Military Restaurant Holdings Hourly Employee Change in Pay Rate Form 2011-2024 free printable template

Show details

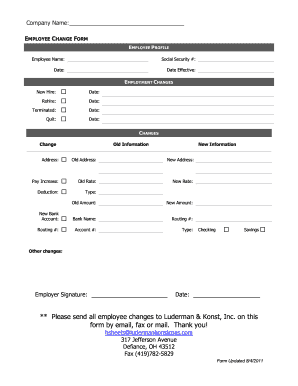

MILITARY RESTAURANT HOLDINGS LLC HOURLY EMPLOYEE CHANGE IN PAY RATE FORM Date Location Name of Employee Date of Hire Last Change in Hourly Pay Rate Date Current Pay Rate Hourly Rate New Position If Any New Pay Rate Hourly Rate Percentage of Increase Maximum Rate for This Position According to Grid EFFECTIVE DATE Next Pay Rate Review Date Justification for change in Pay Rate Approvals Director of Operations V. P. of Human Resources Direct Supervisor Print Name Remember that no raise will be...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your employee pay rate increase form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee pay rate increase form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employee pay rate increase letter online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pay increase form pdf. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Military Restaurant Holdings Hourly Employee Change in Pay Rate Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out employee pay rate increase

How to fill out company payroll:

01

Gather all necessary employee information, such as names, addresses, Social Security numbers, and tax withholding information.

02

Determine the pay period for which you are filling out the payroll, whether it is weekly, bi-weekly, or monthly.

03

Calculate each employee's gross pay by multiplying their hourly wage by the number of hours worked or their salary for the pay period.

04

Deduct any applicable taxes from each employee's gross pay, including federal income tax, state income tax, and Social Security and Medicare taxes.

05

Subtract any pre-tax deductions, such as health insurance premiums or retirement contributions, from each employee's gross pay.

06

Calculate each employee's net pay by subtracting all deductions and taxes from their gross pay.

07

Prepare a paycheck for each employee, specifying their net pay along with any additional information such as hours worked or pay rate.

08

Keep accurate records of each employee's payroll information, including pay stubs, tax forms, and any other relevant documentation.

Who needs company payroll:

01

Any business or organization that has employees needs company payroll. This includes small businesses, large corporations, non-profit organizations, government agencies, and so on.

02

Company payroll is essential for accurately compensating employees for their work and keeping track of their earnings and deductions.

03

It is also necessary for complying with tax and labor laws, ensuring that payroll taxes are properly withheld and reported to the appropriate authorities.

04

Company payroll helps to maintain transparency and accountability in employee compensation, as pay information is documented and easily accessible.

05

Additionally, company payroll is vital for providing employees with accurate pay stubs that detail their earnings, deductions, and other relevant information.

Video instructions and help with filling out and completing employee pay rate increase letter

Instructions and Help about change pay rate form

Fill employee change pay rate form : Try Risk Free

People Also Ask about employee pay rate increase letter

What form is used for payroll?

What is a W-4 form used for?

Why would a company need a W-2?

What is the difference between a 1099 and a W-2?

What is a company W-2 form?

What is the difference between a W-2 and a w4?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What information must be reported on company payroll?

The information typically reported on company payroll includes employee name, Social Security number, wages earned, hours worked, taxes withheld, and any other deductions taken from the employee's paycheck.

What is company payroll?

Company payroll refers to the process of calculating and disbursing wages or salaries to employees of a company. It includes the management of employee compensation, deductions, taxes, and benefits, as well as keeping records of income and employment taxes paid by both the employer and the employees. The payroll department or systems within a company are responsible for ensuring accurate and timely payment to employees based on their work hours, salary, or other agreed-upon compensation terms.

Who is required to file company payroll?

In most countries, it is the responsibility of the employer to file company payroll. This includes calculating and reporting wages, salaries, and other compensation paid to employees and remitting the necessary taxes and social security contributions to the government agencies. The frequency and format of payroll filings may vary depending on local laws and regulations. Businesses may also hire professional accountants or payroll service providers to handle these tasks on their behalf.

How to fill out company payroll?

Filling out company payroll involves several steps. Here is a comprehensive guide to help you through the process:

1. Gather employee information: Collect all relevant employee data such as name, address, Social Security number, bank account details for direct deposit, tax withholding forms (W-4 in the United States), and any other necessary information.

2. Calculate employee hours: Determine the number of hours each employee has worked during the pay period. This may involve manually tracking hours or using a time and attendance system.

3. Calculate gross pay: Multiply the hours worked by the employee's hourly wage to calculate the gross pay. Make sure to account for any overtime or special pay rates.

4. Deduct taxes and withholdings: Calculate the amount of taxes and other withholdings that need to be deducted from each employee's gross pay. This typically includes federal, state, and local taxes, Social Security, Medicare, and any additional deductions like health insurance or retirement contributions.

5. Determine net pay: Subtract the total deductions from the gross pay to calculate the net pay that the employee will receive.

6. Prepare pay stubs: Create pay stubs detailing the employee's gross pay, deductions, and net pay. Include the pay period dates and any other necessary information.

7. Distribute paychecks or organize direct deposit: Either print physical paychecks or set up direct deposit for employees who have provided bank account information.

8. File payroll taxes: Pay taxes withheld from employee wages to the appropriate government entities. This typically includes federal and state income tax as well as Social Security and Medicare taxes. Ensure timely filing to avoid penalties.

9. Keep records: Maintain meticulous records of all payroll-related documents, including pay stubs, tax filings, and employee information. These records may be necessary for audits or compliance purposes.

10. Stay updated with regulations: Be aware of any changes in payroll laws and tax regulations to ensure compliance and accuracy.

It is worth mentioning that using payroll software or outsourcing the payroll process to a professional payroll service can streamline the entire process and minimize errors and compliance risks.

What is the purpose of company payroll?

The purpose of company payroll is to ensure that employees are properly and accurately paid for their work. It involves calculating and distributing employee wages or salaries, as well as withholding and remitting various payroll taxes on behalf of the employees and the company. Payroll also includes maintaining employee records, tracking hours worked, administering benefits, deductions, and bonuses, and complying with relevant employment laws and regulations. Overall, the purpose of company payroll is to manage the financial aspect of employee compensation efficiently and ensure compliance with legal requirements.

What is the penalty for the late filing of company payroll?

The penalty for the late filing of company payroll can vary depending on the country and jurisdiction. In some cases, the penalty may be a fixed amount per day or per employee for each day the payroll is late. In other cases, it may be a percentage of the unpaid taxes or wages. Additionally, there may be interest charges on outstanding balances. It's important to consult with relevant tax authorities or labor departments to determine the specific penalties applicable in a particular location.

How do I execute employee pay rate increase letter online?

pdfFiller has made it simple to fill out and eSign pay increase form pdf. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the employee pay increase form in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your pay rate increase form.

How do I fill out the rate of pay increase form form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign employee pay rate form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your employee pay rate increase online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Pay Increase Form is not the form you're looking for?Search for another form here.

Keywords relevant to change pay form template

Related to change pay rate form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.