Get the free texas resale certificate form

Show details

SAVE A COPY 01-339 (Rev.9-07/6) CLEAR SIDE TEXAS SALES AND USE TAX RESALE CERTIFICATE Name of purchaser, firm or agency as shown on permit Phone (Area code and number) Address (Street & number, P.O.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your texas resale certificate form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas resale certificate form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas resale certificate online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit resale certificate texas form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

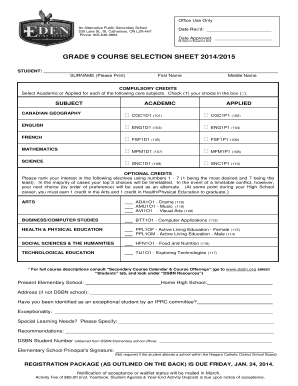

How to fill out texas resale certificate form

How to Fill out Texas Resale Certificate:

01

You must first download the Texas Resale Certificate form from the Texas Comptroller's website.

02

Fill out your business information, including your name, address, and tax identification number.

03

Indicate whether you are the purchaser or seller by checking the appropriate box.

04

Include the name and address of the purchaser or seller as well.

05

Provide a detailed description of the type of tangible personal property being purchased or sold.

06

Specify the reason for the exemption from sales tax, such as resale, manufacturing, or wholesale.

07

Sign and date the certificate.

08

Keep a copy of the completed certificate for your records.

Who Needs Texas Resale Certificate:

01

Texas businesses that plan to purchase goods for resale are required to have a Texas Resale Certificate.

02

Wholesalers, retailers, and manufacturers who plan to sell tangible personal property in the state of Texas also need a resale certificate.

03

It is important to have a valid resale certificate in order to avoid paying sales tax on items that will be resold.

Fill form : Try Risk Free

People Also Ask about texas resale certificate

Do I need a sellers permit to sell online in Texas?

Do I need a resale certificate to sell online in Texas?

How long does it take to get a seller's permit in Texas?

How do I get a resale certificate?

Do I need a resale certificate to sell on Amazon in Texas?

How do I get a resale license in Texas?

Who normally pays for resale certificate in Texas?

How long does it take to get a Texas resale Certificate?

What is a resale certificate in Texas?

How much does it cost to get a resale license in Texas?

Is a resale certificate required in Texas?

How do I get a Texas resale certificate?

Who orders resale certificate in Texas?

Does Texas require a resale certificate?

How much is a reseller permit in Texas?

How do I get a resale certificate in Texas?

Do you need a resale license to sell in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is texas resale certificate?

A Texas resale certificate, also known as a resale exemption certificate, is a document that allows a business or individual to purchase goods tax-free from a supplier with the intention of reselling those goods. It is issued by the Comptroller of Public Accounts in Texas and is used to certify that the items being purchased will be resold and the sales tax will be collected from the final consumer. This certificate is necessary to establish the buyer's eligibility for a sales tax exemption on their purchases for resale purposes.

Who is required to file texas resale certificate?

In Texas, businesses that sell tangible personal property for resale purposes are required to file a Texas Resale Certificate. This includes retailers, wholesalers, distributors, and any other businesses that purchase items for resale rather than for their own use.

How to fill out texas resale certificate?

To fill out a Texas resale certificate, follow these steps:

1. Download the Texas resale certificate form from the official Texas Comptroller of Public Accounts website. The form is called "Texas Sales and Use Tax Resale Certificate" (Form 01-339).

2. Provide your business information. Fill in your company's legal name, mailing address, city, state, ZIP code, and your Texas Sales and Use Tax permit number. If you don't have a permit, leave this section blank.

3. Describe the type of business you operate. Indicate whether you are a sole proprietor, corporation, partnership, limited liability company (LLC), or other.

4. Specify the nature of your business. Check the appropriate box that best describes the type of goods or services you sell.

5. Include your federal employer identification number (FEIN) or Social Security number (SSN), depending on the type of business entity you operate.

6. Provide your signature and date in the designated spaces at the bottom of the form.

7. If you are purchasing goods or services in Texas, give the form directly to the seller. If you are making purchases out of state but plan to resell them in Texas, give a copy of this form to your out-of-state seller.

Remember, the resale certificate is for purchases made solely for resale purposes, and it relieves the seller of the responsibility of collecting sales tax from you. Make sure to keep a copy of each certificate you provide in your records.

What is the purpose of texas resale certificate?

The purpose of a Texas resale certificate is to allow businesses to purchase goods or services for resale without paying sales tax. It serves as proof to the seller that the purchaser intends to resell the items rather than consume them. The resale certificate is issued by the Texas Comptroller of Public Accounts and must be furnished by the buyer to the seller to qualify for sales tax exemption.

What information must be reported on texas resale certificate?

When completing a Texas Resale Certificate, the following information must be reported:

1. Name and address of the purchaser (buyer) acquiring the goods for resale.

2. Taxpayer Identification Number (TIN) or Social Security Number (SSN) of the purchaser.

3. Seller's name and address from whom the items are being purchased.

4. An accurate description of the items being purchased for resale.

5. The buyer's signature and date of signing the certificate, indicating that the information provided is true and correct.

6. The date the resale certificate is presented to the seller.

It is important to note that the resale certificate should only be used for qualifying purchases that will be resold, leased, rented, or incorporated into products for resale. Using the certificate for personal purchases may result in tax liabilities.

What is the penalty for the late filing of texas resale certificate?

In Texas, there is generally no specific penalty for the late filing of a resale certificate. However, failing to timely provide a valid resale certificate to a seller may result in the seller being responsible for collecting and remitting sales tax on the sale. Additionally, if a taxpayer is audited by the Texas Comptroller's Office and cannot provide a valid resale certificate for a purchase, the taxpayer may be liable for any sales tax that should have been collected by the seller on that purchase.

How can I get texas resale certificate?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the resale certificate texas form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit texas tax resale certificate online?

With pdfFiller, the editing process is straightforward. Open your texas resale tax certificate in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit printable texas resale certificate on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as resale tax certificate texas form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your texas resale certificate form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Tax Resale Certificate is not the form you're looking for?Search for another form here.

Keywords relevant to texas resale certificate form

Related to texas resale certificate pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.