Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file form 990?

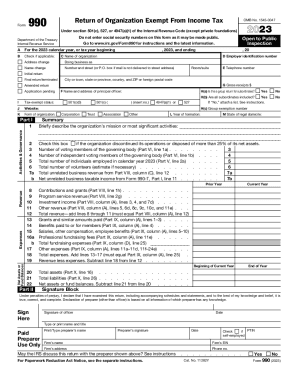

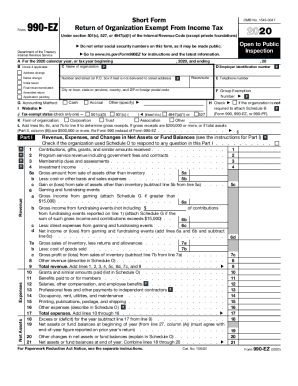

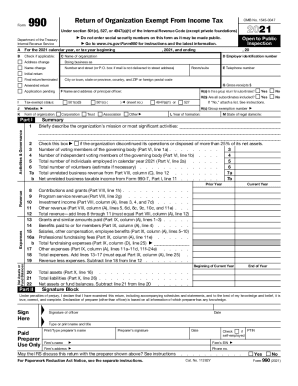

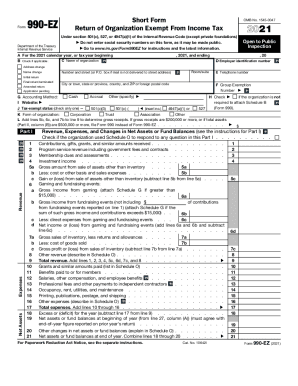

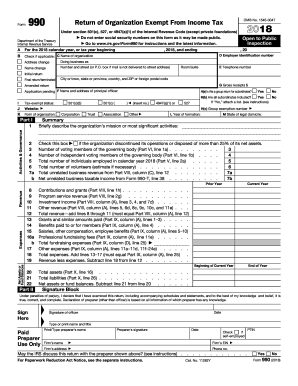

Form 990 is required to be filed by certain tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations. The specific type of organization that must file Form 990 can vary based on the organization's gross receipts and assets. Generally, organizations with gross receipts of more than $200,000 and total assets of more than $500,000 must file Form 990.

What is the purpose of form 990?

Form 990 is an Internal Revenue Service (IRS) form that is used to provide the public with financial information about a nonprofit organization. It is also used by the IRS to determine whether the organization is operating within the law and to assess its compliance with the applicable tax code. The information provided on Form 990 is used to show the public how the organization is using its resources and to ensure that tax-exempt organizations are operating according to the IRS's requirements.

What information must be reported on form 990?

Form 990 is an annual filing required of tax-exempt organizations, nonexempt charitable trusts and section 527 political organizations. Form 990 requires tax-exempt organizations to provide information on their mission, programs, and finances.

The Form 990 requires disclosure of:

1. Organization's mission statement and activities

2. Financial information, including compensation of officers, directors, trustees, and key employees

3. Revenues and expenses

4. Balance sheet

5. List of Board of Directors and officers

6. List of contributors

7. List of grants and contracts

8. Program service accomplishments

9. Names of independent accountants and auditors

10. List of tax filings and returns

11. Other information related to tax-exempt status.

When is the deadline to file form 990 in 2023?

The deadline to file Form 990 in 2023 is May 15, 2024.

What is the penalty for the late filing of form 990?

The IRS does not impose any penalties for late filing of Form 990. However, the IRS may revoke an organization's tax-exempt status if it fails to file Form 990 for three consecutive years.

Form 990 is a tax document that tax-exempt organizations in the United States are required to file annually with the Internal Revenue Service (IRS). It provides information about the organization's mission, programs, governance, finances, and other activities. This form helps the IRS and the public understand how the organization operates and how it uses its resources. The information disclosed on Form 990 is publicly available and can be accessed by anyone who wants to learn more about a particular tax-exempt organization.

How to fill out form 990?

Filling out form 990 can be a detailed and complex process. Here is a general step-by-step guide to help you get started:

1. Gather the necessary information and documents: Collect all the relevant financial records, organizational details, and other supporting documents such as previous year's Form 990, balance sheets, income and expense statements, and any other required schedules or attachments.

2. Understand the different parts of the form: Familiarize yourself with the structure of Form 990 and its various sections. It consists of multiple sections, including the organization's identification, summary of financial information, program and mission details, governance and management information, compensation details, and required schedules.

3. Enter basic organization information: Begin by completing the basic identification information at the beginning of the form, including the organization's legal name, address, EIN (Employer Identification Number), and fiscal year details.

4. Provide financial information: Enter the organization's financial data in the appropriate sections, including revenue details, expenses, assets, liabilities, and net assets. Include information about functional and natural expense classification, public support, grants and contributions, and any unrelated business income.

5. Report program activities and mission statement: Describe the organization's mission, its accomplishments during the year, and how it fulfilled its exempt purpose. Provide information on any significant changes in program activities or objectives.

6. Disclose governance and management details: Answer questions related to the organization's structure, board composition, governance policies, conflicts of interest, and other governance-related information.

7. Provide compensation details: Disclose compensation information for key employees, officers, and highly-compensated individuals. Report their salaries, benefits, bonuses, and any other compensation-related information. Attach Schedule J if there are substantial amounts of compensation or if there are related organizations.

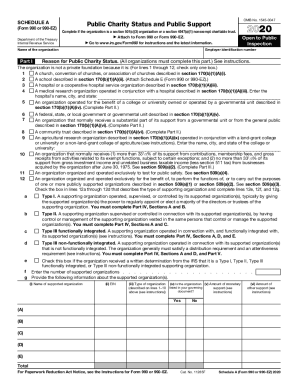

8. Complete required schedules and attachments: Depending on your organization's activities, you may need to complete additional schedules or attachments. These can include Schedule A (information on public charities), Schedule B (reporting of contributions and grants), Schedule C (political and lobbying activities), and others. Make sure to review the instructions for Form 990 to determine which schedules are applicable to your organization.

9. Review and double-check: Once you have completed all the sections of the form, review it carefully to ensure accuracy and consistency. Check for any omissions, errors, or missing information. Review all attached schedules and attachments as well.

10. File the form: File the completed Form 990 by the required deadline. The filing procedure may differ depending on your organization's state and federal requirements. You can file electronically through the IRS website or mail a physical copy to the appropriate IRS address.

It's important to note that this is a general guide, and Form 990 requirements can vary depending on the size, type, and activities of your organization. It's recommended to consult with a tax professional or accountant who specializes in nonprofit tax regulations to ensure accurate and compliant filing.

How can I send form 990 for eSignature?

Once you are ready to share your 990 form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit form 990 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute 990 n from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete 990 n on an Android device?

On an Android device, use the pdfFiller mobile app to finish your form 990. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.