Get the free Accounting for Disclosures

Show details

Q&A Accounting for Disclosures HIPAA Privacy Rule 164.528The following Q&A addresses questions received about the Accounting for Disclosures as required in the HIPAA Privacy Rule 164.528. The Q&A

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

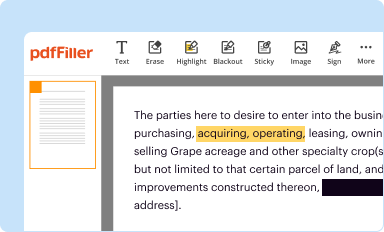

Edit your accounting for disclosures form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

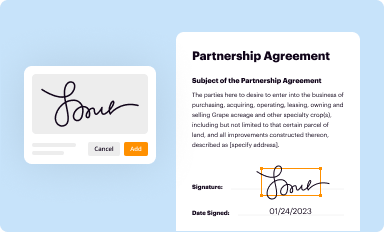

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

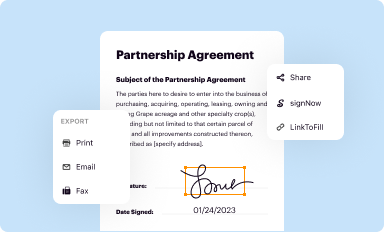

Share your form instantly

Email, fax, or share your accounting for disclosures form via URL. You can also download, print, or export forms to your preferred cloud storage service.

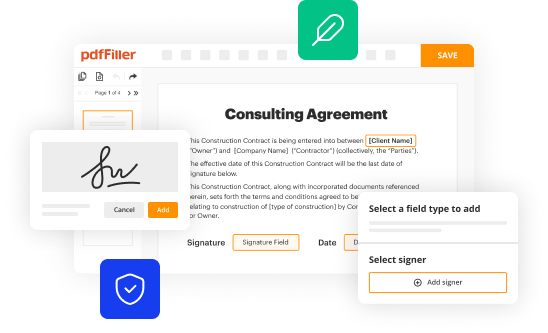

Editing accounting for disclosures online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit accounting for disclosures. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out accounting for disclosures

How to fill out accounting for disclosures:

01

Gather all relevant financial information: Start by collecting all the necessary financial documents, such as income statements, balance sheets, cash flow statements, and any other relevant financial records. This step is crucial to ensure that all the financial information is accurately accounted for and disclosed.

02

Identify the disclosure requirements: Research and identify the specific disclosure requirements that apply to your situation. These requirements may vary depending on factors such as the reporting framework being used (e.g., Generally Accepted Accounting Principles or International Financial Reporting Standards) and the nature of the business or organization.

03

Understand the accounting principles: Familiarize yourself with the accounting principles and guidelines applicable to the specific disclosures you need to make. This step is important to ensure that the disclosures are prepared in accordance with the relevant accounting standards and regulations.

04

Analyze the financial data: Review the financial data and analyze it to determine the appropriate disclosures. Consider factors such as significant accounting policies, contingent liabilities, related party transactions, and any other relevant data that may require disclosure.

05

Prepare the necessary disclosure notes: Based on the analysis of the financial data, draft the disclosure notes that provide additional information and explanations to the financial statements. These notes should be clear, concise, and provide a comprehensive understanding of the financial statements to the users.

06

Review and verify the accuracy: Before finalizing the accounting for disclosures, thoroughly review the disclosure notes and the financial statements to ensure accuracy and completeness. This step may involve seeking input from other stakeholders, such as auditors or legal advisors, to ensure compliance with all applicable regulations.

07

Update the financial statements: Once all the necessary disclosures have been prepared and reviewed, update the financial statements to include the disclosure notes. Make sure that the disclosures are clearly linked to the relevant sections of the financial statements, providing users with a transparent and informative view of the financial performance and position.

Who needs accounting for disclosures?

01

Publicly traded companies: Public companies are typically required to provide extensive disclosures to ensure transparency in their financial reporting to investors and the wider market. These disclosures may include information about the company's financial performance, risks, plans, and governance practices.

02

Non-profit organizations: Non-profit organizations often need to disclose financial information to their stakeholders, such as donors, grantors, and regulatory bodies. These disclosures provide transparency about the organization's financial position, how the funds are being utilized, and the impact of their activities.

03

Government entities: Government agencies and departments need to provide disclosures to demonstrate accountability and transparency in the utilization of public funds. These disclosures may include information on budgetary allocations, expenditures, and any significant financial transactions.

04

Financial institutions: Banks, credit unions, and other financial institutions are required to disclose financial information to regulators and stakeholders to demonstrate their financial stability and compliance with regulatory requirements. These disclosures may include information on loan portfolios, risk exposures, capital adequacy, and more.

05

Privately held companies: Although privately held companies may not have the same level of disclosure requirements as publicly traded companies, they may still need to provide financial information to lenders, investors, or potential buyers as part of due diligence or contractual obligations. These disclosures help stakeholders assess the company's financial health, performance, and potential risks.

06

Other entities: Depending on the specific circumstances, other entities, such as partnerships, joint ventures, or trusts, may also have disclosure requirements. These disclosures aim to provide relevant information to stakeholders, such as partners, beneficiaries, or regulatory bodies.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is accounting for disclosures?

Accounting for disclosures is the process of documenting and reporting any instances where confidential or sensitive information has been shared or disclosed to external parties.

Who is required to file accounting for disclosures?

Organizations that handle sensitive information, such as healthcare providers and financial institutions, are typically required to file accounting for disclosures.

How to fill out accounting for disclosures?

Accounting for disclosures is typically filled out by providing details of the disclosed information, the recipient(s) of the information, the purpose of the disclosure, and any relevant dates and timestamps.

What is the purpose of accounting for disclosures?

The purpose of accounting for disclosures is to ensure transparency and accountability in the handling of sensitive information, and to comply with legal requirements and privacy regulations.

What info must be reported on accounting for disclosures?

Accounting for disclosures typically requires reporting of the type of information disclosed, the individuals or entities it was disclosed to, the purpose of the disclosure, and any additional details relevant to the specific disclosure event.

When is the deadline to file accounting for disclosures in 2023?

The specific deadline to file accounting for disclosures in 2023 may vary depending on the jurisdiction and applicable regulations. It is advisable to consult relevant authorities or seek legal advice for accurate and up-to-date information.

What is the penalty for late filing of accounting for disclosures?

Penalties for late filing of accounting for disclosures may vary depending on the jurisdiction and applicable regulations. Common penalties can include fines, legal consequences, or reputational damage to the organization.

How do I edit accounting for disclosures straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing accounting for disclosures right away.

Can I edit accounting for disclosures on an iOS device?

You certainly can. You can quickly edit, distribute, and sign accounting for disclosures on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I complete accounting for disclosures on an Android device?

Use the pdfFiller app for Android to finish your accounting for disclosures. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your accounting for disclosures online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.