Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

"M form" is not a commonly used term and does not have a specific meaning. It could potentially refer to various subjects or concepts depending on the context. Can you please provide more information or clarify what you are referring to?

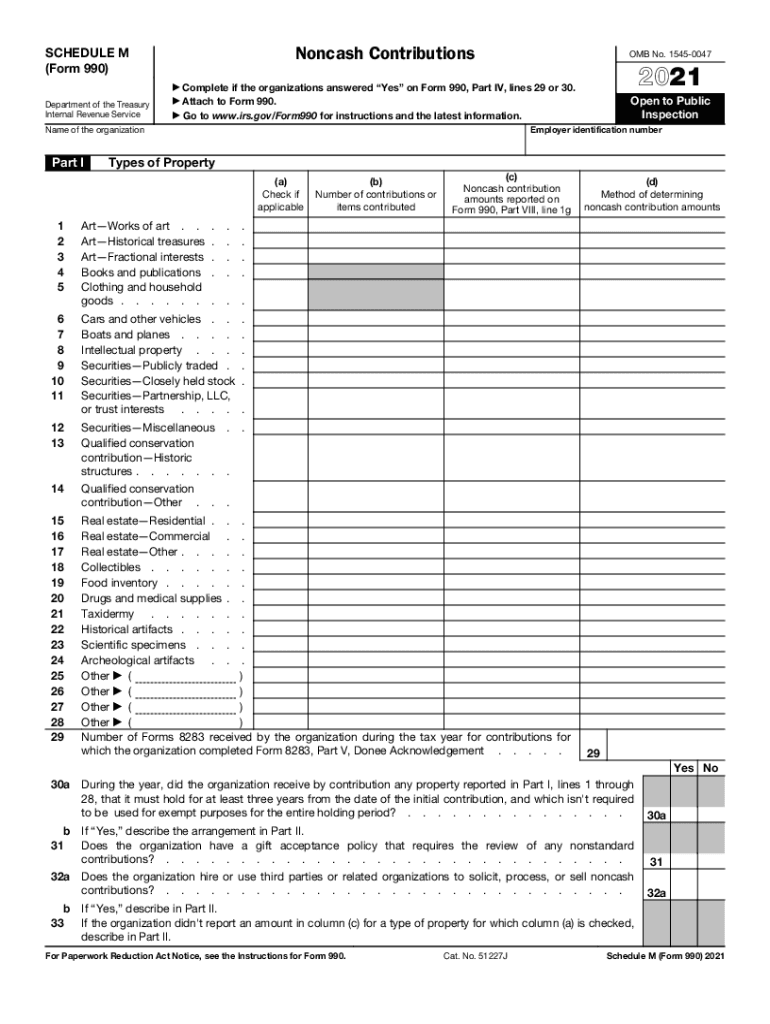

Who is required to file m form?

M form is typically a term used to refer to the Mauritius Revenue Authority (MRA) Form M, which is a tax return form that needs to be filed by individuals and companies in Mauritius. The specific individuals or companies required to file Form M depend on the tax regulations of Mauritius, and can include residents and non-residents who have income or activities within the country that are subject to taxation. It is advisable to consult with a tax professional or the MRA for specific guidance on who is required to file Form M.

To effectively fill out a form, follow these steps:

1. Read the entire form: Familiarize yourself with the form's purpose and instructions. Make sure you understand the information required and any special guidelines.

2. Gather required information: Collect all the necessary documents and information before starting to fill out the form to avoid any delays or mistakes. Prepare any supporting documentation that may be required.

3. Start with personal details: Begin by providing your personal information, such as your full name, address, contact details, and date of birth. Fill out each section carefully, ensuring accuracy.

4. Follow instructions carefully: Pay attention to specific instructions, such as using a specific format (e.g., date, phone number) or providing certain types of information (e.g., original signature, email address).

5. Double-check for completeness: Once you've completed filling out the form, review it thoroughly to ensure you have not missed any sections or fields. Check for errors in spelling, dates, and numbers.

6. Attach required documents: If any additional documents are required, make sure to properly attach them to the form. Use paperclips or staples as directed, or follow electronic submission guidelines if applicable.

7. Review and sign: If the form requires a signature, ensure you sign in the designated space. If submitting the form electronically, provide your digital signature if available or follow the provided instructions.

8. Make copies: Before submitting the filled-out form, make photocopies or save electronic copies for your records. This will be helpful if you need to refer back to the information or proof of submission.

9. Submit the form: Follow the submission guidelines mentioned in the form or provided separately. If mailing the hard copy, choose a reliable and secure method. For electronic submission, ensure you comply with any specific instructions or platforms mentioned.

10. Follow up: If necessary or if instructed, follow up to confirm receipt of your form by the recipient. This can help ensure that your form is seen and processed in a timely manner.

Remember to check the form's instructions or seek assistance from the appropriate authority if you have any questions or need further clarification on specific sections.

What is the purpose of m form?

The purpose of the M form, also known as the multinational form, is to provide a framework for multinational corporations to report their global business activities and financial information. It helps these companies in consolidating their financial statements and assessing their performance on a global scale. The M form allows for a holistic view of the multinational corporation's financial situation, considering the activities and operations of its subsidiaries, branches, and affiliates across different countries.

What information must be reported on m form?

Without specific context, it is unclear which "m form" you are referring to. Please provide more details or specify the purpose of the form to receive accurate information.

When is the deadline to file m form in 2023?

I apologize, but without further information, I cannot determine which specific form you are referring to. Could you please provide more context or specify the form you are inquiring about?

What is the penalty for the late filing of m form?

The penalty for the late filing of an M form, unfortunately, can vary depending on the specific country or jurisdiction. It is recommended to refer to the tax authority or relevant government website of your country for accurate and up-to-date information regarding penalties for late M form filing.

How do I modify my m form in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your schedule m form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit irs m form straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing irs schedule m form right away.

How do I fill out the 2021 schedule m form on my smartphone?

Use the pdfFiller mobile app to complete and sign schedule m form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.