Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is solo 401k plan document?

A Solo 401(k) plan document is a legal document that outlines the rules and regulations for establishing and maintaining a Solo 401(k) retirement plan. It describes the plan's eligibility requirements, contribution limits, investment options, distribution rules, and any other provisions related to the plan. The document is typically provided by a financial institution or plan provider and must comply with the guidelines set by the Internal Revenue Service (IRS) for the administration of retirement plans.

Who is required to file solo 401k plan document?

The owner of a solo 401(k) plan, typically a self-employed individual or small business owner with no employees other than a spouse, is responsible for establishing and filing the solo 401(k) plan document. This document outlines the rules and regulations of the plan and must be filed with the appropriate government agency. However, it is recommended to consult with a qualified tax or financial professional for guidance and assistance in properly setting up and filing the solo 401(k) plan documentation.

How to fill out solo 401k plan document?

Filling out a Solo 401(k) plan document can be a complex process, as it involves several legal and financial considerations. It is recommended to seek assistance from a qualified professional such as a retirement plan specialist or an attorney specializing in retirement plans. However, here are some general steps to get you started:

1. Understand the plan: Familiarize yourself with the Solo 401(k) plan document's provisions, rules, and requirements. This will give you an idea of what information is needed and what options are available to you.

2. Gather required information: Collect all the necessary information needed to complete the plan document. This may include personal and business details, such as your name, Social Security number, the name of your business, and its tax identification number.

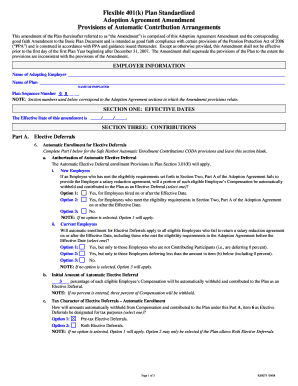

3. Determine plan features: Decide on the features you want to include in your Solo 401(k) plan, such as contribution limits, investment options, and eligibility requirements. Consult a professional to ensure compliance with IRS regulations.

4. Complete plan document: The plan document is typically provided by a qualified retirement plan provider or an attorney specializing in retirement plans. Fill out the required sections, carefully providing accurate and complete information.

5. Review and revise: It is essential to review the completed plan document thoroughly to ensure consistency, accuracy, and compliance with regulations. Make any necessary revisions or amendments.

6. Sign and date: Once you are satisfied with the accuracy and completeness of the document, sign and date it, along with any required witnesses or notaries, according to the plan document's instructions.

7. Keep a copy: Retain a copy of the completed plan document for your records. It is essential to have this documentation available for future reference, changes, or potential audits.

Remember, the process of establishing a Solo 401(k) plan can be complex, and it is crucial to consult with a professional to ensure compliance with applicable laws and regulations.

What is the purpose of solo 401k plan document?

The purpose of a Solo 401(k) plan document is to establish and maintain a retirement savings plan specifically designed for self-employed individuals or business owners with no full-time employees. This document outlines the detailed provisions and rules of the plan, including eligibility criteria, contribution limits, investment options, distribution rules, and other administrative details.

The Solo 401(k) plan document serves as a legal agreement between the plan sponsor (the self-employed individual or business owner) and the plan participants (typically the same person), outlining the rights and responsibilities of each party. It also ensures compliance with the Internal Revenue Service (IRS) regulations and guidelines governing retirement plans, thereby offering tax advantages and allowing the plan sponsor to take advantage of significant retirement savings opportunities.

The plan document is typically provided by a plan provider or a financial institution that specializes in retirement plans, and it must be carefully reviewed and adopted by the plan sponsor to establish the Solo 401(k) plan. By following the guidelines laid out in the document, the plan sponsor can take advantage of the flexibility, control, and tax-deferred growth opportunities offered by the Solo 401(k) plan.

What information must be reported on solo 401k plan document?

The specific information that must be reported on a solo 401(k) plan document includes:

1. Plan Sponsor Information: This includes the name, address, and Employer Identification Number (EIN) of the plan sponsor, which is typically the self-employed individual or business owner who establishes the solo 401(k) plan.

2. Plan Eligibility: The plan document should outline the eligibility requirements for participants, such as age limits and the type of compensation that qualifies for plan contributions.

3. Contribution Limits: It is important to specify the maximum contribution limits for both the employer and employee contributions each year, as set by the IRS. For 2021, the employee contribution limit is $19,500, and the overall annual limit is $58,000 (or $64,500 for those over 50 years old).

4. Profit Sharing Formula: If the solo 401(k) plan includes a profit-sharing component, the plan document should state the formula used to calculate the allocation of employer contributions based on business profits.

5. Vesting Schedule: If there is a vesting schedule for employer contributions (i.e., a time period before participants fully own the employer contributions), it should be included in the plan document.

6. Compensation Definitions: The plan document should clearly define how compensation is calculated for determining plan contributions. This may include details on excluded types of compensation, such as certain bonus payments.

7. Plan Investments: The plan document should outline the available investment options for participants. Solo 401(k) plans typically offer a variety of investment choices, including stocks, bonds, mutual funds, and other approved investments.

8. Loans and Distributions: The plan document must specify the rules and procedures for participant loans, including the allowable loan amounts and repayment terms. It should also outline the eligibility criteria, distribution options, and tax implications for participants who wish to make withdrawals or take distributions from the plan.

9. Plan Amendments and Termination: Details on how the plan document can be amended or terminated should also be included. This ensures that any changes to the plan are properly documented and communicated to participants.

It is important to note that solo 401(k) plans must comply with all applicable IRS regulations, so it is recommended to consult with a qualified retirement plan professional or tax advisor to ensure the plan document includes all required information.

When is the deadline to file solo 401k plan document in 2023?

The deadline to file a Solo 401(k) plan document for the 2023 tax year would typically be December 31, 2023. However, it is important to note that setting up a Solo 401(k) plan should ideally be done well in advance to allow for proper implementation and to ensure that all requirements are met. It is recommended to consult with a tax professional or retirement plan provider for specific guidance and deadlines related to your situation.

What is the penalty for the late filing of solo 401k plan document?

The penalty for the late filing of a solo 401(k) plan document can vary depending on the specific circumstances and the regulations of the Internal Revenue Service (IRS). However, the general penalty for late filing is $25 per day, with a maximum penalty of $15,000. It is important to note that the penalties can increase if the IRS determines that the late filing was intentional or fraudulent.

Where do I find solo 401k plan document template?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific 401k statement sample form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute sample 401k statement online?

Filling out and eSigning 401k statement form is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I fill out 401k plan document sample on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your populus financial group 401k forms by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.