IRS Publication 972 2020-2024 free printable template

Show details

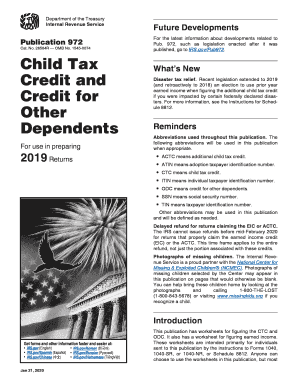

Department of the Treasury Internal Revenue ServicePublication 972Cat. No. 26584R OMB No. 15450074Child Tax Credit and Credit for Other Dependents For use in preparing2020 ReturnsFuture Developments

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your publication 792 child tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 792 child tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit publication 792 child tax credit online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs child tax form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

IRS Publication 972 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out publication 792 child tax

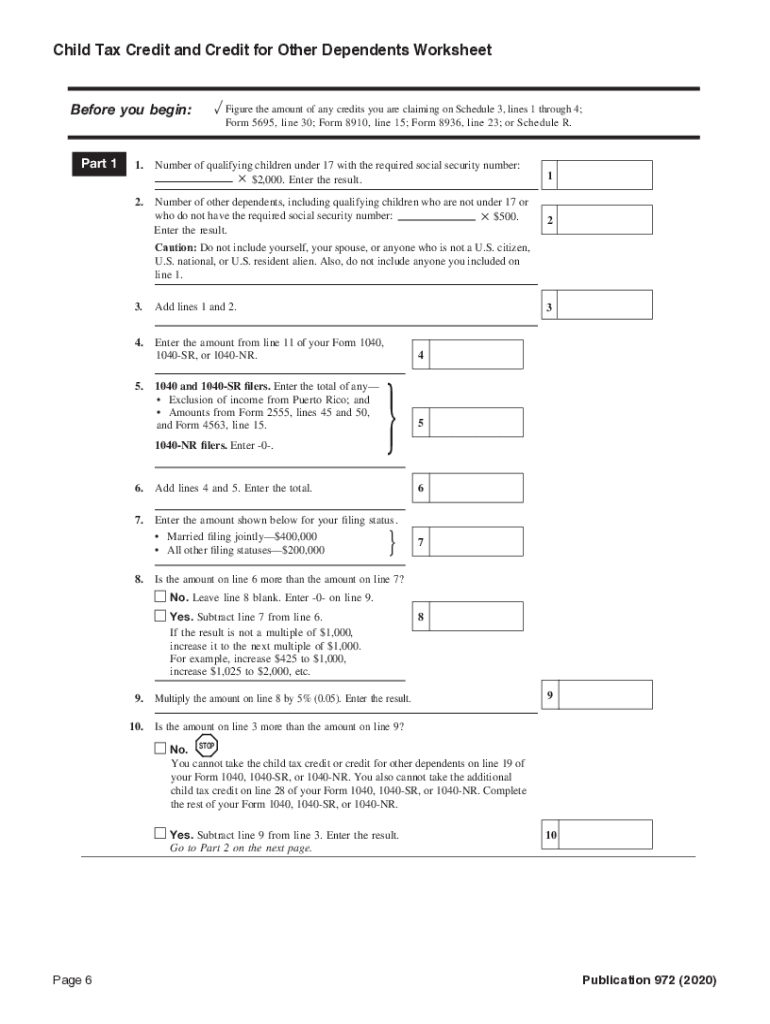

How to fill out publication 972:

01

Gather all necessary information and documentation, including your income statements, tax forms, and any applicable receipts or expenses.

02

Carefully read through the instructions provided in publication 972 to understand the eligibility requirements and the specific forms that need to be filled out.

03

Begin filling out the relevant sections of the publication, ensuring that you provide accurate and complete information.

04

Double-check all the information you have entered to ensure its accuracy and completeness.

05

Follow any additional instructions or guidelines provided in the publication for filing and submitting the filled-out form.

Who needs publication 972:

01

Individuals who have a qualified child or children and wish to claim the child tax credit on their tax return may need publication 972.

02

Parents or legal guardians who meet the income requirements and wish to calculate their child tax credit may also need publication 972.

03

Any taxpayer who wants to understand the qualifications, calculations, and limitations associated with the child tax credit should refer to publication 972 for guidance.

Fill irs publication 972 for 2017 : Try Risk Free

People Also Ask about publication 792 child tax credit

What are the 6 requirements for claiming a child as a dependent?

What are the rules for claiming a child as a dependent?

Will SSI recipients get the Child Tax Credit 2023?

What makes someone qualify as a dependent?

When should I stop claiming my child as a dependent?

What disqualifies you from earned income credit?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file publication 972?

Publication 972 is required to be filed by individuals who are claiming the Child Tax Credit or the Additional Child Tax Credit.

What is the purpose of publication 972?

Publication 972, Child Tax Credit, is intended to help taxpayers understand the rules for claiming the Child Tax Credit, Additional Child Tax Credit, and the credit for other dependents. It provides an overview of the credit, how to claim it, and other relevant information.

When is the deadline to file publication 972 in 2023?

The deadline to file Publication 972 in 2023 is April 15, 2024.

What is the penalty for the late filing of publication 972?

Publication 972 is a tax form related to the child tax credit. The penalty for filing this form late is 5% of the amount of the credit claimed, up to a maximum of $50.

What is publication 972?

Publication 972 is a document published by the Internal Revenue Service (IRS) in the United States. It provides information and guidelines for taxpayers who have dependents and/or are eligible to claim the Child Tax Credit. The publication explains who qualifies as a dependent, how to determine the taxpayer's filing status, how to calculate the child tax credit, and various other related topics.

How to fill out publication 972?

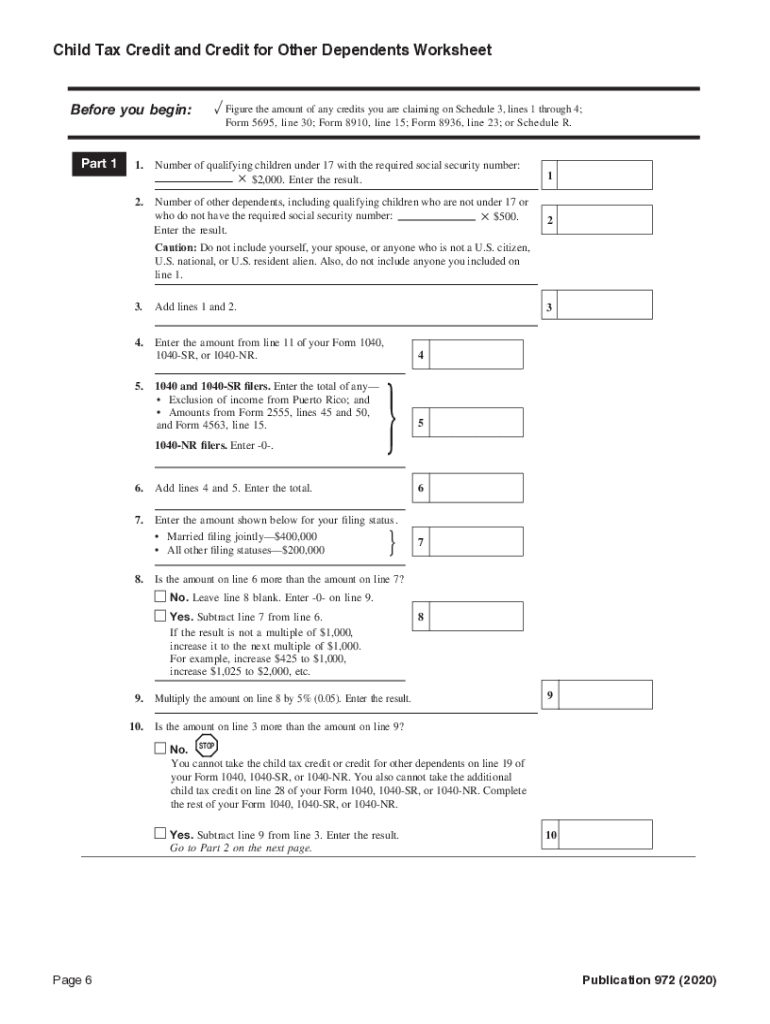

To accurately complete the IRS Form 972, you need to follow these steps:

1. Obtain a copy of Form 972: You can download the form from the IRS website or request a copy by mail.

2. Understand the purpose of the form: Publication 972, also known as the Child Tax Credit, is used to determine if you are eligible for the Child Tax Credit and to calculate the amount you can claim.

3. Gather the necessary information: Collect information related to the child you are claiming the credit for, such as their name, Social Security number, and relationship to you. Additionally, gather information about your income and potential credits, if applicable.

4. Complete Part I: In this section, provide your personal information, such as your name, Social Security number, and filing status.

5. Complete Part II: This section is used to determine if you qualify for the Child Tax Credit. Fill in the required details about your qualifying child, including their name, Social Security number, and relationship to you.

6. Complete Part III: Here, you need to provide information about your earned income for the year and any additional credits you may be eligible for, such as the Additional Child Tax Credit or the Credit for Other Dependents.

7. Calculate the credit: Use the provided worksheets in the publication to calculate the amount of your Child Tax Credit. Ensure you follow the instructions carefully to avoid errors.

8. Double-check and sign: Once you have completed all the necessary sections and calculated the correct amount, review your form to ensure accuracy. Finally, sign and date the form.

9. Keep a copy: Before submitting the form, make a copy for your records.

10. Submit your form: Send the completed and signed Form 972 to the IRS using the address specified in the instructions.

What information must be reported on publication 972?

Publication 972, also known as the Child Tax Credit, provides information on claiming the child tax credit on your tax return. The publication covers various aspects related to eligibility, amount, and requirements to claim the credit. Here are some specific information that must be reported on Publication 972:

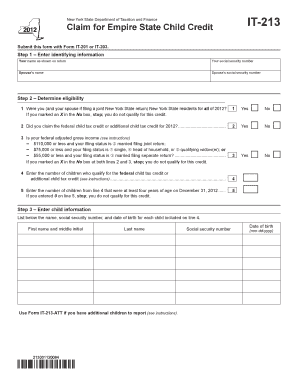

1. Qualifying Child Information: You must report details about each qualifying child, including their name, relationship to you, Social Security number, and date of birth.

2. Child's Address: If the child did not live with you for the entire year, you need to report their address and the number of months they lived with you.

3. Relationship: You need to specify your relationship with the child, such as son, daughter, stepchild, foster child, etc.

4. Identification Number: You need to provide your own Social Security number or Individual Taxpayer Identification Number (ITIN) on which the credit will be claimed.

5. Filing Status: You must indicate your filing status, such as Single, Head of Household, Married Filing Jointly, or Married Filing Separately.

6. Income Information: Publication 972 requires reporting your modified adjusted gross income (MAGI) and earned income. Some additional details about investment income and certain tax-free benefits may also need to be reported.

7. Calculation of Child Tax Credit: The publication provides a step-by-step process to calculate the amount of child tax credit you are eligible for, based on your income and number of qualifying children.

8. Other Credits: You may need to report any other nonrefundable credits you are claiming, as the child tax credit interacts with certain other credits.

Please note that the specific requirements and reporting may change from year to year, so it is important to consult the most recent version of Publication 972 for accurate information.

How do I modify my publication 792 child tax credit in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your irs child tax form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I execute irs 972 online?

pdfFiller has made it easy to fill out and sign irs publication 972. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I complete publication 972 for 2018 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your irs gov pub 972 form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your publication 792 child tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs 972 is not the form you're looking for?Search for another form here.

Keywords relevant to irs schedule 972 form

Related to 972 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.