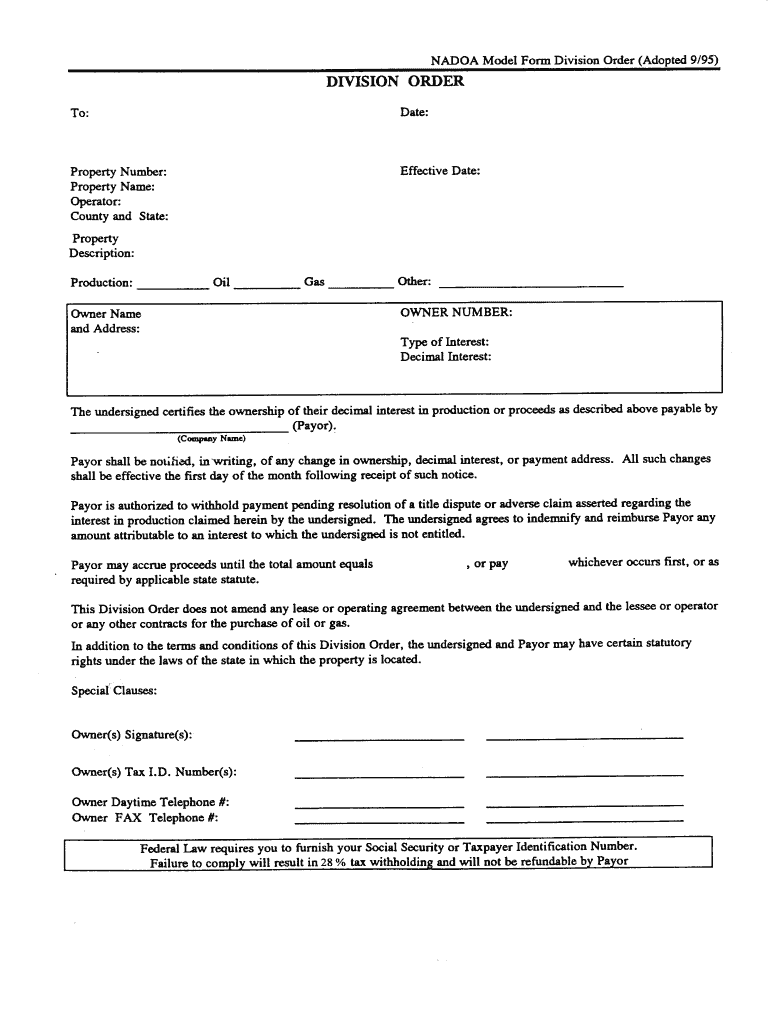

Who needs a division order?

A division order is signed by the mineral owner who is entitled for a share of the mineral produced. This may be gas, oil or other natural gas liquids.

What is division order for?

Once division order is filled out by a division order analyst it is sent to the interest owner to notify that mineral production has started, and it brings revenue.

However, the primary goal of the division order is to get a confirmation from the interest owner about the accuracy of the revenue amount paid and interest owner's personal data. As a rule, mineral owner is entitled for the decimal interest. When reviewing the division order, the mineral owner should make sure that the interest he/she is entitled for does not exceed the agreed amount of share. If it does, then the mineral owner can be pursued for compensation. So it is all about accuracy of the information given in the order division. Therefore, before signing it pay attention to:

- The name of the company that has started the production of the mineral

- Description of the property that is being produced

- The type of the interest

- Decimal interest

- Legal agreements

By signing the division order mineral owner agrees that all data provided in the document is accurate as well as the decimal interest.

Is division order accompanied by other forms?

Alongside the division order you should fill out W-9 form for the government to withdraw tax on the amount of revenue you will get as an interest owner.

When is division order due?

The division order is due when it is thoroughly reviewed, verified and signed by the mineral owner.

How do I fill out division order?

The division order contains fields filled out by the operator. There he/she indicates:

- Property number

- Property name

- Operator

- County and state

- Property description

- Owner name and address

- Type of interest

- Decimal interest

The owner should only put a signature in the appropriate fields, indicate tax ID number, telephone number.

Where do I send division order form?

Return the signed division order to the operator of the company that has started the production of the mineral.