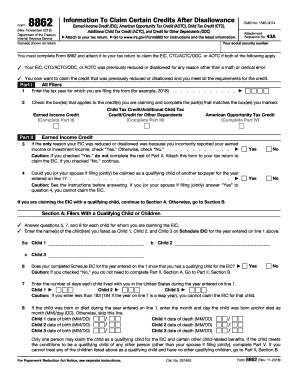

What is Form 8862?

Another title for this document is Information To Claim Certain Сredits After Disallowance. Taxpayers use the form to reclaim tax credits that were rejected on previous tax returns because of unresolved occurrences with the Internal Revenue Service.

Who should file Form 8862 2021?

Taxpayers should submit this record to the Internal Revenue Service if they want to claim one of the credits mentioned below:

- Earned income credit (EIC)

- Credit for other dependents (ODC

- (Additional) Child tax credit (A)CTC

- American Opportunity Credit (AOTC)

This document must be submitted only by individuals who have previously been denied to take credits once more.

Please note – If your claim for one of the mentioned above credits was denied due to "reckless or intentional disregard of the rules," you must wait for at least two years before claiming another. If a claim was denied because of fraud, you must wait for ten years.

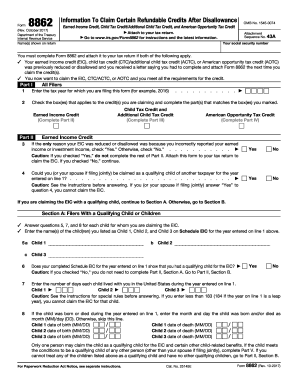

What information do I need to file the 8862 form?

Filers should provide their names, Social Security Numbers, and names and addresses of children, students, or other dependants (based on the type of claim).

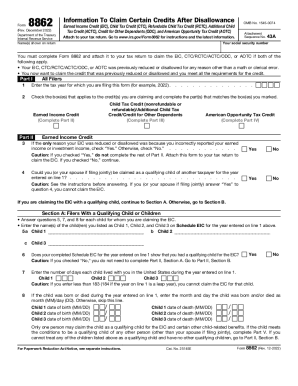

How do I fill out Form 8862 in 2022?

Easily complete the template online with pdfFiller. Discover how to prepare the document online:

- Click Get Form to open it in the online filler.

- Enter your name and SSN in the first line.

- In Part I, indicate the year and credit(s) for which you submit this record.

- To apply for EIC, fill out Part II. To begin, answer two questions and click the appropriate checkboxes.

- If you answer Yes in line 3, do not fill out the rest of the template. Go to step 10.

- Complete further Sections.

- To apply for CTC, RCTC, ACTC, fill out Part III. Add names of children or dependants and complete a survey.

- To apply for AOTC, fill out Part IV. Indicate students' names and answer a few questions to ensure they meet the eligibility requirements for AOTC.

- Complete Part V for children who meet the conditions to be qualifying children.

- Click Done to save changes to the document and access the exporting menu.

- Select Save as to download the record to your device or transfer it to the cloud, Email to send it to your inbox, or Print to create a hard copy.

- Attach the hard copy to your tax return and send it to the Internal Revenue Service.

- Wait for the decision from the IRS. Their representatives may contact you to ask for additional details and check if you can claim credits.

Is IRS Form 8862 accompanied by other forms?

Filers should attach this template to their tax returns.

When is IRS Form 8862 due?

Usually, taxpayers send it to the IRS with their returns before April 15. In 2022, the due date is April 18.

Where do I send the 8862 form?

Send it to the regional IRS office responsible for processing your return. The IRS offices list can be found on the official website.