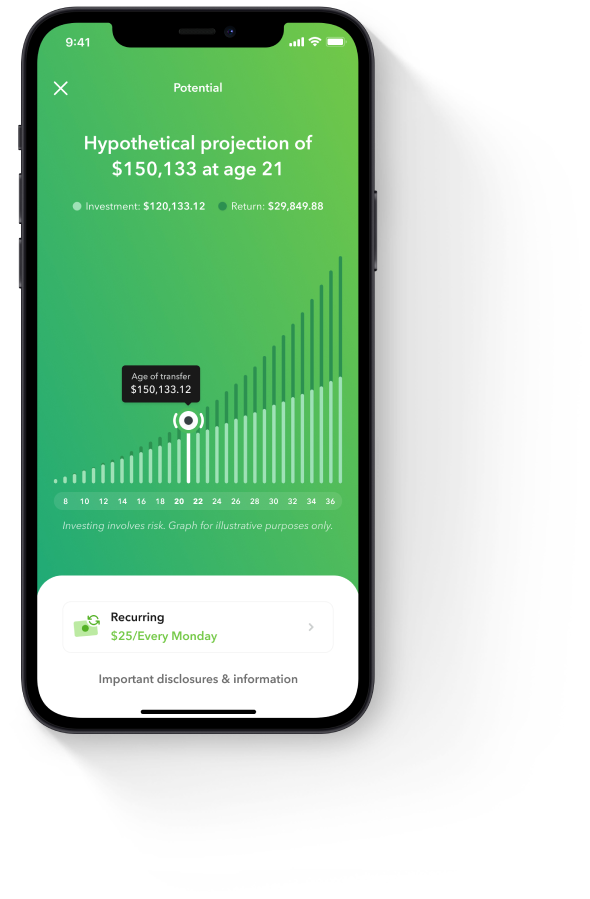

The chart shows an estimate of how much an investment could grow over time based on the initial deposit, contribution schedule, time horizon, and interest rate specified. Changes in those variables can affect the outcome. Reset the calculator using different figures to show different scenarios. Results do not predict the investment performance of any Acorns portfolio and do not take into consideration economic or market factors which can impact performance.

See your potential

Automatic - Automatic - Automatic - Automatic - Automatic - Automatic - Automatic - Automatic - Automatic - Automatic -

Link all of your credit or debit cards

Link all of your credit or debit cards

We’ll set aside your spare change from every purchase

We’ll set aside your spare change from every purchase

And invest the change once it reaches at least $5

And invest the change once it reaches at least $5

Highly-rated ETFs

Mentions of individual top companies in reference to possible ETF holdings only, not as a recommendation to buy or sell any specific security.

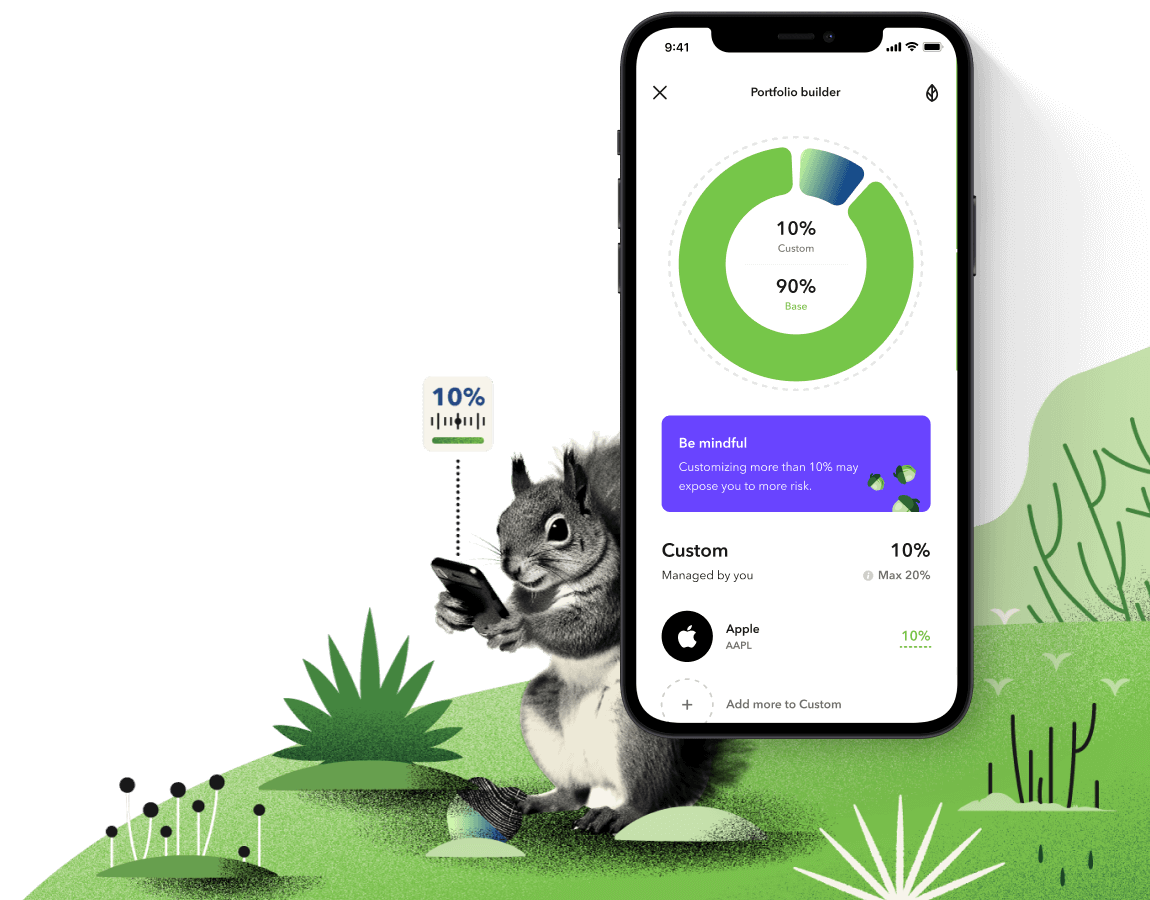

Diversified by us - Customized by you - Diversified by us - Customized by you - Diversified by us - Customized by you -

Give your money a chance to work as hard as you do

Frequently asked

Where is my money invested?

There are five different Acorns Core portfolios and four different Acorns ESG Portfolios, built by experts. Each portfolio is composed of exchange-traded funds — ETFs for short. An ETF is made of broad holdings of stocks and/or bonds. Depending on your portfolio, you’re invested in a mix of companies, markets, and bonds—and if you choose, a Bitcoin-linked ETF. The overview or prospectuses of the ETFs can be found below:

- Large Company – VOO

- Medium Company Stocks – IJH

- Small Company Stocks – IJR

- International Company Stocks – IXUS

- Short Term Bonds – ISTB

- US Aggregate Bonds – AGG

- iShares ESG Aware MSCI USA ETF | ESGU

- iShares ESG Aware MSCI EM ETF | ESGE

- iShares ESG Aware MSCI USA Small-Cap ETF | ESML

- iShares ESG Aware 1-5 Year USD Corporate Bond ETF | SUSB

- iShares ESG Aware MSCI EAFE ETF | ESGD

- iShares 1-3 Year Treasury Bond ETF | SHY

- iShares MSCI USA ESG Select ETF | SUSA

- iShares U.S. Treasury Bond ETF | GOVT

- iShares MBS ETF | MBB

- iShares ESG Aware USD Corporate Bond ETF | SUSC

- Proshares Bitcoin Strategy ETF - BITO

- Shares Short Treasury Bond – SHV

- SPDR Bloomberg Barclays 1-3 Month T-Bill – BIL

- Goldman Sachs Access Treasury 0-1 Year – GBIL

- JPMorgan Ultra-Short Income – JPST

- iShares Ultra Short-Term Bond – ICSH

If you have any other questions, feel free to reach out to us here.

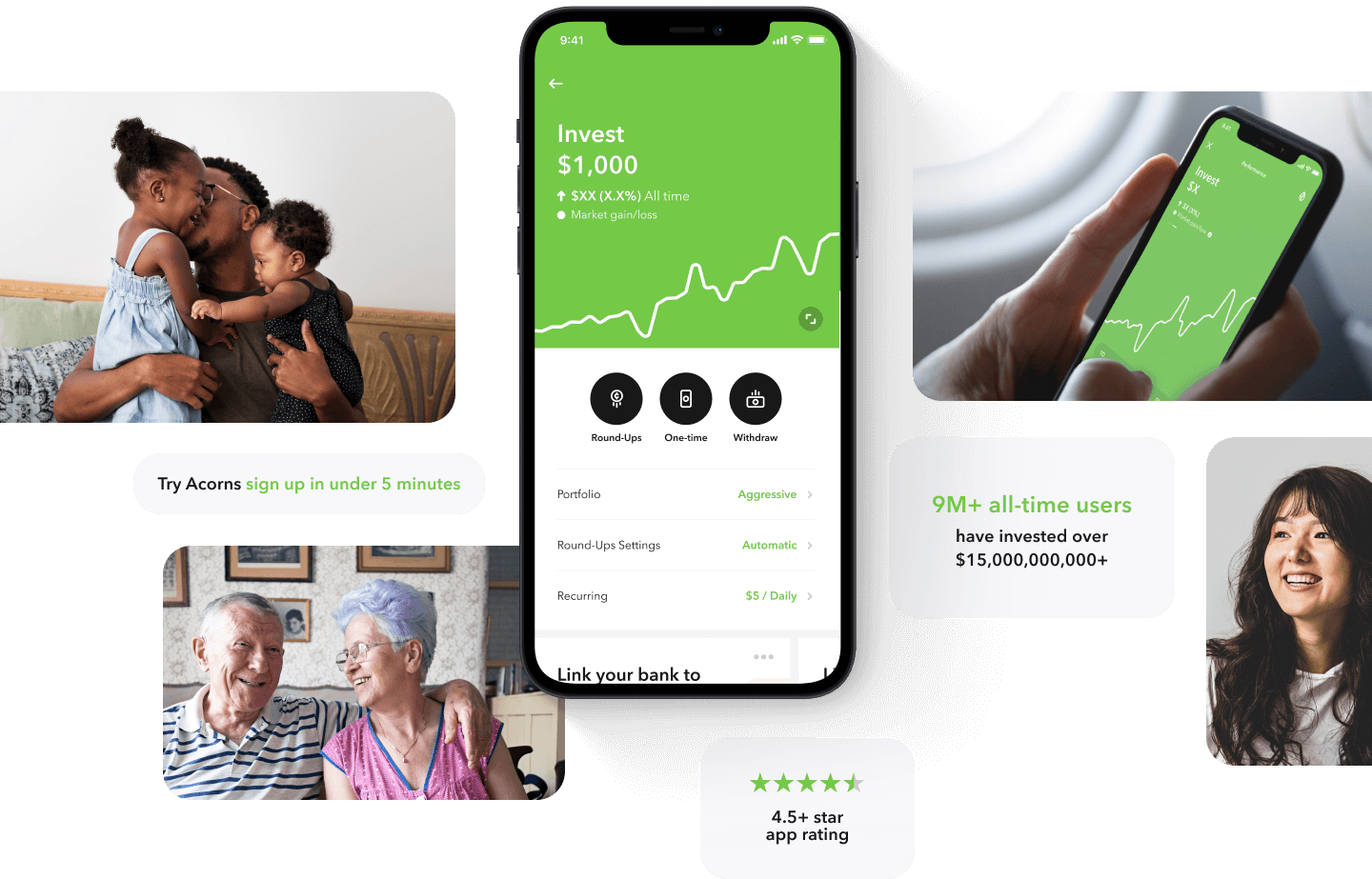

How do I choose an Investment Portfolio?

Acorns will recommend a portfolio for you based on your age, time horizon, income, goals, and risk tolerance. Our ETF portfolios range from aggressive (all stocks) to conservative (all bonds), with a mix in between.

You may switch portfolios after registration without a charge or penalty from Acorns. However, changing portfolios with any investment account may cause a taxable event.

What should I consider when the market is down?

Your Acorns portfolio is designed with the goal of weathering the stock market’s normal ups and downs. This is why your Acorns portfolio is diversified, or composed of lots of different things. When some things are down, others may be up, to help balance your performance over time.

Remember: The stock market can be volatile, but every U.S. market downturn in history has ended in an upturn. Past performance does not guarantee future results.

To learn more, check out the articles below.

What are ESG Portfolios?

Acorns ESG portfolios are composed of Exchange Traded Funds (ETFs) that invest in companies rated for how they approach environmental, social, and governance issues. This is their Morgan Stanley Corporate International (MSCI) ESG rating.

MSCI ESG ratings are a comprehensive measure of a company’s long-term commitment to socially responsible investments (SRI) and environmental, social and governance (ESG) investment standards. In particular, the MSCI ESG ratings focus on a company’s exposure to financially relevant ESG risks.

To explore Acorns ESG portfolios, visit your Invest screen, tap Portfolio, and scroll to “Theme.”