Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

There doesn't appear to be a widely recognized term "form tax." It is possible that you may be referring to a specific tax form, in which case providing the specific form number or context would be helpful in providing a more accurate answer.

Who is required to file form tax?

The individuals and entities that are required to file a tax return (Form Tax) vary based on their income, filing status, age, and other factors. In the United States, for example, individuals are generally required to file a federal income tax return if their income exceeds a certain threshold.

As of 2021, the filing requirements for federal income tax returns for individuals in the United States are as follows:

1. Single individuals under the age of 65: Must file a tax return if their gross income is at least $12,550.

2. Single individuals aged 65 or older: Must file a tax return if their gross income is at least $14,250.

3. Married individuals filing jointly and both spouses under 65: Must file a tax return if their gross income is at least $25,100.

4. Married individuals filing jointly and one spouse 65 or older: Must file a tax return if their gross income is at least $26,100.

5. Married individuals filing jointly and both spouses 65 or older: Must file a tax return if their gross income is at least $27,400.

6. Head of household under 65: Must file a tax return if their gross income is at least $18,800.

7. Head of household aged 65 or older: Must file a tax return if their gross income is at least $20,500.

8. Qualifying widow(er) with dependent child under 65: Must file a tax return if their gross income is at least $25,100.

9. Qualifying widow(er) with dependent child aged 65 or older: Must file a tax return if their gross income is at least $26,100.

It's important to note that these income thresholds may change each year, and there may be additional filing requirements for individuals with certain types of income or specific situations. It's always recommended to consult the IRS guidelines or a tax professional to determine specific filing requirements.

How to fill out form tax?

Filling out a tax form can seem overwhelming at first, but if you follow these general steps, it can become much more manageable:

1. Gather your tax documents: Collect all the necessary documents such as W-2 forms, 1099 forms (if applicable for self-employment or freelance income), investment statements, mortgage interest statements, and any other relevant documents.

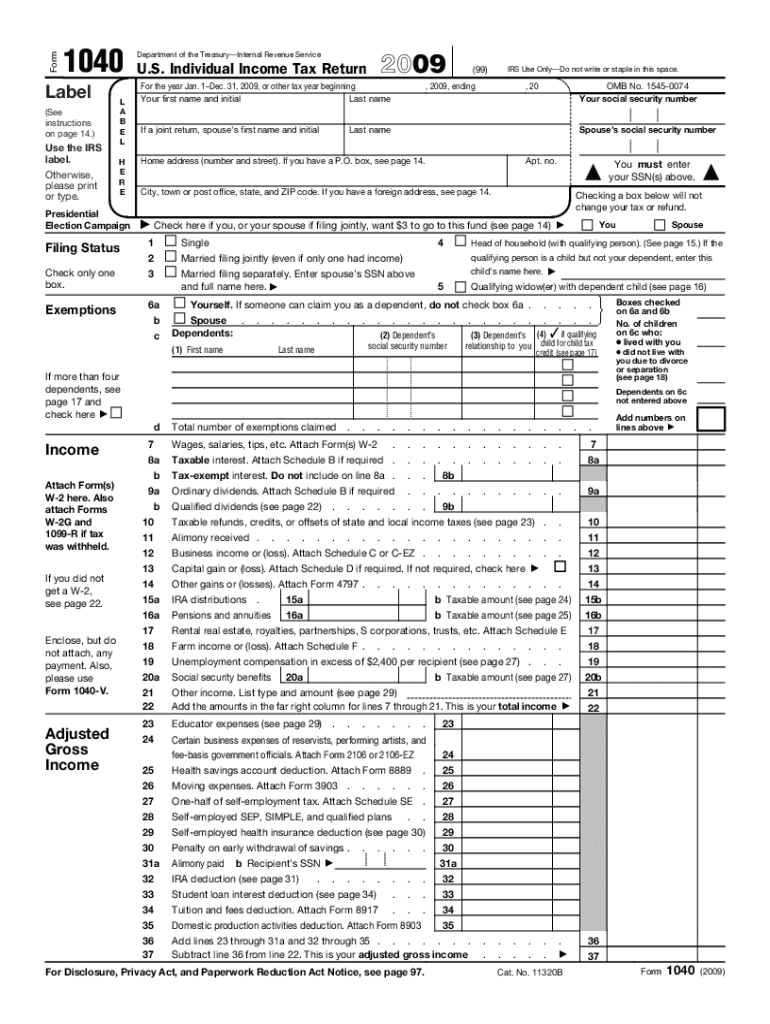

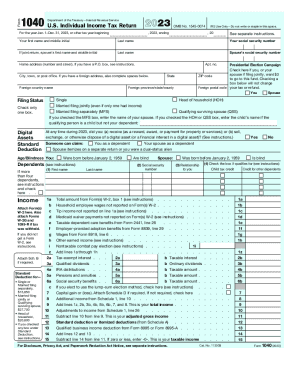

2. Choose the right form: Determine which tax form is suitable for your situation. Most individuals use either Form 1040 or Form 1040EZ.

3. Personal information: Provide your personal information, including your name, Social Security Number (SSN), address, and filing status (e.g., single, married filing jointly, etc.).

4. Income: Report all sources of your income, including wages, salaries, tips, business income, interest income, dividends, rental income, etc. Ensure each source of income is accurately reported.

5. Deductions: Determine whether you will take the standard deduction or itemize your deductions. If itemizing, list eligible expenses such as medical expenses, state and local taxes, mortgage interest, and charitable contributions.

6. Credits: Determine if you qualify for any tax credits, such as the Earned Income Tax Credit (EITC) or Child Tax Credit. Deduct eligible credits from your total tax liability.

7. Calculate tax liability: Calculate your tax liability by applying the appropriate tax rate to your taxable income.

8. Payments and refunds: Report any tax payments already made, such as income tax withholdings from paychecks or estimated quarterly tax payments. If you overpaid your taxes, you may be eligible for a tax refund.

9. Sign and date: Ensure you sign and date your tax form. If filing jointly, your spouse should also sign.

10. Submitting: Send your completed form to the appropriate tax agency, either by mail or electronically, depending on your preference.

It's essential to note that tax laws can be complex, and it might be beneficial to seek the assistance of a qualified tax professional or use tax preparation software to ensure accuracy and maximize your tax benefits.

What is the purpose of form tax?

It is unclear what you mean by "form tax." If you are referring to a tax form, its purpose is to report one's income, deductions, and tax liability to the government.

What information must be reported on form tax?

The information that must be reported on Form Tax, or commonly known as the federal income tax return (Form 1040), includes but is not limited to:

1. Personal information: Your name, Social Security number, filing status, and the number of dependents you claim.

2. Income: All sources of income including wages, salaries, tips, self-employment income, rental income, interest, dividends, capital gains, retirement income, and any other taxable income.

3. Deductions: Eligible deductions such as student loan interest, mortgage interest, medical expenses, state and local taxes, contributions to retirement accounts, and other itemized deductions (if you choose to itemize).

4. Credits: Tax credits that you qualify for, such as the child tax credit, earned income credit, education credits, and others.

5. Tax withholdings: Information about any taxes already withheld from your income by your employer or other sources.

6. Additional taxes: Reporting any additional taxes owed, such as self-employment tax, early withdrawal penalties from retirement accounts, or any other taxes applicable to your situation.

7. Payments and refunds: Calculating the total tax you owe or are due as well as any estimated tax payments or credits applied, and any refund you expect to receive.

It's important to note that this is not an exhaustive list, and the specific information you need to report may vary depending on your individual circumstances and applicable tax laws. Therefore, it's advisable to consult the instructions provided with the tax form or seek professional help if you have any doubts or complex tax situations.

When is the deadline to file form tax in 2023?

The deadline to file taxes in 2023 is typically April 18th. However, it's important to note that tax filing deadlines can vary depending on various factors such as holidays or weekends. It is always recommended to double-check with the IRS or a tax professional to ensure you have the accurate information regarding tax filing deadlines for any given year.

What is the penalty for the late filing of form tax?

The penalty for late filing of a tax form can vary depending on the country and the specific tax regulations in place. In the United States, for example, the penalty for late filing of a federal income tax return is usually 5% of the unpaid taxes for each month or part of a month that the return is late, up to a maximum of 25% of the unpaid taxes. There may be additional penalties and interest charges applied as well. It's important to consult the tax laws and regulations specific to your jurisdiction for accurate information on late filing penalties.

Where do I find 2009 form tax?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the 2009 form tax in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit 2009 form tax online?

With pdfFiller, it's easy to make changes. Open your 2009 form tax in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the 2009 form tax electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your 2009 form tax and you'll be done in minutes.