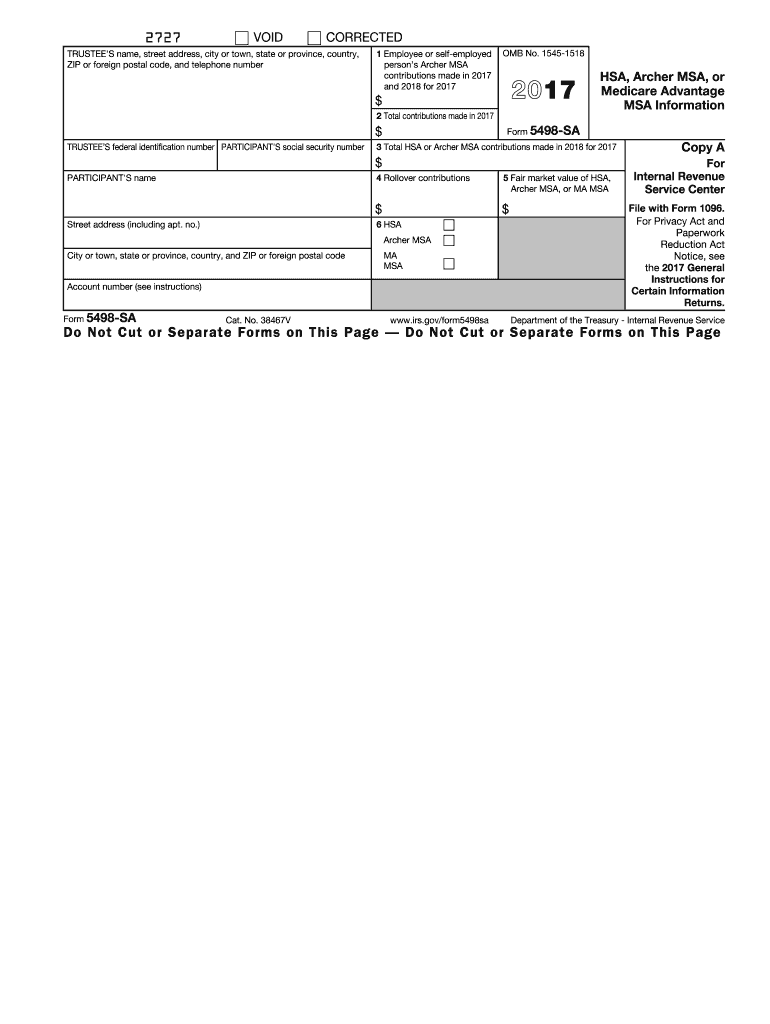

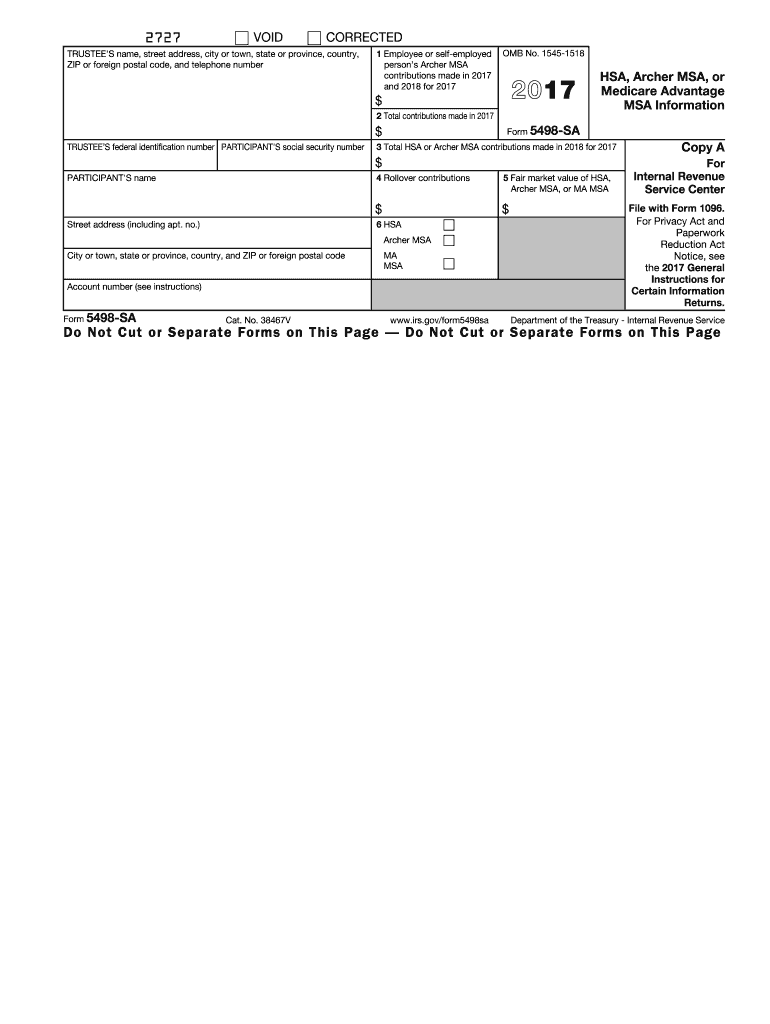

Will I get a 5498-SA every year?

You won't get a 5498-SA form if you didn't have contributions and your balance was zero dollars at the end of the year. Please note this form is informational only and doesn't need to be filed with your income tax return.

Why did I get a 5498-SA and a 1099-SA?

The IRS Form 1099-SA is used for reporting HSA distributions; the IRS Form 5498-SA is used for reporting contributions. If you did not have contributions during the year, then you will not see the IRS Form 5498-SA.

Do I have to report 5498-SA?

Do I Have to (Or Should I) Report My HSA Contributions? Form 5498-SA is not required in order to file a tax return.

Does form 5498-SA need to be reported?

Where does Form 5498-SA go on a tax return? Participants of an HSA, Archer MSA or MA MSA do not have to file Form 5498-SA with their individual income tax return. However, if distributions from any of these accounts were taxable, they should be noted on Schedule 1 of Form 1040, Part I, line 8e.

Why did I receive form 5498-SA?

Form 5498-SA reports your annual contributions to these tax-free accounts that you use to pay for medical expenses. Contributions to similar accounts, such as Archer Medical Savings Accounts and Medicare Advantage MSAs will also warrant a Form 5498-SA. This form must be mailed to participants and the IRS by May 31.

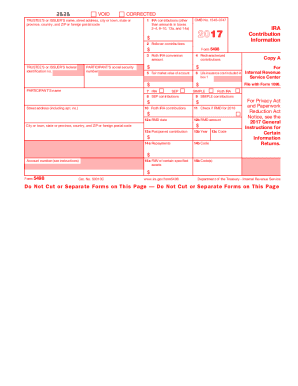

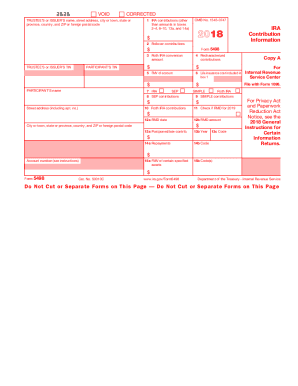

Where does form 5498 go on tax return?

Form 5498 is for informational purposes only. You are not required to file it with your tax return. This form is not posted until May because you can contribute to an IRA for the previous year through mid-April. This means you will have finished your taxes before you receive this form.

What do you do with form 5498-SA?

Form 5498-SA reports your annual contributions to these tax-free accounts that you use to pay for medical expenses. Contributions to similar accounts, such as Archer Medical Savings Accounts and Medicare Advantage MSAs will also warrant a Form 5498-SA. This form must be mailed to participants and the IRS by May 31.

Do you have to enter 5498-SA?

Do I Have to (Or Should I) Report My HSA Contributions? Form 5498-SA is not required in order to file a tax return.

What do I do if I have 5498-SA?

Note: Do not attach Form 5498-SA to your income tax return. Instead, keep it for your records. Generally, contributions you make to your Fidelity HSA are made on a pretax basis via payroll deduction and are not deductible.

Where does form 5498-SA go on tax return?

Note: Do not attach Form 5498-SA to your income tax return. Instead, keep it for your records. Generally, contributions you make to your Fidelity HSA are made on a pretax basis via payroll deduction and are not deductible. Any contributions you make on an after-tax basis—via check, for example—are tax deductible.

What do I do with form 5498-SA on my taxes?

The 5498-SA tax form is used to report contributions to a health savings account (HSA). It is for informational purposes and is not required to file a tax return.

Why do I have a 1099-SA and a 5498-SA?

IRS form 1099-SA shows the amount of money you spent from your HSA during the tax year. IRS form 5498-SA shows the amount of money deposited into your HSA for the tax year.

Does form 5498-SA go on tax return?

Note: Do not attach Form 5498-SA to your income tax return. Instead, keep it for your records. Generally, contributions you make to your Fidelity HSA are made on a pretax basis via payroll deduction and are not deductible.

What should I do with 5498-SA?

The 5498-SA tax form is used to report contributions to a health savings account (HSA). It is for informational purposes and is not required to file a tax return.

Form 5498-SA reports your annual contributions to these tax-free accounts that you use to pay for medical expenses. Contributions to similar accounts, such as Archer Medical Savings Accounts and Medicare Advantage MSAs will also warrant a Form 5498-SA. This form must be mailed to participants and the IRS by May 31.