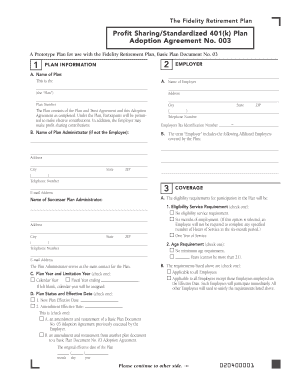

Fidelity Brokerage Services Self-Employed 401(k) - Contribution Remittance Form 2017-2024 free printable template

Show details

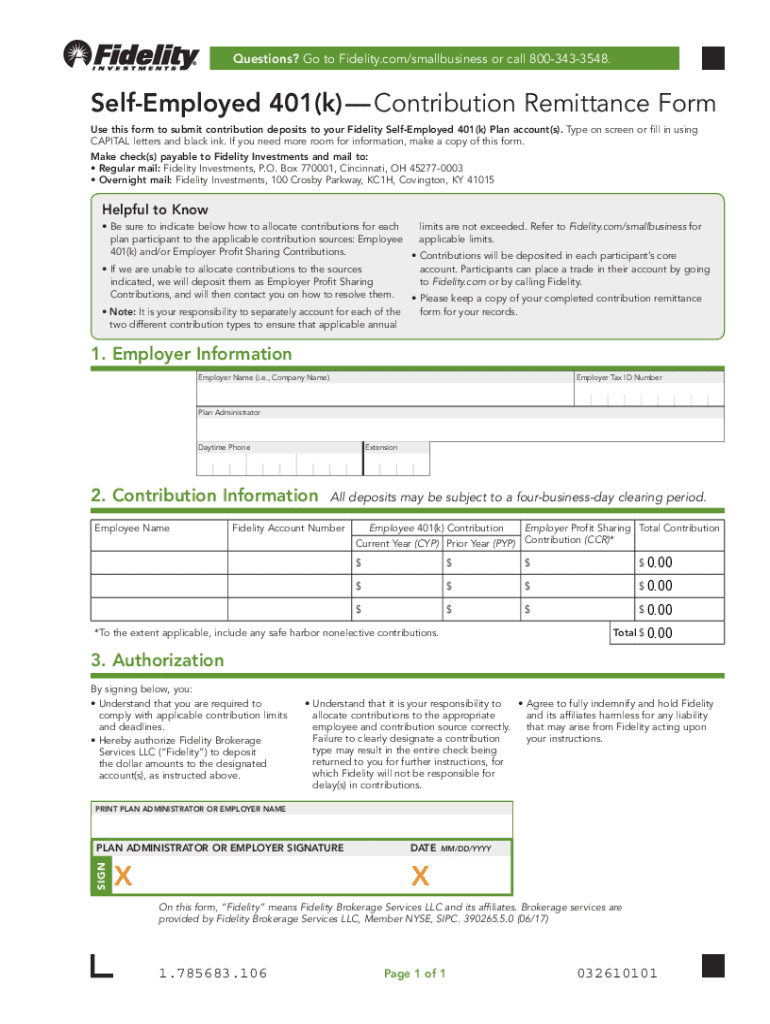

PrintResetSaveQuestions? Go to Fidelity.com/smallbusiness or call 8003433548. Reemployed 401(k)Contribution Remittance Form Use this form to submit contribution deposits to your Fidelity Reemployed

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your fidelity 401k contribution 2017-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity 401k contribution 2017-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fidelity 401k contribution online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fidelity form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Fidelity Brokerage Services Self-Employed 401(k) - Contribution Remittance Form Form Versions

Version

Form Popularity

Fillable & printabley

4.8 Satisfied (75 Votes)

4.4 Satisfied (42 Votes)

How to fill out fidelity 401k contribution 2017-2024

How to fill out fidelity self employed 401k:

01

Visit the Fidelity website and log in to your account. If you don't have an account, you will need to create one.

02

Once logged in, navigate to the "Accounts & Trade" section and click on "Retirement & Planning."

03

Look for the option to open a new self-employed 401k account and click on it.

04

Follow the instructions provided to provide all the necessary personal and financial information. This may include your Social Security number, employment details, and financial goals.

05

Choose the investment options for your self-employed 401k. Fidelity offers a wide range of investment options, including mutual funds, stocks, bonds, and target-date funds.

06

Decide on your contribution rate. Fidelity allows you to contribute up to the annual limit set by the IRS, which may vary each year. You can choose a fixed dollar amount or a percentage of your income.

07

Set up automatic contributions if desired. Fidelity offers the option to schedule regular contributions to your self-employed 401k account, making it easier to save consistently.

08

Review all the information you provided and make any necessary changes before submitting your application.

Who needs fidelity self employed 401k:

01

Self-employed individuals who want to save for retirement. The fidelity self-employed 401k is designed specifically for individuals who work for themselves or own a small business without any employees.

02

Those who want to take advantage of tax advantages. The self-employed 401k allows individuals to make tax-deductible contributions, potentially lowering their taxable income during their working years.

03

Individuals who want to have control and flexibility over their retirement savings. With a self-employed 401k, you can choose your investment options and contribution rate, giving you more control over your retirement savings strategy.

Fill fidelity self employed : Try Risk Free

People Also Ask about fidelity 401k contribution

How do I contact Fidelity self-employed 401k?

Does Fidelity have a self-directed account?

What is the best 401k for self-employed?

Does Fidelity have a solo 401k plan?

Can you set up a 401k if self-employed?

Does Fidelity have self directed 401k?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of fidelity self employed 401k?

The purpose of a fidelity self employed 401k is to provide retirement savings options to self-employed individuals. This type of plan allows individuals to save for retirement on a tax-advantaged basis and offers the same benefits as traditional 401k plans, including tax-deferred growth, employer contribution options, and investment options.

What information must be reported on fidelity self employed 401k?

Fidelity self-employed 401k plans require employers to report the following information on their plan:

1. Employer Identification Number (EIN)

2. Plan name

3. Plan year end

4. Plan start date

5. Employer contribution amount

6. Employee contribution amount

7. Total contributions

8. Investment performance

9. Distribution of assets

10. Plan fees

11. Plan expenses

12. Plan document and amendments

13. Summary annual report

14. Audited financial statement

15. Tax filings

16. Participant data

17. Beneficiary information

18. Loan information

What is the penalty for the late filing of fidelity self employed 401k?

The penalty for the late filing of a fidelity self employed 401k is a 6% excise tax, plus interest, on the amount which is not timely filed.

What is fidelity self employed 401k?

Fidelity Self-Employed 401(k) is a retirement savings plan designed for self-employed individuals or small business owners who do not have any full-time employees, except for a spouse. It allows self-employed individuals to save for retirement while taking advantage of the tax benefits and flexibility offered by a 401(k) plan.

This plan offers similar features to a traditional 401(k) plan, such as the ability to contribute a portion of income on a tax-deferred basis, potential employer contributions, and a variety of investment options. However, since there are no full-time employees, the plan is exempt from certain compliance tests and administrative requirements that apply to traditional 401(k) plans.

With a Fidelity Self-Employed 401(k), self-employed individuals have the opportunity to save for retirement while reducing their taxable income and potentially benefiting from any matching contributions made by the employer (self-employed individual) to themselves. The plan also allows for higher contribution limits compared to other retirement plans available to self-employed individuals, such as Traditional IRAs or SEP-IRAs.

Overall, Fidelity Self-Employed 401(k) provides an effective retirement savings vehicle with tax advantages and increased savings potential for self-employed individuals or small business owners without any full-time employees, helping them secure their financial future.

Who is required to file fidelity self employed 401k?

Self-employed individuals who have a solo 401(k) plan, also known as a solo or self-employed 401(k) plan, are required to file fidelity self-employed 401k.

How to fill out fidelity self employed 401k?

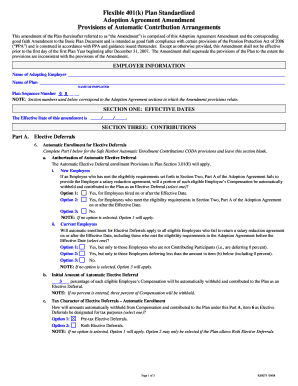

To fill out the Fidelity Self-Employed 401(k) plan, you will need to follow these steps:

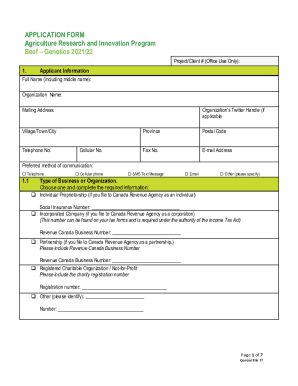

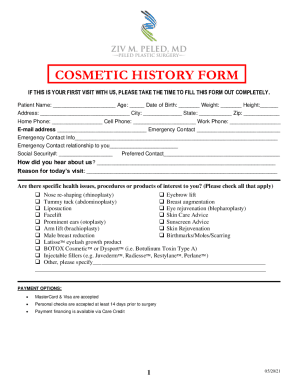

1. Gather the required information: Before starting the application, gather all the necessary details such as your personal information, social security number, business information, and financial details.

2. Access the Fidelity website: Visit the Fidelity Investments website and navigate to the Self-Employed 401(k) page.

3. Start the application: Click on the "Open Account" or "Apply Now" button to begin the application process.

4. Provide personal information: Enter your personal details, including your name, address, date of birth, and social security number.

5. Specify your business information: Provide details about your business, such as the name, type, and date of establishment.

6. Determine your contribution: Indicate the amount you plan to contribute to your Self-Employed 401(k) plan, considering the annual contribution limits set by the Internal Revenue Service (IRS).

7. Select your investment options: Fidelity offers a range of investment options that you can choose from. Determine your investment preferences and select the funds or assets you want to invest in.

8. Designate beneficiaries: Specify the beneficiaries who will receive the plan's assets in case of your death.

9. Review and submit: Before finalizing the application, carefully review all the provided information to ensure accuracy. Once verified, submit your application.

10. Fund your account: After successfully submitting the application, you will need to fund your Self-Employed 401(k) account. This can be done through electronic funds transfer, check, or an existing Fidelity account transfer.

11. Review investment performance: Regularly monitor your investments' performance and make necessary adjustments to align with your retirement goals.

Keep in mind that the above steps are a general guide, and the process may vary depending on the specific requirements and procedures at the time of your application. It is always recommended to consult with a financial advisor or contact Fidelity Investments directly for any clarification or assistance during the application process.

When is the deadline to file fidelity self employed 401k in 2023?

The deadline to file a Fidelity Self-Employed 401(k) plan in 2023 would typically be the same as the deadline for filing individual income tax returns, which is April 15th, 2024. However, if you file for an extension, the deadline would be extended to October 15th, 2024. It's always advisable to check with a tax professional or financial advisor for specific deadlines and guidance regarding your situation.

How can I modify fidelity 401k contribution without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including fidelity form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit fidelity investments contribution in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing fidelity form fillable and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out the fidelity form download form on my smartphone?

Use the pdfFiller mobile app to fill out and sign fidelity contribution form on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Fill out your fidelity 401k contribution 2017-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Investments Contribution is not the form you're looking for?Search for another form here.

Keywords relevant to fidelity 401k form

Related to 401k remittance

If you believe that this page should be taken down, please follow our DMCA take down process

here

.