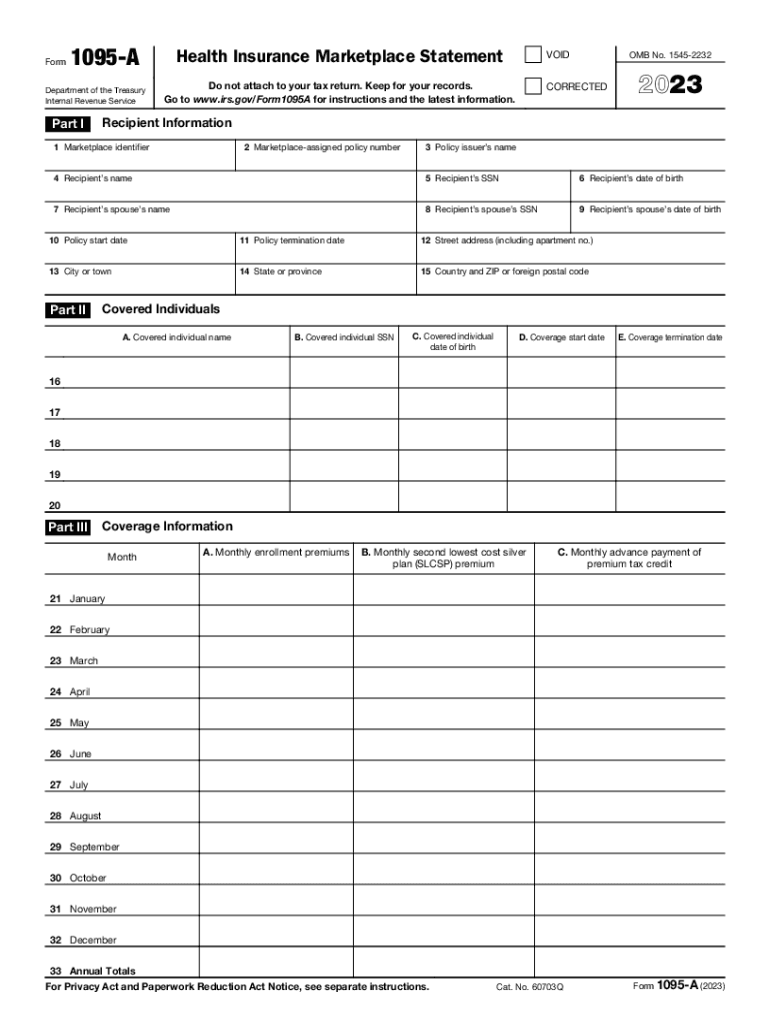

What is Form 1095-A 2023?

Form 1095-A (Health Insurance Marketplace Statement) provides important tax information about the cost of health insurance and the federal subsidy that you may have received in 2023. This subsidy, known as the Premium Tax Credit (PTC), makes the cost of healthcare coverage cheaper for individuals who purchased plans through the health insurance marketplaces. You'll use Form 1095-A to check if there's any difference between the premium tax credit you used in 2023 and the amount you qualify for. Unlike most tax credits, the government pays the PTC in advance each month directly to insurers.

Who should file the 1095-A 2023?

IRS Form 1095-A, furnished by Health Insurance Marketplaces, is for individuals registered for health plan coverage with the Health Insurance Marketplace. If you receive a 1095-A, use it to complete your tax return and a new IRS form, Form 8962.

What information do you need when you file Form 1095-A?

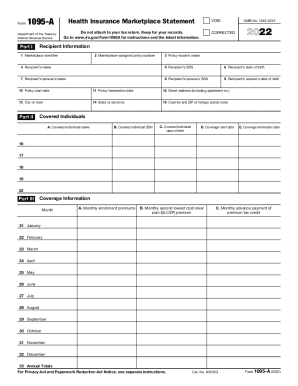

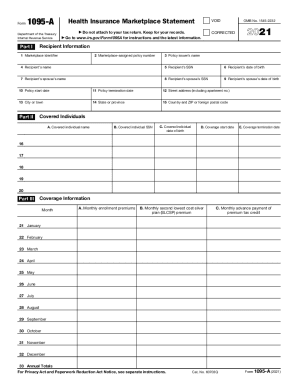

Form 1095-A is completed by health insurance providers who offer coverage through the Health Insurance Marketplace. The document includes information about Marketplace plans taxpayers had in 2023. For the taxpayer, Form 1095-A is for informational purposes only. It does not have to be filed with your tax return. However, information from Form 1095-A is needed to complete Form 8962 (Premium Tax Credit).

How do I fill out Form 1095-A 2023 in 2024?

Form 1095-A consists of two pages and three sections: Part I, Recipient Information, Part II, Covered Individuals, and Part III, Coverage Information.

Here’s how you can fill out Form 1095-A online with pdfFiller:

- Click the Get Form button to open the respective form in the editor.

- Fill out the required fields and review them.

- Click DONE to finalize the process.

- Next, download or save the completed 1095-A to your computer.

- Select to send the form via USPS to your coverage provider.

For more information on how to get a 1095-A and fill it out, please visit your Marketplace’s website.

Is Form 1095-A accompanied by other forms?

Form 8962 reconciles the monthly Premium Tax Credit payments reported on 1095-A with your actual annual income and family size. With that information, you can determine if the subsidy payments paid to the insurer throughout the year were too high or too low. If they were too high, the IRS will take the difference from your tax refund. Conversely, if the payments weren’t enough, the marketplaces will pay out the remaining credits to you.

When is Form 1095-A due?

There is no due date for filing Form 1095-A. It is an annual return used by taxpayers to fill out Form 8962, which in turn is due April 18, 2022.

Where do I send Form 1095-A?

The form is not to be filed with IRS. You can find an electronic version of the 1095-A Form along with the information on how to get a 1095-A form online on the Marketplace’s website you purchased healthcare coverage with. Health Insurance Marketplaces furnishes Form 1095-A to each individual they provide health coverage to, so they must send it directly to the insurance holder.