Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is uba corporate account opening?

UBA Corporate Account Opening is a service offered by United Bank for Africa (UBA) that allows businesses to create and manage corporate accounts. This service allows businesses to access a range of banking services including online banking, money transfers, and payment solutions. It also provides businesses with access to UBA’s range of products and services, such as foreign exchange, trade finance and merchant services.

How to fill out uba corporate account opening?

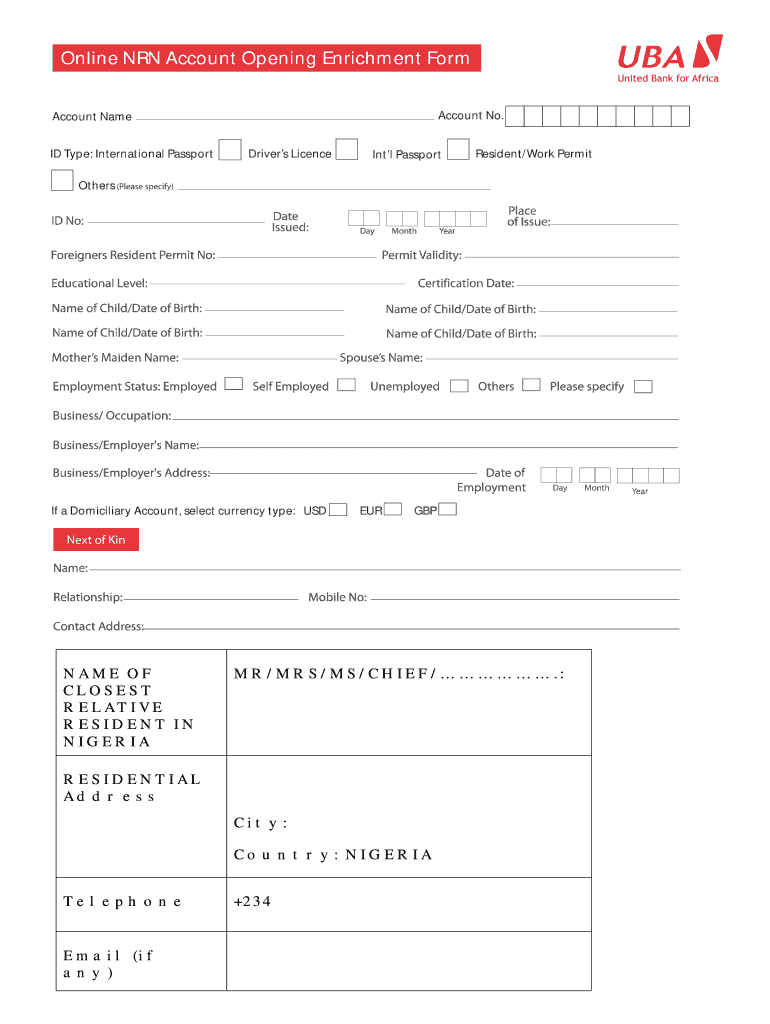

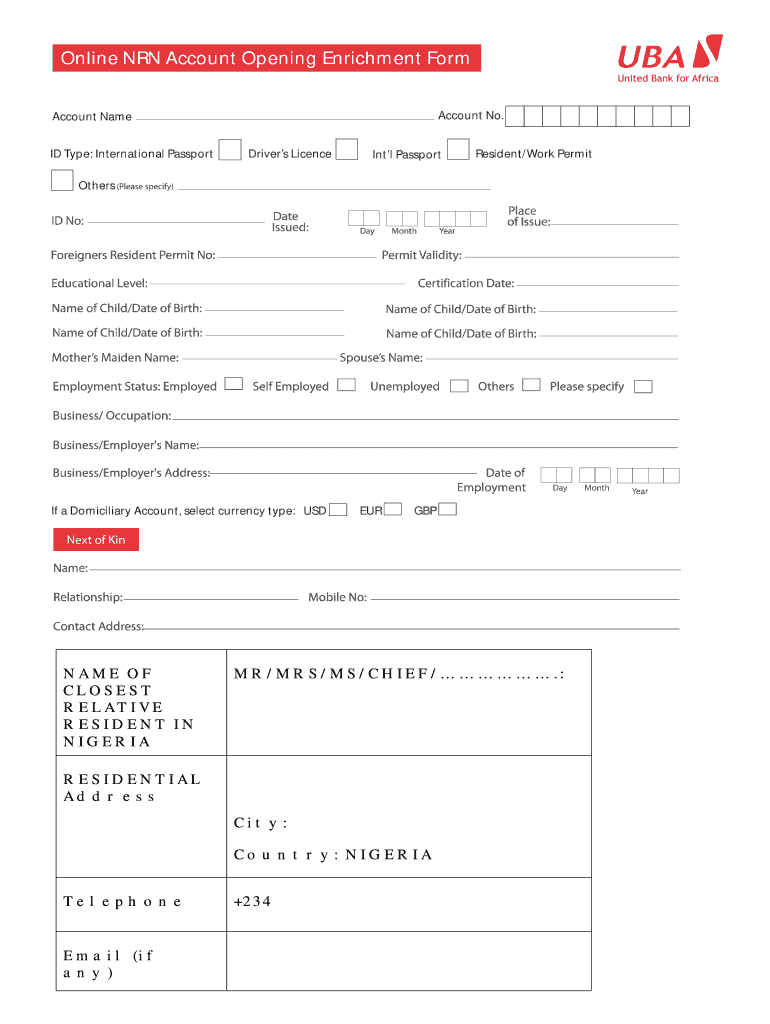

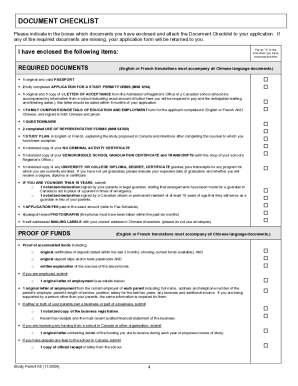

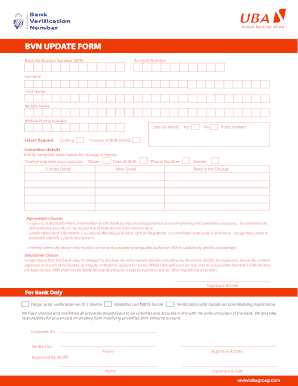

1. Visit the nearest UBA bank branch and obtain a Corporate Account Opening Form.

2. Fill out the form with the necessary information, including the corporate name, type of business, contact information, and other relevant information.

3. Provide documents such as the Memorandum and Articles of Association, Certificate of Incorporation, and other necessary documents.

4. Attach two passport-sized photographs and a valid means of identification.

5. Submit the form and documents to the bank and wait for the account opening process to be completed.

6. Upon completion, you will be provided with a Corporate Account Opening kit that includes your Account Number, ATM Card, and other necessary documents.

When is the deadline to file uba corporate account opening in 2023?

The deadline to file UBA corporate account opening in 2023 is yet to be determined.

What is the penalty for the late filing of uba corporate account opening?

The penalty for the late filing of a uba corporate account opening is a fine of up to 10,000 Naira (approximately $27.50 USD). This fine is imposed by the Central Bank of Nigeria.

What is the purpose of uba corporate account opening?

The purpose of opening a UBA (United Bank for Africa) corporate account is to provide businesses and organizations with a dedicated and specialized account for their financial operations. This type of account is specifically designed to cater to the unique needs of businesses, enabling them to conveniently manage their finances and carry out various banking transactions.

The main purposes of opening a UBA corporate account include:

1. Efficient financial management: A corporate account allows businesses to track and manage their revenue, expenses, and cash flow effectively. It provides detailed statements and reporting tools that assist in monitoring financial activities.

2. Facilitating transactions: Corporate accounts offer businesses access to a wide range of transactional services, such as electronic fund transfers, payments, direct debits, and standing orders. This enables businesses to easily and securely conduct their financial transactions with clients, suppliers, and partners.

3. Access to credit facilities: Corporate accounts may give businesses access to credit facilities, such as business loans and overdrafts. These financial products can help them meet their working capital requirements, expand their operations, or make investments.

4. Enhanced credibility and professionalism: Having a dedicated corporate account adds credibility to a business, especially when dealing with customers, suppliers, and other stakeholders. It creates a professional image and demonstrates a commitment to proper financial management.

5. Dedicated account management: UBA provides specialized account management services for corporate account holders. These services can include personalized support, priority banking services, and dedicated relationship managers who assist businesses in finding tailored financial solutions.

Overall, opening a UBA corporate account aims to provide businesses with a comprehensive banking solution that meets their specific financial needs, streamlines their transactions, and facilitates growth and success.

What information must be reported on uba corporate account opening?

When opening a UBA (United Bank for Africa) corporate account, the following information typically needs to be reported:

1. Legal Entity Information: The legal name, registered address, and type of business entity (e.g., corporation, partnership, sole proprietorship) must be provided. Additionally, details about the company's unique identifier, such as the Tax Identification Number (TIN) or Corporate Affairs Commission (CAC) registration code, may be required.

2. Ownership and Control: Details about the ultimate beneficial owners (UBOs) or individuals with significant control (ISC) over the company must be disclosed. This includes their full names, residential addresses, nationalities, occupations, and percentage of ownership.

3. Directors and Authorized Signatories: Information about the company's directors, including their names, addresses, nationalities, and positions held, must be reported. Similarly, the authorized signatories with their respective roles and contact details should be provided.

4. Business Activities: A description of the company's primary business activities, industry sector, and target market should be given.

5. Financial Information: The anticipated source and amount of funds to be deposited into the corporate account must be disclosed. This may include information related to projected sales, investment capital, or anticipated inflows from clients or partners.

6. Identification Documents: Copies of identification documents for all UBOs, directors, and authorized signatories are required. These may include national identification cards, passports, or driving licenses.

7. Proof of Address: Supporting documents verifying the residential addresses of UBOs, directors, and authorized signatories, such as utility bills or bank statements, may need to be provided.

8. Business Documentation: Additional documents related to the business, such as a copy of the company's registration certificate, memorandum and articles of association, board resolution authorizing account opening, business licenses, and permits, might be required.

It is important to note that the specific information and documentation required may vary based on the jurisdiction, the type of business, and UBA's internal policies and procedures. It is recommended to consult the bank directly or refer to their official website for the most accurate and up-to-date information on the account opening process.

How do I edit uba corporate account opening form pdf online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your uba account opening form to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an electronic signature for signing my uba account opening form pdf in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your uba reference form and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete account opening form pdf on an Android device?

Use the pdfFiller app for Android to finish your how to fill uba form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.