Get the free solutions tool financial form

Show details

Financial Planning Questionnaire To complete this form by hand 1 Print all pages of this form. 1 Save this writable PDF to your computer then open it using Adobe s Acrobat Reader. Annual expenses for other dependents for example parents Estate Planning Do you have updated wills Do you have powers of attorney Have you executed health care proxies When were these documents last updated Have you established any trusts If yes names of trust s you have established Whom may we thank for referring...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your solutions tool financial form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your solutions tool financial form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing solutions tool financial online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit financial fact finder template form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out solutions tool financial form

How to fill out financial planning fact finder:

01

Start by gathering all relevant financial information, such as income, expenses, assets, and liabilities.

02

Provide personal details like your name, contact information, and social security number, if necessary.

03

Fill in your current financial goals and objectives, whether it's saving for retirement, buying a house, or paying off debt.

04

Indicate your risk tolerance level by selecting the appropriate options, considering your comfort level with potential investment losses.

05

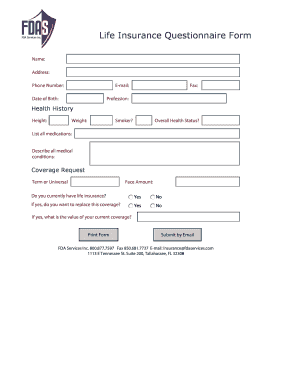

Detail your current insurance coverage, including types of policies, coverage amounts, and beneficiaries.

06

Include any specific financial concerns or considerations that you may have, such as estate planning or educational expenses.

07

Review the completed fact finder form for accuracy and completeness before submitting it to your financial planner.

Who needs financial planning fact finder:

01

Individuals who want to improve their financial situation and achieve their financial goals.

02

People who are interested in creating a comprehensive financial plan tailored to their specific needs.

03

Anyone who wants to gain a better understanding of their current financial situation and make informed decisions about their money.

Fill fact find template : Try Risk Free

People Also Ask about solutions tool financial

What is a fact finder financial planning?

How do you create a realistic financial plan?

What are the 7 areas of financial planning?

What is the best way to create a financial plan?

What are the 4 basics of financial planning?

What is a realistic financial plan?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is financial planning fact finder?

Financial planning fact finder is a document used by financial planners to gather information about a client's financial situation, goals, and objectives. It serves as a starting point for the financial planning process and helps the planner to gain an understanding of the client's current circumstances, identify the client's goals, and develop a strategy to achieve those goals. The fact finder typically includes questions about the client's income, assets, liabilities, insurance coverage, investments, and estate planning.

How to fill out financial planning fact finder?

1. Gather the necessary information. Before filling out the fact finder, make sure you have all the information you need. This includes basic personal information such as name, address, contact information, and date of birth. You should also have information about any assets, debts, and current income sources.

2. Fill out the basic information. Begin by filling out the basic information section of the fact finder. This includes your name, contact information, and date of birth.

3. Provide information about assets and debts. In this section, you will provide information about any assets you own, such as real estate, investments, and other property. You will also need to provide information about any debts you may have, such as credit cards, car loans, and mortgages.

4. Provide income information. In this section, you will need to provide information about any sources of income you may have, such as wages, investments, and rental income.

5. Provide information about goals and objectives. In this section, you will need to provide information about your financial goals and objectives. This could include retirement planning, college savings, or other long-term goals.

6. Review the information. After you have completed the fact finder, review all of the information you provided to make sure it is accurate. Once you are satisfied with the information, you can submit the fact finder to your financial advisor for review.

What is the purpose of financial planning fact finder?

Financial planning fact finders are documents used to collect information from a client about their financial goals, needs, and resources. The purpose of a financial planning fact finder is to provide an organized and comprehensive overview of the client’s current financial situation and objectives, in order to help financial advisors develop appropriate strategies and solutions that will meet the client’s needs.

Who is required to file financial planning fact finder?

Financial advisors or planners are required to file a financial planning fact finder.

What information must be reported on financial planning fact finder?

The information that must be reported on a financial planning fact finder typically includes:

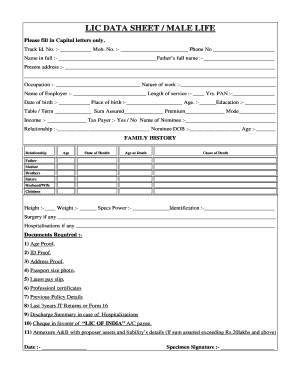

1. Personal information: This includes the client's name, age, address, contact details, and marital status.

2. Financial goals and objectives: The client's short-term and long-term financial goals, such as saving for retirement, paying for education, buying a house, etc.

3. Current financial situation: This includes details about the client's income, expenses, assets (e.g., savings, investments, real estate), liabilities (e.g., loans, mortgages, credit card debts), insurance coverage, and tax situation.

4. Risk tolerance: The client's willingness and ability to take on financial risk, including their investment preferences, risk aversion, and time horizon for financial goals.

5. Time horizon: The client's planned timetable for achieving specific financial goals, which can help determine appropriate investment strategies and timeframes.

6. Dependents and beneficiaries: Details about the client's dependents (e.g., children, aging parents) and beneficiaries (e.g., spouse, children) for estate planning purposes.

7. Investment knowledge and experience: The client's level of understanding and experience with various investment products, such as stocks, bonds, mutual funds, etc.

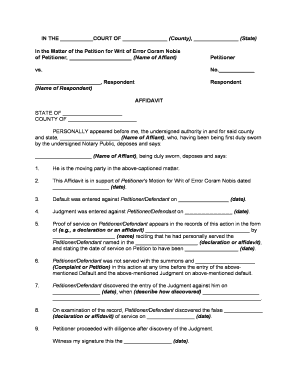

8. Legal considerations: Any legal aspects that need to be taken into account, such as wills, trusts, power of attorney, or other legal documents.

9. Health considerations: Any health-related issues that may impact financial planning, such as existing medical conditions or long-term care needs.

10. Other relevant information: Any other information that may be applicable to the financial planning process, such as special circumstances, family dynamics, or specific concerns.

It's important to note that the specific information required may vary depending on the financial planning firm, the client's situation, and the purpose of the fact finder.

What is the penalty for the late filing of financial planning fact finder?

The penalty for late filing of a financial planning fact finder will depend on the specific regulations and guidelines set by the governing body or organization that oversees financial planning standards in a particular jurisdiction. In general, there may be penalties such as fines or disciplinary actions imposed on financial planners who fail to submit the required documentation on time. It is advisable to consult the relevant regulatory authority or professional organization to determine the specific penalties applicable in a given jurisdiction.

How do I make edits in solutions tool financial without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing financial fact finder template form and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my financial planning fact finder template in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your intended financial planning and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

Can I edit strategicpoint financial questionnaire on an Android device?

You can edit, sign, and distribute financial fact finder form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your solutions tool financial form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Planning Fact Finder Template is not the form you're looking for?Search for another form here.

Keywords relevant to financial planning fact finder form

Related to financial advisor fact finder

If you believe that this page should be taken down, please follow our DMCA take down process

here

.