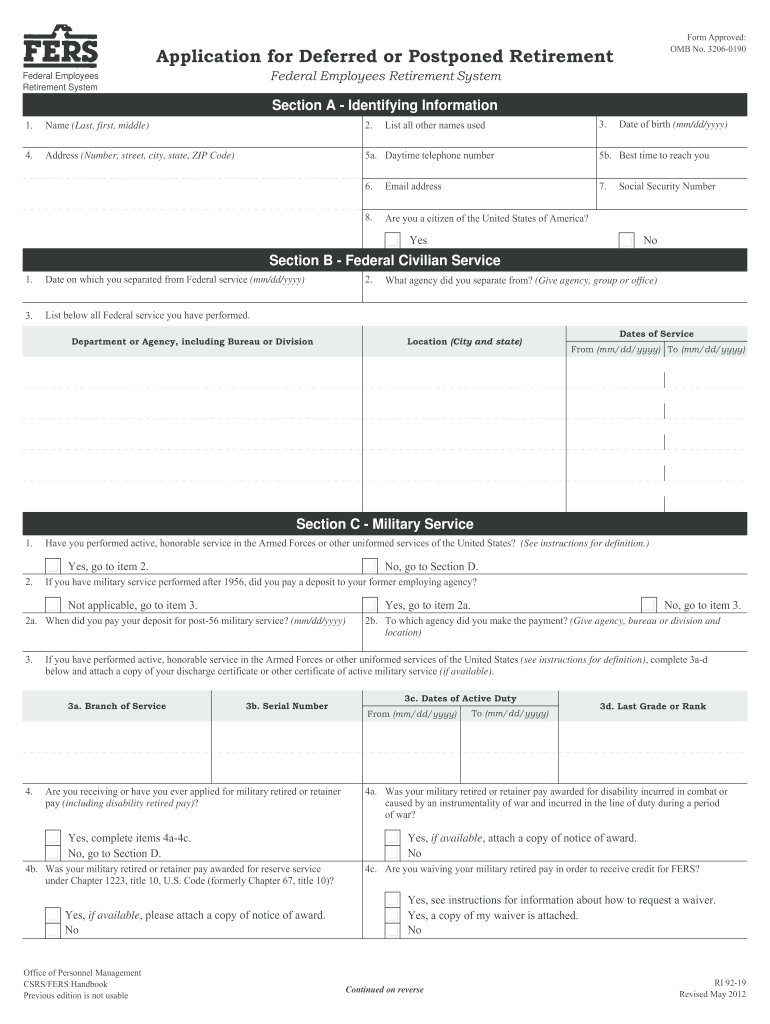

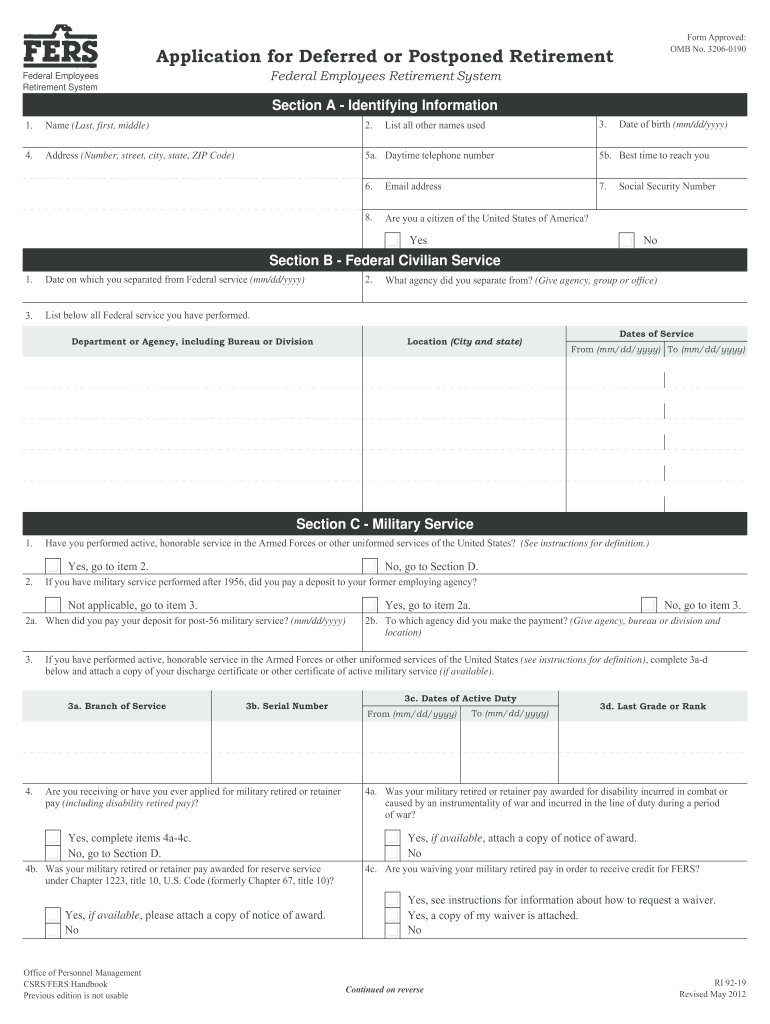

FERS RI 92-19 2012-2024 free printable template

Get, Create, Make and Sign

How to edit ri 92 19 online

FERS RI 92-19 Form Versions

How to fill out ri 92 19 2012-2024

How to fill out FERS retirement?

Who needs FERS retirement?

Video instructions and help with filling out and completing ri 92 19

Instructions and Help about ri 92 19a form

Don't want to hurt you Cole and don't it's not we can do this okay how are we going to become parents overnight come on I barely know how to drive I obviously can't cook, and you saw the way it was the salmon apart okay this is fine, but we'll learn okay what we'll learn together oh how can you be pence when I can't even tell my dad that I'm pregnant figure it out okay are you have to trust him what's the baby going to do overfit hang yourself come on we're just kids we are stupid kids who did a stupid thing this what you think you have to mean what sort of stupid oh we're on our school trip we don't want to get rowdy or anything extend maybe we can all get out our needlepoint he's right this is the lame-o right so let's get here down the road, and maybe we should just send Mike stand her big so grown up no I'll sophisticate I'm sure she could get sir Oh YouTube potato chips yeah I'm not going anywhere then you guys can do this room is about as dangerous as I'm going to live finale these do is it dangerous nice Tom Pittman you forget my special time don't you dare Spider got hysterical oh well then why didn't you have one of the boys get rid of it you know I have a very thick hide but to imply that I would actually put my daughter in danger dart I don't really care I care about Sarah not just now very nice lady she doesn't see or hear from you — you want something and what you're asking her to do can get her killed okay no it's not okay well you want a phone and email or something I am your daughter doesn't hear a word from you, and she asks what it doesn't matter except tonight of course was she sad and tells me the same three happy memories over and over why because that's all there is question please do you have any idea what she's been through this week do you have a clue what are you talking about did you happen to notice that your daughter's going through a hard time as she's sad or were you just too busy looking out for number one I mean come on you, you worry more about this little Wok looking for your own daughter stop thank you I don't need to protect me from my mom you go take something please okay I'll lock up on my way out stay away from the window sorry about he's he's right he's right about me one of the kids in pediatrics turns from you should have you volunteered over there a long time ago yeah I wasn't really sure about doing it, but I saw Sam stark today you saw Sam take care of it is he okay whatever I have to give her that skip run any answers for me uh dance race the medical stuff don't look oh yeah this stuff I brought over yeah, yeah good yeah some woman's missing now the woman in the x-rays we have to find her you want to do I tell you to do nothing else hey you're supposed to be sleeping its my friend keys you're safe that's all you need to know except for all the bullets fly not going to get any of that here how do I know that you're just going to have to trust us, so I need to know are you trying to stop me what's...

Fill ri 92 19 opm : Try Risk Free

People Also Ask about ri 92 19

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ri 92 19 2012-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.