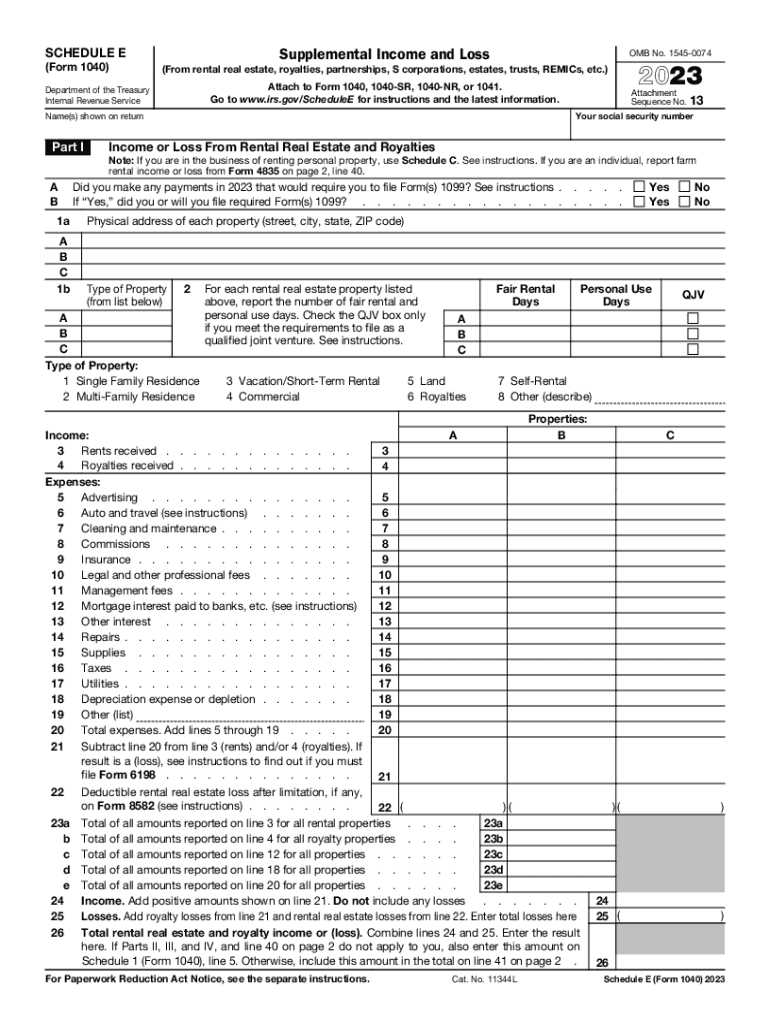

Who needs IRS Form 1040 Schedule E?

Schedule E is usually used in conjunction with Form 1040 and accounts for supplemental income and loss. Therefore, everyone who received income from real estate, royalties, S corporations or partnerships should report it on Schedule E.

What is IRS 1040 Schedule E for?

Schedule E serves to report income received from real estate, trusts, residual interest and other areas or to inform the IRS about the loss of earnings that occurred in any of the above-mentioned areas.

Is IRS 1040 Schedule E Accompanied by other Forms?

In conjunction with Form 1040, Schedule E usually accompanies the tax return and doesn't require any other attachments. But there are some forms that you may be asked to file alongside Schedule E. These are From 1040 Schedule A, or Forms 3520, 4562, 4684, 4797, 6198 etc. You can find the full list of forms on the IRS official website in the instructions for Schedule E.

When is IRS Form 1040 Schedule E Due?

Schedule E is submitted together with Form 1040 that is on April 15th every year. However, in 2017 the tax day falls on April 18th because of the holidays.

How do I Fill out IRS Form 1040 Schedule E?

Schedule E is a two-page form with 4 parts to be completed:

- Part 1 accounts for income or loss from real estate and royalties. In this part provide the address of the property, its type, the expenses it took you to maintain the property, income it has brought you, and losses you’ve suffered

- Part 2 accounts for income and losses from partnership and S corporations. The fields in this part are to be completed with the detailed figures of passive and non-passive income and loss

- Part 3 requires data about income and loss from estates and trusts

- Part 4 accounts for real estate mortgage investments conduits

- Part 5 gives a summary of income and loss reported both in Schedule E and in Form 1040.

Where do I Send Form 1040 Schedule E?

Once done, Schedule E is sent to the IRS together with Form 1040.