Cisco Uniform Sales & Use Tax Cert 2015-2024 free printable template

Show details

New Mexico Taxation and Revenue Department

P. O Box 5557

Santa Fe, New Mexico 875025557ACD31050

REV. 92015www.tax.newmexico.gov/

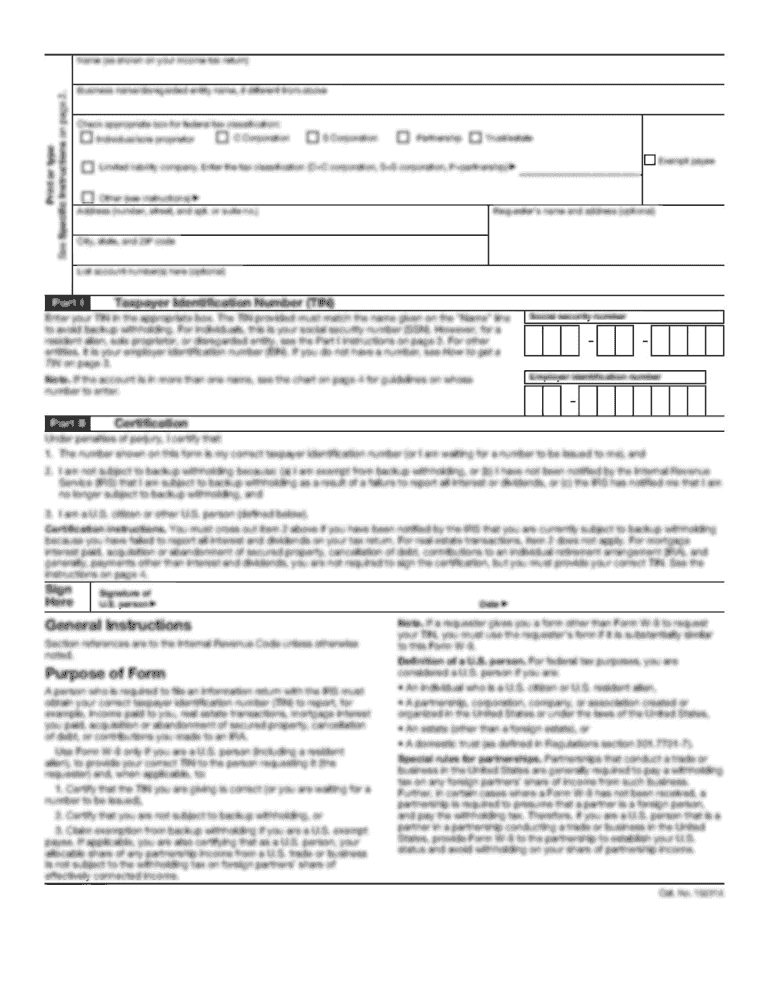

INSTRUCTIONS FOR NONTAXABLE TRANSACTION CERTIFICATES

REQUIREMENTS:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your sales use tax certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales use tax certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sales use tax certificate online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit use certificate form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

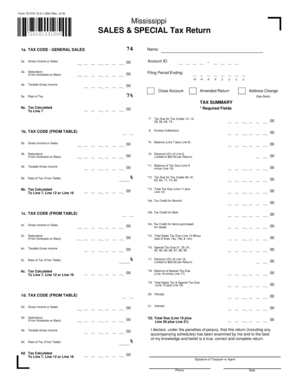

How to fill out sales use tax certificate

How to fill out sales use tax certificate:

01

Obtain a copy of the sales use tax certificate form from the relevant tax authority or website.

02

Carefully read the instructions and requirements provided with the form to ensure you have all the necessary information and documentation.

03

Start by providing your business or personal information, such as name, address, and contact details, as requested on the form.

04

Indicate the purpose of the form, whether it is for a sales tax exemption or a use tax reporting.

05

In the designated sections, provide details of the transactions for which the certificate is being filled out, including the buyer's information and the description of the products or services involved.

06

Specify the tax exempt or taxable status of the transaction, depending on the applicable laws and regulations.

07

If required, provide additional supporting documentation or evidence to validate the exemption or taxable status of the transaction.

08

Review all the information provided to ensure accuracy and completeness.

09

Sign and date the certificate in the designated areas.

10

Submit the completed sales use tax certificate to the relevant tax authority or keep a copy for your records.

Who needs sales use tax certificate:

01

Businesses involved in selling goods or services that are subject to sales tax.

02

Individuals or organizations making purchases that may be exempt from sales tax.

03

Buyers or sellers participating in transactions where use tax reporting is required by law.

Fill uniform sales and use tax certificate multi jurisdiction : Try Risk Free

People Also Ask about sales use tax certificate

How do I get a Texas sales and use tax exemption certificate?

How do I get a US sales tax exemption certificate?

What is a Texas sales and use tax resale certificate for?

Is sales and use tax the same as resale certificate in Florida?

What is tax exemption certificate in USA?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

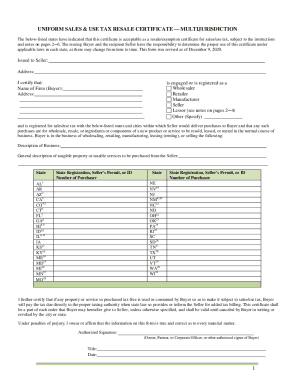

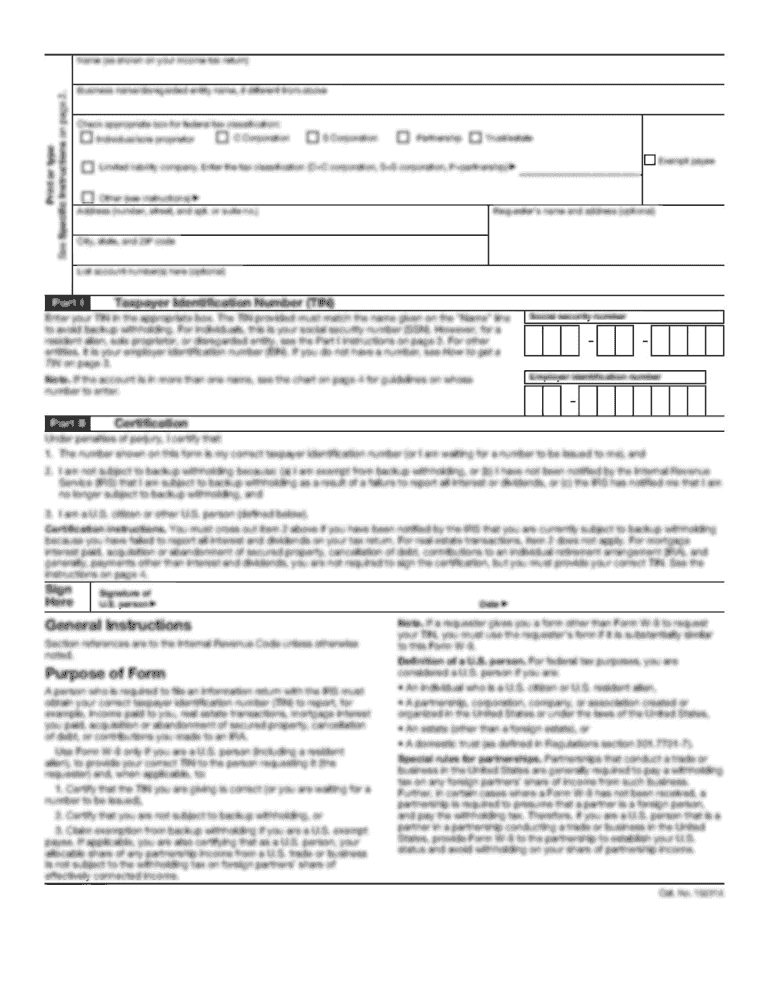

What is uniform sales use tax?

Uniform sales use tax is a tax imposed on certain purchases that is collected by the seller of the goods or services. It is often imposed in addition to any applicable state and local taxes. The tax is based on the rate of the state in which the purchase is made and is generally used to fund state and local governments.

Who is required to file uniform sales use tax?

Generally, any business that sells taxable goods or services in a state where the business has a physical presence (nexus) is required to file a sales and use tax return and pay sales and use taxes. This includes retailers, wholesalers, manufacturers, and service companies. Depending on the state, the business may need to register with the state's Department of Revenue and obtain a sales tax permit before it can begin collecting and remitting sales and use taxes.

How to fill out uniform sales use tax?

Uniform Sales and Use Tax forms are typically completed on a computer using a specific software application. However, if you do not have access to the software application, you can fill out the form by hand.

When filling out the form, you will need to provide the following information:

1. Your name, address, and contact information.

2. The name and address of the customer or purchaser.

3. The type of product purchased and its sales price.

4. The applicable sales tax rate.

5. The amount of tax due.

6. The date of the sale.

7. The signature of the seller or vendor.

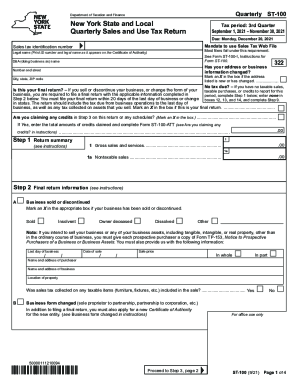

When is the deadline to file uniform sales use tax in 2023?

The deadline to file uniform sales use tax in 2023 is April 30, 2024.

What is the purpose of uniform sales use tax?

The purpose of the uniform sales use tax is to provide consistency and standardization in the imposition and collection of sales and use taxes across different jurisdictions, typically within a country or state. It aims to simplify the tax collection process for businesses operating in multiple jurisdictions by establishing uniform tax rules, rates, and reporting requirements. The uniform tax system helps to prevent tax evasion, encourages compliance, and ensures that all businesses pay their fair share of sales and use taxes. Additionally, it can promote fair competition among businesses as they are subject to the same tax obligations regardless of the jurisdiction in which they operate.

What information must be reported on uniform sales use tax?

The specific information that must be reported on a Uniform Sales and Use Tax return may vary depending on the jurisdiction. However, some common information that is typically required includes:

1. Gross Sales: The total amount of sales made during the reporting period, including any taxable and exempt sales.

2. Taxable Sales: The total amount of sales subject to sales tax during the reporting period.

3. Exempt Sales: The total amount of sales that are exempt from sales tax, such as sales to tax-exempt organizations or certain types of products.

4. Tax Collected: The total amount of sales tax collected during the reporting period.

5. Purchases Subject to Use Tax: The total amount of purchases made during the reporting period that are subject to use tax. Use tax is usually applicable when taxable goods or services are purchased from out-of-state vendors who do not charge sales tax.

6. Use Tax Collected: The total amount of use tax collected during the reporting period.

7. State and Local Tax Rates: The applicable sales and use tax rates for the jurisdiction where the business operates.

8. Gross Revenue: The total revenue generated by the business during the reporting period, including both taxable and exempt sales.

It is important to note that these requirements can vary depending on the state, city, or county where the business is located. Businesses are advised to consult the specific instructions provided by their local taxing authority or seek professional advice to ensure accurate reporting and compliance with sales and use tax regulations.

What is the penalty for the late filing of uniform sales use tax?

The penalty for the late filing of a uniform sales use tax will vary depending on the jurisdiction and specific circumstances. Generally, the penalty is a percentage of the tax owed and can range from a few percent to a substantial amount. It is advisable to check with the specific tax authority or consult a tax professional to determine the exact penalty for late filing in your jurisdiction.

How do I make edits in sales use tax certificate without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing use certificate form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I edit sales use certificate on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share use tax certificate from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out seller certificate on an Android device?

Complete your uniform sales and use tax certificate and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

Fill out your sales use tax certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sales Use Certificate is not the form you're looking for?Search for another form here.

Keywords relevant to uniform sales and use tax certificate multijurisdiction

Related to exempt use certificate

If you believe that this page should be taken down, please follow our DMCA take down process

here

.