Canada B401 E 2020-2024 free printable template

Show details

Clear DataProtected B

when completedFuel Charge Return for Nonregistrants

under the Greenhouse Gas Pollution Pricing Act

If you are not registered and are not required to be for the purpose of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

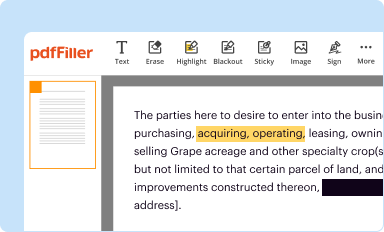

Edit your canada return pdf form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

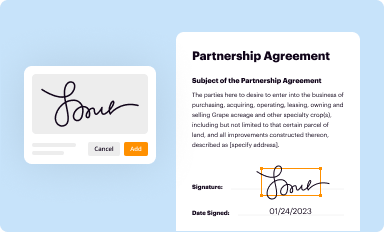

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your canada return pdf form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

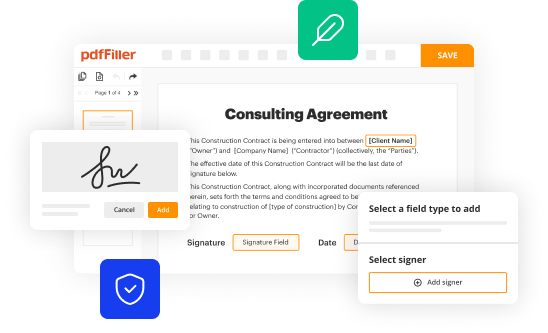

How to edit canada return pdf online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit revenue return form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out canada return pdf form

How to fill out revenue return form?

01

Start by gathering all the necessary financial information and documents, such as income statements, expense receipts, and tax identification numbers.

02

Carefully read the instructions provided with the revenue return form to understand the specific requirements and steps involved.

03

Begin filling out the form by providing personal information, such as your name, address, and contact details.

04

Follow the prompts on the form to accurately report your income from various sources, including employment, investments, and self-employment.

05

Deduct any allowable expenses or deductions as instructed on the form to calculate your taxable revenue.

06

Ensure that you report all income and deductions correctly to avoid any penalties or issues with tax authorities.

07

Double-check all the information entered on the form for accuracy and completeness before submitting it.

08

If required, attach any supporting documents or schedules as specified in the instructions.

09

Sign and date the completed revenue return form.

10

Keep a copy of the filled-out form and all related documents for your records and reference.

Who needs revenue return form?

01

Individuals or businesses that have generated income during a specific tax year need to fill out a revenue return form.

02

Employed individuals who receive wages or salaries, self-employed individuals, freelancers, contractors, and those with investment income usually need to fill out this form.

03

Different countries may have specific thresholds or requirements for when someone needs to file a revenue return form, so it is important to check with the local tax authority or seek professional advice.

Fill canada return print : Try Risk Free

People Also Ask about canada return pdf

What is the tax return form called in Canada?

How do I get a TD1 form?

What is T1 vs T4?

What is the Canadian version of a w2?

What is a Canadian tax return called?

How do I get a Canadian tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is revenue return form?

The term "revenue return form" does not have a specific or standardized definition. It could refer to a form or document used to report or document revenue returns or refunds. This could be in the context of tax returns, sales returns, or any other situation where revenue is being returned to a customer or entity. Without more specific context, it is difficult to provide a definitive answer.

How to fill out revenue return form?

To appropriately fill out a revenue return form, follow these steps:

1. Review the form: Familiarize yourself with the layout and instructions provided in the revenue return form. Ensure you have all necessary supporting documents and information.

2. Personal information: Fill in your personal details such as your name, address, phone number, Social Security number, or taxpayer identification number. Include information for any dependents if required.

3. Income details: Report all sources of income accurately. This may include wages, salaries, tips, interest, dividends, rental income, self-employment income, pensions, etc. Utilize the appropriate sections or schedules provided in the form to ensure all types of income are properly accounted for.

4. Deductions and credits: Determine which deductions and credits you are eligible for and provide the necessary information. Common deductions include student loan interest, mortgage interest, medical expenses, and charitable contributions. Common credits may include child tax credit, earned income credit, or education credits.

5. Calculate taxable income: Subtract deductions and credits from your total income to arrive at your taxable income. Ensure you have applied the correct tax rates and brackets as specified in the form.

6. Withholding and payments: Enter your income tax withholdings from your employer or other sources, as well as any estimated tax payments you might have made. Include any applicable tax credits.

7. Calculate owed or refunded amount: Subtract your total tax payments from your calculated tax liability to determine if you owe additional taxes or if you are due a refund.

8. Signature: Sign and date the form to certify the accuracy of the information provided. If filing jointly, ensure your spouse also signs where required.

9. Review before submission: Verify all information for accuracy and completeness. Double-check calculations and cross-reference with supporting documents.

10. Submit the form: Send the completed revenue return form by mail or electronically, depending on the prescribed method by the revenue agency. If filing electronically, follow the specified guidelines for submission.

Keep copies of the completed form and supporting documents for your records.

What is the purpose of revenue return form?

The purpose of a revenue return form is to report and provide details of the revenue or income generated by an individual or business entity. This form is typically used to fulfill tax obligations and ensure accurate reporting of income to the relevant tax authorities. It allows the taxpayer to calculate and report the amount of taxable revenue and pay any applicable taxes owed. The revenue return form helps in maintaining transparency, facilitating compliance, and ensuring proper financial recordkeeping.

What information must be reported on revenue return form?

The specific information required to be reported on a revenue return form can vary depending on the jurisdiction and the type of business. However, some common information that may be required includes:

1. Gross revenue: This refers to the total revenue earned by the business during a specific period. It includes all sales, fees, and other income generated.

2. Taxable revenue: This is the portion of the gross revenue that is subject to tax. Certain types of income, such as interest, dividends, or exempt sales, may be excluded from taxable revenue.

3. Expenses: The form may require details about the various expenses incurred by the business, including cost of goods sold, operating expenses, and other deductions.

4. Net income: This is calculated by subtracting the total expenses from the gross revenue. It represents the profit or loss of the business before tax.

5. Tax liability: The form generally requires the calculation of the tax owed based on the applicable tax rate or tax bracket.

6. Tax credits and deductions: Businesses may be eligible for certain tax credits or deductions, such as research and development credits or depreciation deductions. These need to be reported on the form.

7. Other relevant financial information: Depending on the specific requirements, the form may ask for additional financial details, such as balance sheet information, capital gains or losses, or any outstanding tax liabilities from previous periods.

It is important to consult the specific guidelines and instructions provided by the tax authorities in your jurisdiction to ensure accurate reporting on the revenue return form.

What is the penalty for the late filing of revenue return form?

The penalty for late filing of revenue return forms varies depending on the jurisdiction and specific circumstances. Generally, late filing penalties can be imposed as a fixed amount or calculated as a percentage of the tax owed or unpaid. Late filing penalties may also accrue interest on the outstanding tax amount. It is advisable to consult the relevant tax authority or a tax professional to determine the specific penalties applicable in your jurisdiction and situation.

How can I send canada return pdf to be eSigned by others?

Once your revenue return form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make edits in ca return without leaving Chrome?

fuel charge can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I complete canada revenue return on an Android device?

Use the pdfFiller mobile app to complete your charge form on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your canada return pdf form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ca Return is not the form you're looking for?Search for another form here.

Keywords relevant to canada revenue printable form

Related to canada revenue form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.