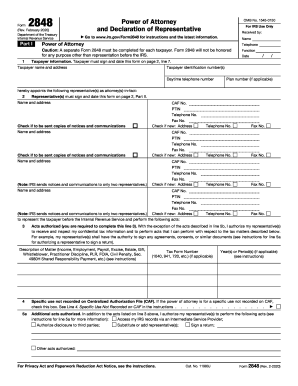

Who needs an IRS Form 2848?

Form 2848 is to be filed by the representative who is applying for power of attorney.

What is the IRS Form 2848 for?

Form 2848 is a United States Internal Revenue Service tax form used for listing a power of attorney for a taxpayer. The power of attorney allows a representative to file taxes and appear on behalf of another person in IRS proceedings. The form 2848 states the standard definition of a power of attorney, which means that the taxpayer can define the scope of the power of attorney by filling out this form. This form is important as it states whether the taxpayer will allow the representing party to receive tax refund checks but not to cash them.

Is the IRS Form 2848 accompanied by other forms?

You should attach a copy of any power of attorney which was filed before this one if any, in order to keep them valid.

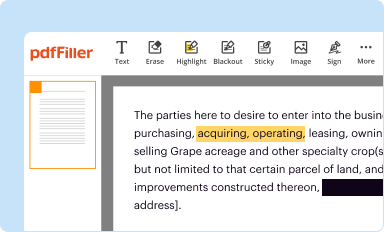

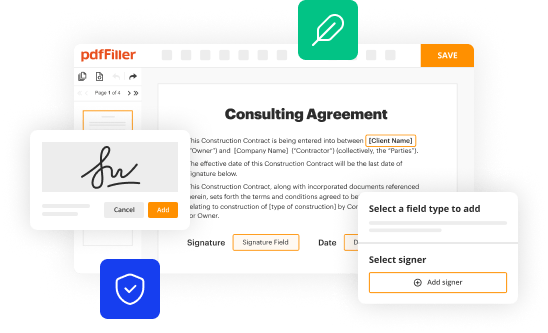

How do I fill out Form 2848?

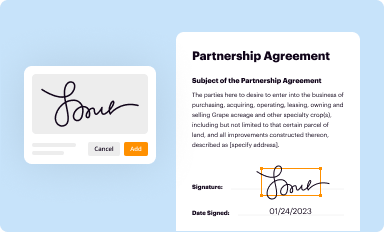

The taxpayer’s and representative’s personal information should be provided. Then, you'll need to determine the extent of representation, which you select for the representative. If a power of attorney is given for a joint tax return, both parties must sign off the power of attorney in order for the form 2848 to be effective. The representative must declare their status in part two and certify the declaration by their signature.

Where do I send Form 2848?

Once completed, the form is ready to be submitted to the IRS office.