OH Individual Income Tax Return - Village of Monroeville 2015-2024 free printable template

Show details

Village of Monroeville Individual Income Tax Return 2015 Due by April 18, 2016, FILING IS REQUIRED EVEN IF NO TAXES ARE DUE FOR TAX OFFICE USE Income Tax department P.O. Box 496 Monroeville, OH 448470496

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your 1040 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1040 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1040 form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit file tax form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out 1040 form

How to fill out 1040 form?

01

Gather all necessary documents, such as W-2 forms, 1099 forms, and any other income statements.

02

Determine your filing status (single, married filing jointly or separately, head of household, etc.) and enter it on the form.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Enter your income in the appropriate sections, making sure to report all sources of income accurately.

05

Claim any deductions or credits you qualify for, such as the standard deduction or child tax credit.

06

Calculate your total tax liability using the tax tables or the IRS tax calculator.

07

Determine if you owe any additional taxes or if a refund is due. If you owe taxes, make sure to include payment with your form.

08

Attach any supporting documents, such as schedules or forms that are required based on your specific situation.

09

Review your form for accuracy and completeness before signing and dating it.

10

Mail your completed 1040 form to the address provided by the IRS.

Who needs 1040 form?

01

Individuals who earn income from various sources, including employment, self-employment, or investments, need the 1040 form.

02

Taxpayers who itemize deductions, claim credits, or report certain types of income, such as rental income or capital gains, also need to use the 1040 form.

03

Married couples who file separately, heads of household, and individuals with dependents or special tax situations may also need to use the 1040 form. It is important to consult the IRS guidelines or seek professional advice to determine which form is appropriate for your specific situation.

Fill tax 1040 form : Try Risk Free

People Also Ask about 1040 form

Who should complete Form 1040?

What qualifies you to use Form 1040?

What is the difference between W 2 and 1040 form?

Who needs to fill out a 1040 form?

What is 1040 tax form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

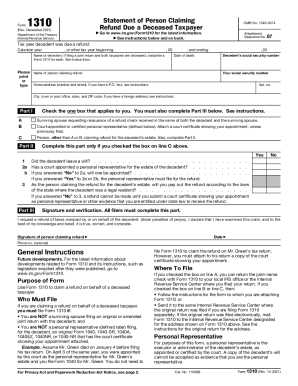

What is 1040 form?

Form 1040 is the standard form used for individual U.S. federal income tax returns. The form is used by individuals who have taxable income to report to the Internal Revenue Service (IRS). It is the most complex of all the individual tax forms since it is used to report the most types of income and deductions.

Who is required to file 1040 form?

Any U.S. citizen or resident alien with a filing requirement must file a Form 1040. This includes taxpayers who are self-employed, have income from investments, receive income from rental properties, and those who are eligible for certain credits or deductions.

What information must be reported on 1040 form?

1. Filing status

2. Personal information (name, address, Social Security number)

3. Dependents

4. Income (wages, salaries, interest, dividends, etc.)

5. Adjustments to income (student loan interest, educator expenses, alimony, etc.)

6. Deductions (standard or itemized)

7. Tax credits (child tax credit, education credits, etc.)

8. Other taxes (self-employment tax, household employment taxes, etc.)

9. Payments (estimated tax payments, prior year’s balance due, etc.)

10. Refund or amount owed

What is the penalty for the late filing of 1040 form?

The penalty for the late filing of a 1040 form is 5% of the unpaid taxes for each month that the return is late, up to a maximum of 25%. In addition, there may be a penalty of up to $205 or 100% of the unpaid taxes, whichever is lesser.

How to fill out 1040 form?

Filling out Form 1040, the U.S. Individual Income Tax Return, can be done by following these steps:

1. Gather all necessary documents: Collect all of your income and expense-related documents, such as W-2 forms, 1099 forms, receipts for deductions, and any other relevant financial records.

2. Understand your filing status: Determine your filing status (e.g., single, married filing jointly, head of household, etc.), as it will affect your tax rate and deductions.

3. Complete your personal information: Fill out your name, address, Social Security number, and other personal details on the top of the form.

4. Report your income: Fill in each section of the income section (lines 1-22) based on the specific type of income you received during the tax year. This may include wages, self-employment income, retirement benefits, rental income, etc.

5. Subtract deductions: Claim any applicable deductions to reduce your taxable income. This can include deductions for student loan interest, self-employment expenses, medical expenses, and others. You can use Schedule A or the standard deduction in the case of not itemizing deductions.

6. Calculate your tax liability: Based on your taxable income, refer to the tax tables provided by the IRS to determine your tax liability on line 11a.

7. Claim tax credits: If eligible, claim any tax credits for which you qualify. These may include the Child Tax Credit, Earned Income Credit, or credits for education expenses.

8. Calculate your refund or balance due: Subtract your tax credits (line 17) from your tax liability (line 16), then subtract any withholding or estimated tax payments (line 18) to determine if you're owed a refund or if you owe additional taxes.

9. Complete payment and signature information: If you owe taxes, indicate your desired payment method and include appropriate remittance, such as a check or electronic payment. Sign and date the form.

10. Attach additional forms and schedules: If required, attach any supporting schedules or additional forms, such as Schedule A for itemized deductions or Schedule C for self-employed income.

11. Keep a copy for your records: Make a copy of your filled-out 1040 form, along with all supporting documents, for your own records.

It's important to note that the above steps are only a general guide. If you have complex financial situations, it may be beneficial to consult a tax professional or use tax software to ensure accurate completion of your 1040 form.

What is the purpose of 1040 form?

The purpose of the 1040 form is to report an individual's income and calculate the amount of taxes owed or refundable for a specific tax year. It is the main form used by individuals to file their federal income tax returns with the Internal Revenue Service (IRS) in the United States. The form includes sections where taxpayers can outline their sources of income, claim deductions, exemptions, and credits, as well as calculate their overall tax liability.

When is the deadline to file 1040 form in 2023?

The deadline to file the 1040 form for the tax year 2022 (which is typically filed in 2023) is April 17, 2023. Please note that the deadline may be modified if it falls on a weekend or holiday. It is always recommended to verify the exact deadline with the Internal Revenue Service (IRS) or a trusted tax professional.

Where do I find 1040 form?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the file tax form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an eSignature for the tax filing in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your tax form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit tax filing return on an Android device?

You can edit, sign, and distribute tax return form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your 1040 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Filing is not the form you're looking for?Search for another form here.

Keywords relevant to file tax filing form

Related to tax return form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.