Get the free PERSONAL IDENTIFICATION NUMBER PIN - FORM For Existing

Show details

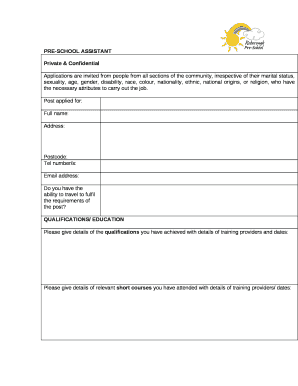

PERSONAL IDENTIFICATION NUMBER (PIN) FORM For Existing Investors only For Telephone & Internet Transactions Application no: WPD100904 Please fill the Form in BLOCK LETTERS. * These details are mandatory,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your personal identification number pin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal identification number pin form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal identification number pin online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit personal identification number pin. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

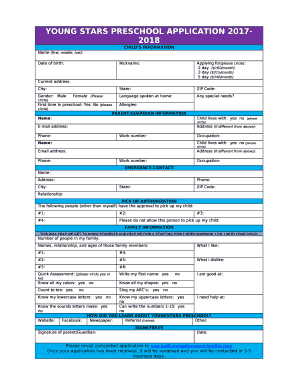

How to fill out personal identification number pin

How to fill out personal identification number (PIN):

01

Make sure you have the necessary documentation: To fill out a personal identification number (PIN), you will typically need your identification card or passport, as well as any other required documents specified by your country's government or financial institution.

02

Locate the application form: Find the specific form or application required to obtain a PIN. This may be available online, at the relevant government office, or at a bank or financial institution.

03

Provide personal information: Fill out the form by providing your full name, address, date of birth, and any other required personal information accurately and legibly.

04

Submit identification documents: Attach copies of your identification card or passport, as well as any other supporting documents required, such as proof of address or citizenship.

05

Review and sign: Carefully review all the information provided on the form, ensuring there are no errors or inconsistencies. Sign and date the form where required.

06

Submit the application: Once you have completed the form and attached all necessary documents, submit the application to the designated authority or institution. This may involve mailing the application, visiting a government office, or submitting it online.

07

Wait for processing: The processing time for a PIN can vary depending on the specific requirements and the entity handling your application. It is advisable to follow up on the status of your application if required.

08

Receive your PIN: Once your application is processed successfully, you will receive your personal identification number (PIN) through the method specified by the issuing authority or financial institution. This could be through mail, email, or directly from a bank representative.

Who needs personal identification number (PIN)?

01

Individuals with bank accounts: Most individuals who have a bank account will typically need a personal identification number (PIN) to perform transactions at ATMs, authorize payments, or access online banking services.

02

Credit and debit cardholders: If you have a credit or debit card, you will likely have a PIN associated with it. This PIN is important for secure transactions and cash withdrawals.

03

Taxpayers: In some countries, taxpayers may need a personal identification number (PIN) to file tax returns, access online tax services, or communicate with tax authorities.

04

Government benefit recipients: Individuals receiving government benefits, such as unemployment benefits or social assistance, may need a personal identification number (PIN) to access their funds through automated systems or government portals.

05

Identification for official purposes: In certain instances, a personal identification number (PIN) may be required for official purposes, such as applying for a driver's license, obtaining a national identity card, or registering for specific services.

Remember to always follow the guidelines and requirements set by your country's government or relevant institutions when obtaining and using a personal identification number (PIN).

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is personal identification number pin?

Personal Identification Number (PIN) is a unique number assigned to an individual for identification purposes.

Who is required to file personal identification number pin?

Individuals who earn income and are eligible for tax filing are required to file their Personal Identification Number (PIN).

How to fill out personal identification number pin?

To fill out Personal Identification Number (PIN), individuals need to provide their unique PIN number assigned by the tax authority.

What is the purpose of personal identification number pin?

The purpose of Personal Identification Number (PIN) is to accurately identify individuals for tax and financial transactions.

What information must be reported on personal identification number pin?

Personal Identification Number (PIN) must include personal details, income information, and other relevant financial data for tax purposes.

When is the deadline to file personal identification number pin in 2024?

The deadline to file Personal Identification Number (PIN) in 2024 is typically April 15th, unless extended by the tax authority.

What is the penalty for the late filing of personal identification number pin?

The penalty for late filing of Personal Identification Number (PIN) may include fines, interest charges, and other punitive measures imposed by the tax authority.

How can I send personal identification number pin to be eSigned by others?

When you're ready to share your personal identification number pin, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out the personal identification number pin form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign personal identification number pin and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit personal identification number pin on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share personal identification number pin on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your personal identification number pin online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.