TX 05-359 2017-2024 free printable template

Show details

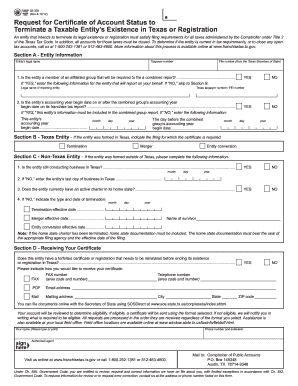

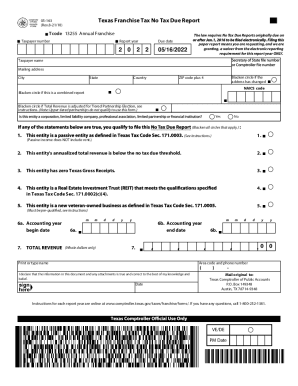

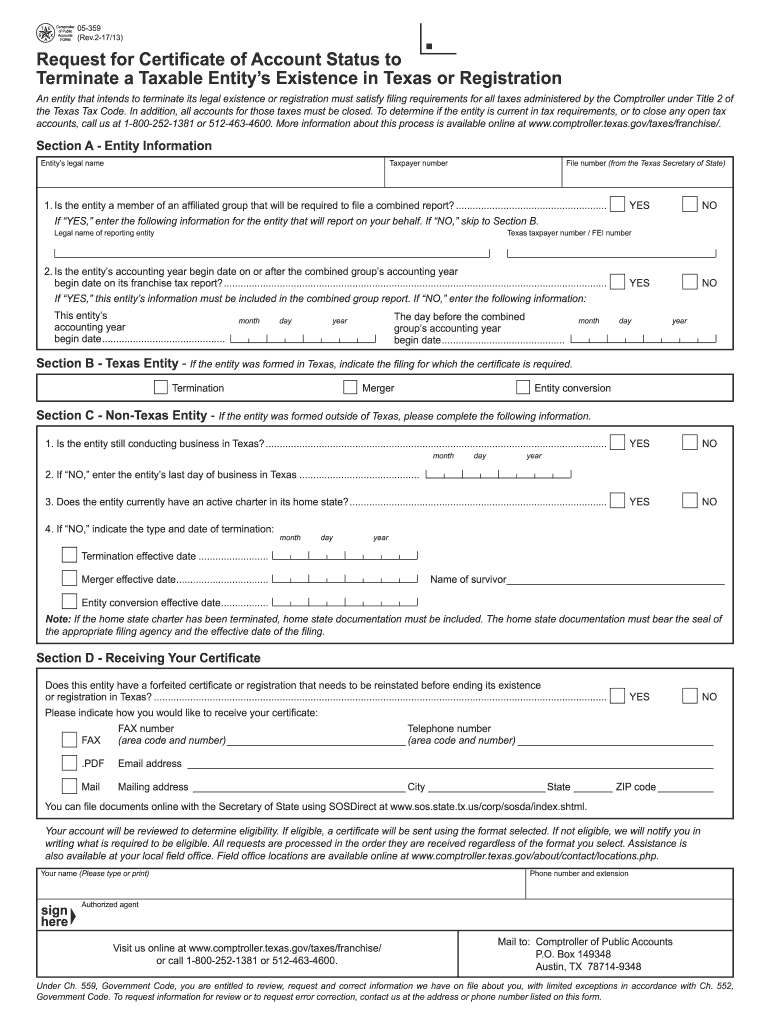

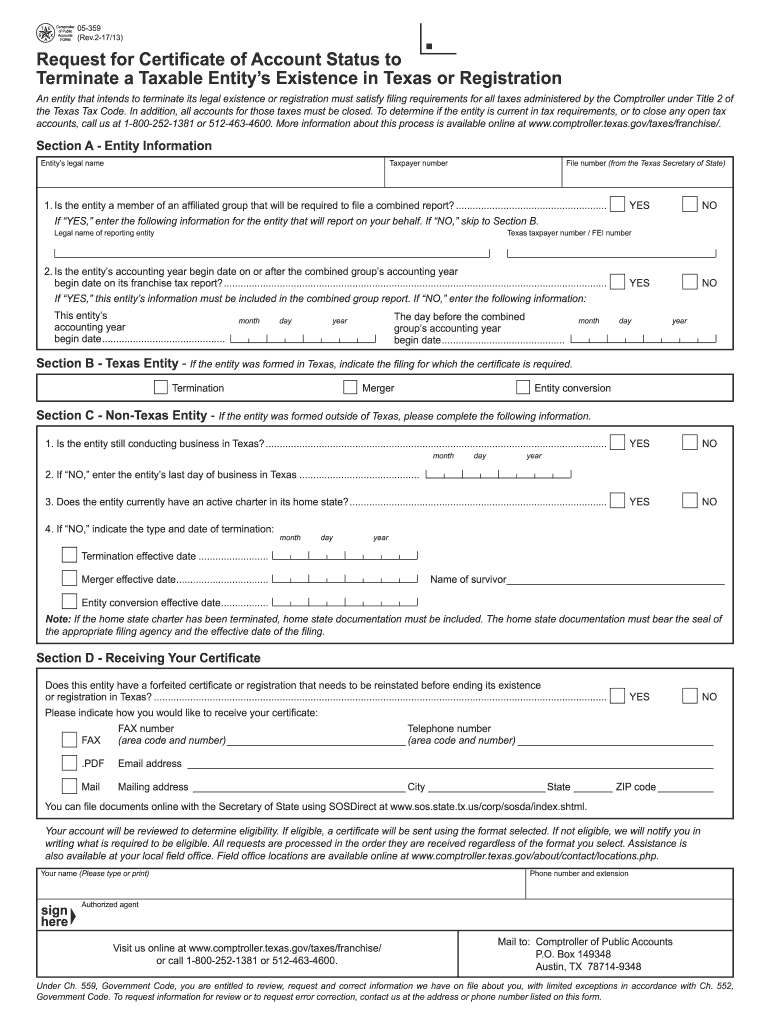

O. Box 149348 Austin TX 78714-9348 Under Ch. 559 Government Code you are entitled to review request and correct information we have on file about you with limited exceptions in accordance with Ch. 552 Government Code. 05-359 Rev.2-17/13 PRINT FORM CLEAR FIELDS Request for Certificate of Account Status to Terminate a Taxable Entity s Existence in Texas or Registration An entity that intends to terminate its legal existence or registration must satisfy filing requirements for all taxes...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

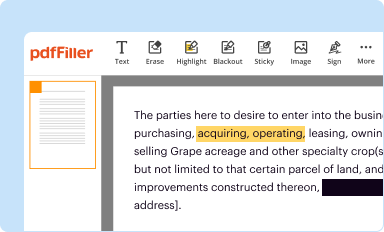

Edit your form 05 359 2017-2024 form online

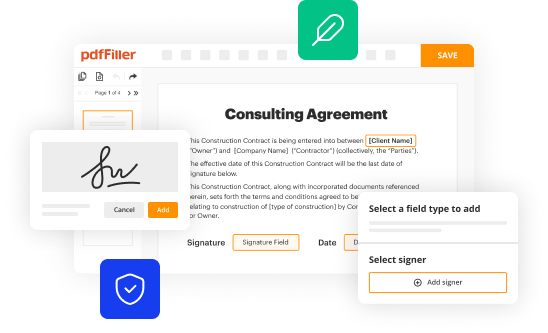

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

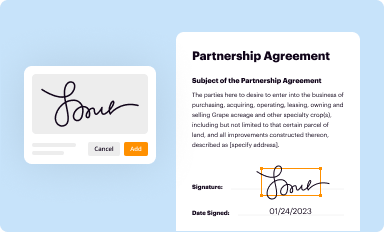

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

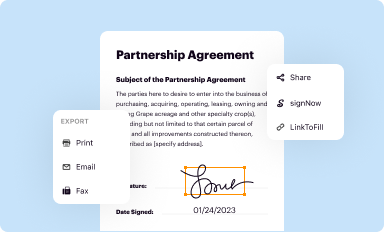

Share your form instantly

Email, fax, or share your form 05 359 2017-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 05 359 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit texas 05 359 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

TX 05-359 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 05 359 2017-2024

How to fill out tax return:

01

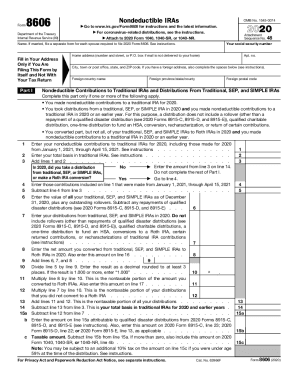

Gather all necessary documents: Collect all income statements, deduction receipts, and any other financial documents related to your income and expenses for the tax year.

02

Determine your filing status: Decide whether you will be filing as single, married filing jointly, married filing separately, head of household, or qualifying widow(er). This will determine your tax rate and eligibility for certain deductions and credits.

03

Choose the appropriate tax form: Select the tax form that corresponds to your filing status and financial situation. The most common form is the 1040, but there are variations like 1040A and 1040EZ depending on your circumstances.

04

Fill in personal information: Provide your name, Social Security number, address, and other personal details as required on the tax form.

05

Report your income: Include all sources of income, such as wages, self-employment earnings, dividends, interest, rental income, and any other taxable income you received during the tax year.

06

Deductions and credits: Determine which deductions and credits you are eligible for and ensure you are claiming them correctly. Common deductions include student loan interest, mortgage interest, medical expenses, and charitable contributions.

07

Calculate your tax liability: Use the appropriate tax tables or tax software to calculate the amount of tax you owe based on your income and deductions. If you have been making regular estimated tax payments or have taxes withheld from your paycheck, you may have already paid some of the tax liability.

08

Review and sign: Double-check all the information you have entered, making sure there are no errors or omissions. Then, sign and date the tax return form before submitting it.

Who needs tax return:

01

Individuals with taxable income: If you earned income during the tax year and it exceeds the minimum threshold set by the IRS, you are generally required to file a tax return.

02

Self-employed individuals: If you are self-employed and had net earnings of $400 or more, you are required to file a tax return.

03

Individuals with certain types of income: Even if your income falls below the filing threshold, you may still need to file a tax return if you received income from sources like dividends, rental properties, or self-employment.

04

Individuals claiming refunds or credits: Filing a tax return is necessary to claim any tax refunds you may be entitled to or to take advantage of certain tax credits, such as the Earned Income Tax Credit or the Child Tax Credit.

05

Non-resident aliens: Non-resident aliens who have earned income in the United States are often required to file a tax return, even if their income is below the filing threshold. The rules for non-resident aliens are different from those for U.S. citizens and residents.

Video instructions and help with filling out and completing form 05 359

Instructions and Help about 05 359 certificate account status form

Fill 05 359 certificate account : Try Risk Free

People Also Ask about form 05 359

When should I expect my tax refund 2023?

Are tax refunds delayed 2023?

When can I expect tax return?

What tax return means?

How to get a tax refund?

Is it better to owe or get a refund?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax return?

Tax return is a form that taxpayers use to report their income, deductions, and other financial information to the Internal Revenue Service (IRS). The information reported on a tax return is used to calculate how much tax an individual owes or how much of a refund they are due. Taxpayers must complete and file a return each year in order to pay the correct amount of tax or receive a refund.

Who is required to file tax return?

In the United States, anyone who earns income or has income that is not otherwise exempt from taxation must file a tax return. Generally, those who earn over a certain amount of income must file a federal income tax return, and may also need to file a state income tax return.

What is the purpose of tax return?

The purpose of a tax return is to report a person’s income and calculate their tax liability for the year. Tax returns also allow taxpayers to claim deductions, credits, and other expenses that may reduce their tax liability. Finally, tax returns can be used to claim a refund if the taxpayer overpaid their taxes during the year.

What information must be reported on tax return?

Information that must be reported on a tax return includes:

1. Personal information, such as name, address, Social Security number, and filing status.

2. Income, such as wages, salaries, tips, self-employment income, and interest income.

3. Deductions and credits, such as charitable donations, mortgage interest, and child tax credit.

4. Taxable income, which is the amount of income left after deductions and credits are taken.

5. Tax liability, which is the amount of taxes owed or refunded.

6. Payment information, such as the amount of estimated taxes paid or tax withheld.

When is the deadline to file tax return in 2023?

The deadline to file tax returns in the United States for the 2023 tax year (taxes due April 15, 2024) is Tuesday, April 15, 2024.

What is the penalty for the late filing of tax return?

The penalty for filing a late tax return is 5% of the additional taxes owed amount for every month that the taxes are late, up to a maximum of 25%. However, if the taxes are more than 60 days late, the minimum penalty is the lesser of either $205 or 100% of the taxes owed.

How to fill out tax return?

Filling out a tax return can be a complex process, but here is a general step-by-step guide to help you get started:

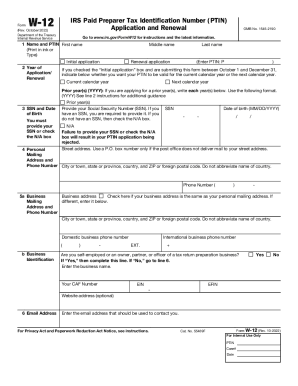

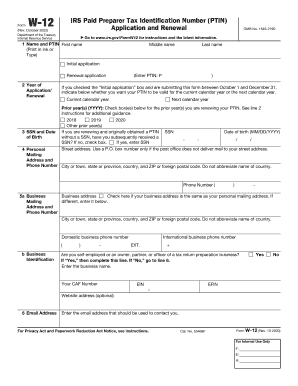

1. Gather all necessary documents: Collect important paperwork such as your W-2 forms, 1099 forms (for self-employment income or investment income), receipts for deductible expenses, and any other relevant financial documents.

2. Choose the right tax form: The most common form used to file an individual tax return is Form 1040, which has several variations depending on your filing status and other factors. Determine which form is appropriate for your situation.

3. Provide personal information: Fill in your personal details on the tax return form. This includes your name, Social Security number, filing status, and any dependents you are claiming.

4. Report income: Enter your income from various sources on the appropriate lines. Wages from employment are usually reported on Form W-2, while other types of income, such as self-employment income, rental income, or investment income, may require additional forms or schedules.

5. Deductions and credits: Determine if you qualify for any deductions or tax credits. This may include deductions for expenses like mortgage interest, medical expenses, or education expenses. Credits may apply to areas such as childcare, education, or energy-efficient home improvements.

6. Calculate your taxes: Use the tax tables or software provided to determine the amount of tax you owe based on your income, deductions, and credits. Alternatively, you can use tax software or consult with a tax professional to ensure accurate calculation.

7. Complete payment and refund details: Indicate whether you owe any additional tax or if you are due a refund. Provide the necessary bank account details if you want to receive your refund via direct deposit.

8. Sign and date: Make sure to sign and date your tax return. If you are filing jointly with a spouse, both of you will need to sign.

9. Submit your tax return: Send your completed tax return to the appropriate tax authority, either by mail or electronically through e-file, depending on the options available in your country.

Remember, tax laws and requirements may vary by country and jurisdiction. It can be helpful to consult with a tax professional or use reliable tax software to ensure full compliance with current tax regulations.

How do I edit form 05 359 online?

The editing procedure is simple with pdfFiller. Open your texas 05 359 form in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I edit 05 359 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute texas certificate account status from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out form 05 359 instructions on an Android device?

Use the pdfFiller app for Android to finish your form 05 305 certificate of account status. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your form 05 359 2017-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

05 359 is not the form you're looking for?Search for another form here.

Keywords relevant to texas request certificate account status form

Related to texas comptroller form 05 305

If you believe that this page should be taken down, please follow our DMCA take down process

here

.