet?

In order to complete the Recovery Rebate Credit Worksheet, the following information must be reported:

1. Filing status: Indicate your filing status, which can be either single, married filing jointly, head of household, or qualifying widow(er) with dependent child.

2. Number of eligible individuals: Report the total number of eligible individuals in your household. This includes yourself, your spouse, and any qualifying children.

3. Recovery Rebate amount: Enter the amount of any economic impact payments received during the year. You can find this information on Notice 1444 or Notice 1444-B, which you should have received from the IRS.

4. Total eligible Recovery Rebate amount: Calculate the total eligible Recovery Rebate amount by adding up the amounts for each eligible individual in your household.

5. Adjusted gross income (AGI): Report your AGI from your 2019 tax return. If you have not yet filed your 2020 tax return, use your 2019 AGI. If you have filed your 2020 return, use the AGI from that return.

6. Total withholding and estimated tax payments: Enter the total amount of federal income tax withheld from your paychecks and any estimated tax payments you made during the year.

7. Recovery Rebate Credit claimed: Calculate the potential amount of the Recovery Rebate Credit by subtracting your Recovery Rebate amount (step 3) from your total eligible Recovery Rebate amount (step 4).

It's important to note that the specific instructions and requirements for reporting the Recovery Rebate Credit may vary depending on the tax software or tax preparer you are using.

What is the penalty for the late filing of recovery rebate credit worksheet?

The penalty for late filing of the Recovery Rebate Credit (RRC) worksheet depends on the specific tax jurisdiction and regulations involved. It is important to note that the RRC is claimed as part of your federal income tax return, so any penalties would be based on the late filing of your tax return in general.

The current penalty for late filing of a federal tax return is typically assessed as a percentage of the unpaid taxes owed. The penalty is 5% of the unpaid tax amount per month after the tax filing deadline, up to a maximum of 25% of the unpaid taxes.

However, if you are due a refund or do not owe any taxes, there is typically no penalty for filing late. It is important to file your tax return as soon as possible to claim the Recovery Rebate Credit or any other tax benefits you may be eligible for.

How do I modify my recovery rebate credit worksheet pdf in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your recovery rebate credit worksheet 2021 form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit recovery rebate credit worksheet 2021 pdf online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your fillable recovery rebate credit worksheet to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I edit credit recovery form on an Android device?

You can make any changes to PDF files, such as printable recovery rebate credit worksheet form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your recovery rebate credit worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Recovery Rebate Credit Worksheet 2021 Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to recovery rebate worksheet form

Related to recovery rebate worksheet pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.