Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is exemption certificate?

An exemption certificate is a document that is issued by a government agency or other approved organization to an individual or business as proof that they are exempt from certain taxes or fees. The certificate may be used to validate the exemption status for goods or services that the individual or business purchases.

Who is required to file exemption certificate?

The person making a taxable purchase is typically required to file an exemption certificate. This applies to businesses that make purchases for resale, manufacturing, or other exempt purposes.

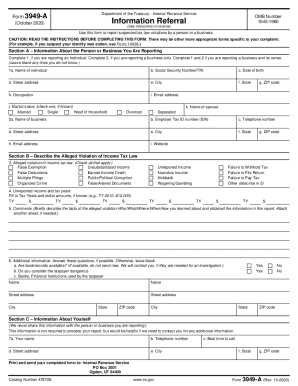

What information must be reported on exemption certificate?

The information that must be reported on an exemption certificate typically includes the purchaser's name and address, the seller's name and address, the date of the sale, the type of exemption being claimed, and a description of the goods or services being purchased. Depending on the jurisdiction, additional information may need to be provided, such as the registration number and expiration date of the purchaser's exemption certificate.

When is the deadline to file exemption certificate in 2023?

The deadline to file exemption certificates in 2023 depends on the state in which you are filing. Generally, the deadline for filing exemption certificates is between January 1st and April 15th of that year.

What is the penalty for the late filing of exemption certificate?

The penalty for the late filing of an exemption certificate varies depending on the state, and may include fines, penalties, and interest. Generally, the penalty is assessed on the amount of taxes due on the transaction for which the certificate was required.

How to fill out exemption certificate?

To fill out an exemption certificate, follow these steps:

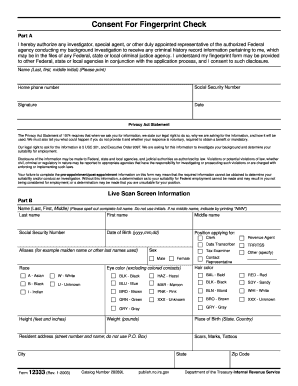

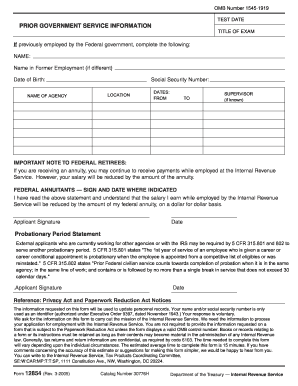

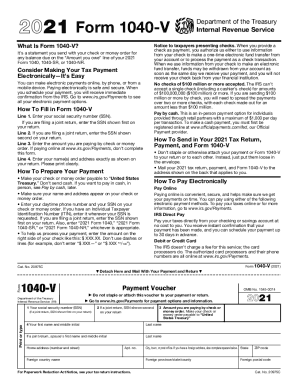

1. Obtain the correct form: Depending on the type of exemption, there may be specific forms provided by your state's tax department or other relevant authority. Make sure you have the correct form for your exemption situation.

2. Read the instructions: Start by carefully reading the instructions on the exemption certificate form. Understand what information needs to be provided and how to complete each section.

3. Provide basic information: Begin by filling in your personal or business information, such as your name, address, and contact details. Make sure to provide accurate and up-to-date information.

4. Specify your exemption: Clearly state the reason for the exemption on the form. This could include reasons like being a reseller, being eligible for a certain religious or nonprofit exemption, or qualifying for a specific tax category.

5. Include supporting documentation: In many cases, you will need to attach supporting documentation that proves your eligibility for the exemption. This may include copies of state-issued identification, state tax identification numbers, or other relevant documents.

6. Ensure completeness and accuracy: Double-check that you have filled in all the required fields correctly, leaving no blank spaces. Review the form and accompanying documents to ensure they are accurate and up to date.

7. Submit the form: Once the exemption certificate is completed and reviewed, sign and date the form. Keep a copy for your records and submit the original to the appropriate authority, such as your state's tax department or the entity requesting the certificate.

Remember, exemption certificate requirements can vary from state to state and may also vary depending on the specific situation. It is advisable to consult with a tax professional or refer to the relevant tax authorities' guidelines to ensure compliance and accuracy when filling out an exemption certificate.

What is the purpose of exemption certificate?

The purpose of an exemption certificate is to provide evidence or documentation that exempts certain individuals, organizations, or transactions from certain taxes or regulations. This certificate is usually issued by the relevant governmental authority and serves to authenticate the exemption status. It is often required in various contexts such as sales tax exemption, property tax exemption, or exemption from certain regulatory requirements. The certificate helps ensure compliance with applicable laws and regulations while allowing eligible parties to claim legitimate exemptions.

How can I modify exemption certificate without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your irs pdf forms fillable into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete irs pdf fillable forms on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your pdf california, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out fillable irs pdf forms on an Android device?

On an Android device, use the pdfFiller mobile app to finish your california tax form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.