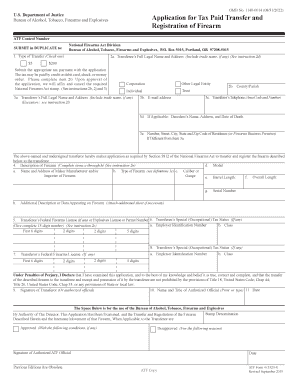

Who needs an ATF Form 4?

Any person intending to transfer a firearm (transferor) must complete and file ATF Form 4 in two counterparts.

What is ATF Form 4 for?

The Form is an application for approval of the transfer of a firearm; apart from that, it serves the following purposes: (a) identification of the transferor and transferee; (b) payment of the transfer tax; (c) identification of the firearm; and (d) registration of the firearm to the transferee.

Is ATF Form 4 accompanied by other forms?

An individual transferee must attach two FBI Forms FD-258 (Fingerprint Card with blue lines) to the application. This requirement does not apply to licensed manufacturers, importers or dealers under the Gun Control Act.

The transferee may be required to receive a State or local permit or license prior to the acquisition of the firearm; in this case, you should include a copy of the permit with the application.

When is ATF Form 4 due?

The application must be submitted before the transfer of a firearm.

How do I fill out ATF Form 4?

Pages 4 through 6 of the Form contain detailed instructions on how to fill it.

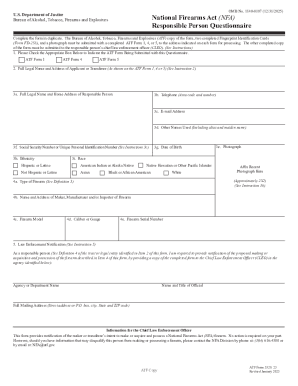

You should provide personal information of the transferor and transferee, and a description of the firearm. The chief law enforcement officer fills and signs Section 13 Law Enforcement Certification. The officer is asked to confirm that possession of the firearm by the transferee would not violate the law.

The transferee must complete the Transferee Certification Section answering a number of questions about his compliance with the law. The transferee should also affix his/her recent photograph here.

The transferor should also complete item 21 providing information relating to payment of the transfer tax.

Where do I send ATF Form 4?

You should send both copies of the ATF Form 4 and attachments to the Bureau of Alcohol, Tobacco, Firearms and Explosives, P.O. Box 530298, Atlanta, GA 30353-0298.