Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Borang A is a form used by Malaysian citizens to apply for a passport. The form is available online and must be completed and submitted before a passport can be issued. The form requires personal information, such as name, address, and date of birth, as well as the applicant's photograph.

When is the deadline to file borang a in 2023?

The deadline to file Borang A in 2023 depends on the specific filing requirements of the jurisdiction you are filing in. Please contact your local tax office for more information.

What is the penalty for the late filing of borang a?

The penalty for late filing of Borang A is a fine of up to RM1,000 and/or imprisonment of up to six months.

Who is required to file borang a?

In Malaysia, individuals who earn income from employment, business, or any other sources are required to file Borang A, also known as the Individual Income Tax Return Form. This includes both residents and non-residents who have derived income from Malaysian sources.

How to fill out borang a?

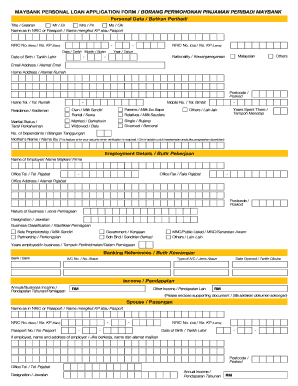

To properly fill out Borang A, follow these steps:

1. Start by reading the instructions given with the form carefully. Make sure you understand all the requirements and information needed to complete the form.

2. Gather all the necessary documents and information. This may include your personal identification details, income information, and any supporting documents required.

3. Begin with the personal details section. Fill in your full name, identification number or passport number, date of birth, gender, and nationality.

4. Provide your contact information, including your current address, phone number, and email address.

5. If applicable, indicate your marital status and provide the necessary details about your spouse, such as their name and identification number.

6. Proceed to the income section. This is where you will provide details about your employment status, monthly income, and employment history. Include all relevant information about your current and previous employers.

7. If you have any dependent children or family members, provide their details in the dependents' section. Include their names, ages, and identification numbers.

8. Indicate if you have any other sources of income, such as rental income, investments, or self-employment. Provide the necessary details for each additional income source.

9. If you have any deductions or allowances applicable to your case, ensure you fill in the appropriate section. Common deductions include EPF (Employees Provident Fund) and SOCSO (Social Security Organization) contributions.

10. Finally, carefully review the completed form to avoid any errors or omissions. Double-check that you have provided all required documents and signatures.

11. Once you are satisfied with the information provided, submit the filled-out form following the specific instructions given. This may involve submitting the form physically at a government office or through online submission platforms if available.

Remember to keep a copy of the filled-out form for your records.

What is the purpose of borang a?

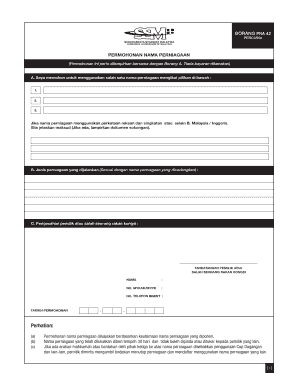

Borang A is a form used in Malaysia for various purposes. It is commonly known as the "Personal Particulars Form" or "Borang Maklumat Diri". The purpose of Borang A is to gather and record personal information of individuals.

Some common uses of Borang A include:

1. Employment: It is often used as part of the job application process to collect personal details such as name, address, contact information, education, work experience, and other relevant information about the job applicant.

2. Government documentation: Borang A may be required for various government-related matters such as passport applications, driving license registration, visa applications, and other official purposes where personal information needs to be recorded.

3. Educational institutions: Borang A may be used by educational institutions for student enrollment, registration, or other administrative processes to gather personal details of students.

4. Census or population surveys: Borang A may also be used for population surveys or census purposes, where authorities need to collect detailed personal information about individuals in a particular area or country.

The specific purpose of Borang A may vary depending on the context and organization using it. However, it generally serves as a standardized form to collect personal information efficiently and accurately.

What information must be reported on borang a?

It is unclear which specific Borang A you are referring to as there are multiple forms and documents with that name used in different contexts.

However, generally, Borang A is a common form used in Malaysia for various purposes, such as for income tax filing or employee registration. The information required to be reported on Borang A can vary depending on its specific purpose.

For example, if Borang A is for income tax filing, the following information may need to be reported:

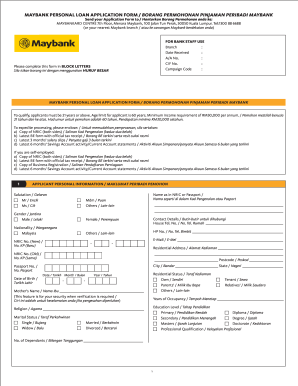

1. Personal details: Full name, identity card (or passport) number, address, and contact information.

2. Employment details: Employer's name, address, and tax identification number (e.g., Employer's Identification Number in Malaysia).

3. Salary and income details: Including total income earned during the relevant tax year, allowances and benefits received, and deductions for tax relief or expenses.

4. Other income sources: Any additional income received from other sources, such as rental property, investments, or business profits.

5. Tax payments and refunds: Information about any tax payments already made or tax refunds received.

6. Deductions and tax relief: Details of eligible deductions and tax relief, such as for EPF (Employees Provident Fund) contributions or insurance premiums.

7. Declarations, signatures, and supporting documents: Declaration of accuracy and completeness of the form, along with signatures, and attachment of relevant documents depending on the specific requirements (e.g., salary slips, supporting documents for deductions or tax relief claims).

It is essential to refer to the specific guidelines or instructions related to the particular Borang A that you are inquiring about, as different forms may have differing requirements and purposes.

How can I send borang a ssm for eSignature?

When your borang a form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I edit borang ssm on a smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing borang pendaftaran perniagaan right away.

How do I fill out ssm borang a using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign borang a ssm download form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.