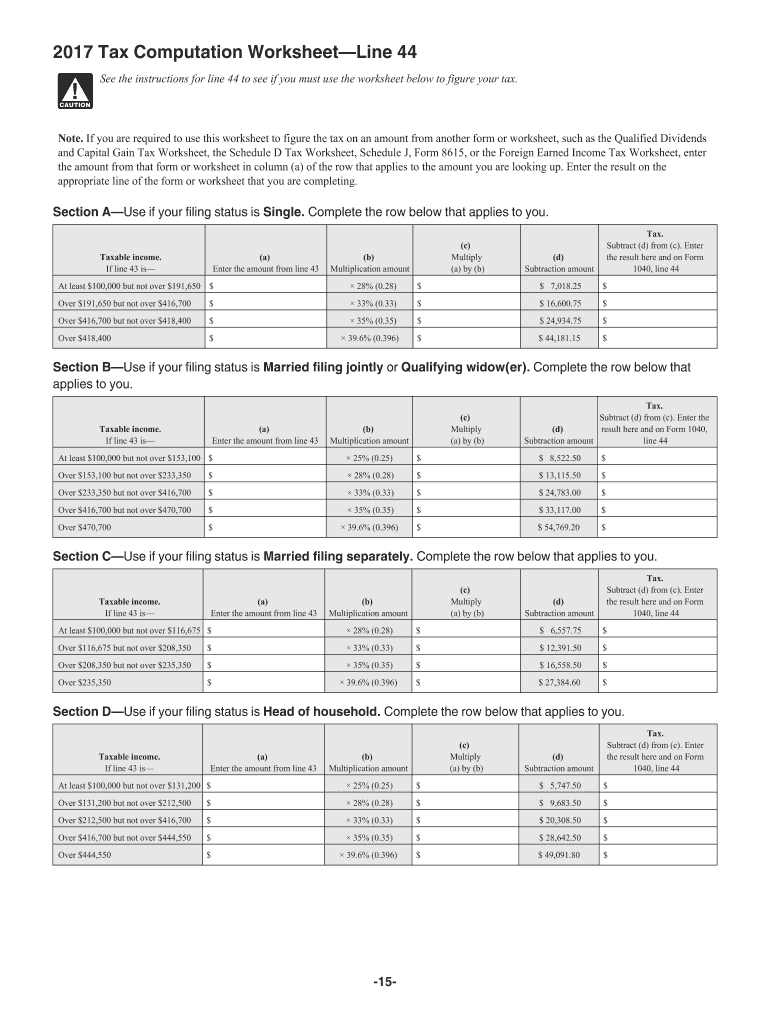

Who Needs 1040 — Tax Table?

The US internal Revenue Service has prepared 1040 Tax Tables to assist individual taxpayers to figure out the amount of federal tax due as it must be reported on Form 1040 or its version.

What is the Purpose of 1040 — Tax Table?

The purpose of 1040 — Tax Table is only to inform taxpayers; it does contain the form to file itself.

Is 1040 — Tax Table a Self-Sustained Document?

1040 — Tax Table is not the only piece of information to refer to when filing an individual tax return. It is highly recommended that all the instructions are carefully read prior to filing. Here are the instructions for 2016’s Form 1040.

How Long is 1040 — Tax Table effective?

1040 — Tax Table is actually a part of the instructions for Form 1040. The IRS issues an updated version of the annual tax return report on a yearly basis, therefore the instructions are revised and updated, too. That’s why it is highly recommended that taxpayer check up on the latest available version of the instruction.

Do I Need to Fill out 1040 Tax Tables?

No, there is no need to write anything on the Tax Table, nor it is to be filed with Form 1040 (or its version).