Get the free challan 280 pdf editable form

Show details

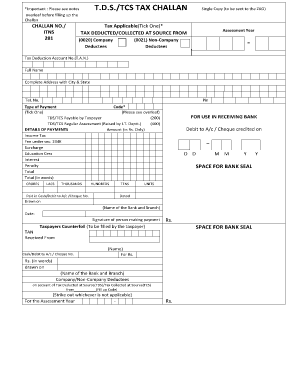

* Important : Please see notes overleaf before filling up the Chillán NO./ ITS 280 Single Copy (to be sent to the ZOO) Tax Applicable (Tick One)* (0020) INCOME-TAX ON COMPANIES (CORPORATION TAX)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your challan 280 pdf editable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your challan 280 pdf editable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing challan 280 pdf editable online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit challan 280 in excel form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out challan 280 pdf editable

How to fill out challan 280 in excel:

01

Open Microsoft Excel on your computer.

02

Create a new spreadsheet or open an existing one where you want to fill out the challan.

03

Use the gridlines and cells of the spreadsheet to input the necessary information required in the challan form.

04

Begin by filling out the personal information section, such as your name, address, and phone number, in the designated cells.

05

Move on to the financial details section and enter the relevant information like income, tax deducted, and tax payable.

06

Include any additional details or declarations that are required in the challan form.

07

Double-check all the filled information to ensure accuracy and completeness.

08

Save the completed challan in excel format for future reference or printing.

Who needs challan 280 in excel:

01

Individuals or businesses who are required to pay income tax in India.

02

Taxpayers who want to file their tax payment details in an organized and electronic format.

03

Individuals or organizations who prefer using Microsoft Excel for financial record-keeping and reporting purposes.

Fill income tax challan 280 in excel format download : Try Risk Free

What is form itns 280?

ITNS 280 fill able income challan form in MS Excel and PDF Format. ... ITNS 280 is the challan for payment of Income Tax. Challan ITNS 280 can be used to pay income tax on Companies and Other than Companies.

People Also Ask about challan 280 pdf editable

How to regenerate challan 280 receipt?

How to fill challan 280 for self assessment tax?

Where to upload challan 280?

What is type of payment in Challan 280?

How do I create a challan for self assessment tax?

How can I get my challan serial number?

How do I update my ITR after paying self assessment tax?

How can I generate Itns 280 Challan?

How to fill in the challan details while filing the ITR?

How to upload challan 280 online?

How to fill challan 280 offline?

How can I correct my ITR after submission?

How do I revise ITR after assessment?

How do I verify after paying self assessment tax?

How to create a challan in Excel?

What to do after paying outstanding tax demand?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is challan 280 in excel?

Challan 280 in Excel is a spreadsheet template used to record payments made through the Government e-Payment Gateway. It is used to record the details of the payments made to the government, including the date, time, amount, and payment mode. It is also used to track the status of the payments and any additional charges or fees associated with the payments.

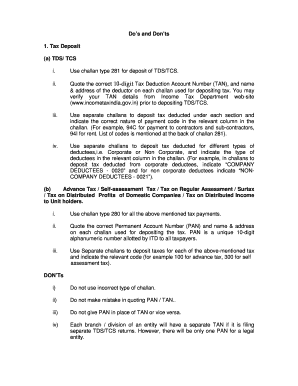

Who is required to file challan 280 in excel?

Any individual or business entity who is liable to deduct tax at source (TDS) under the provisions of the Income Tax Act, 1961, must file challan 280 in excel format. This includes individuals, companies, government organizations, societies, trusts, etc.

How to fill out challan 280 in excel?

You can use a template to fill out Challan 280 in Excel. To do so, you can download a Challan 280 Excel Template from the internet. This template will provide you with pre-filled information that you can fill out according to the information on your Challan. You will need to input the correct information for the payer, the payee, the bank, the amount, and any taxes that may be applicable. Once you have filled out the template, you can save it and print it out.

What is the purpose of challan 280 in excel?

Challan 280 in Excel is a template used to calculate tax deductions for employees according to the Indian Income Tax Act. It helps employers to manage their deductions and calculate the exact amount of withholding tax on employees’ salaries. It also helps the employers to submit the deductions to the Income Tax Department.

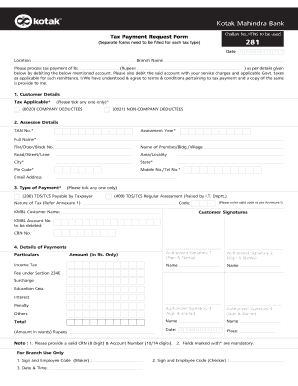

What information must be reported on challan 280 in excel?

1. Name of the deductor/collector.

2. PAN of the deductor/collector.

3. Address of the deductor/collector.

4. Amount of Tax Deducted at Source (TDS).

5. Rate of Tax Deduction.

6. TDS Amount Paid.

7. TDS Amount deposited.

8. Challan Identification Number (CIN).

9. Date of Payment.

10. Major Head Code.

11. Minor Head Code.

12. Nature of Payment.

13. Bank Name.

14. Bank Branch Name.

15. Bank Branch Code.

16. Bank Challan Serial Number.

17. Bank BSR Code.

18. Tax Deducted/ Collected at Source.

19. Name of the Assessee/ Deductor.

20. PAN of the Assessee/ Deductor.

21. Address of the Assessee/ Deductor.

22. Whether the amount paid is adjusted against demand or not.

23. Name of the Person from whom Tax Deducted/Collected.

24. PAN of the Person from whom Tax Deducted/Collected.

25. Address of the Person from whom Tax Deducted/Collected.

26. Remarks.

When is the deadline to file challan 280 in excel in 2023?

The deadline to file Challan 280 in excel in 2023 is 31st March 2023.

What is the penalty for the late filing of challan 280 in excel?

The penalty for late filing of Challan 280 in Excel is a fine of Rs.200 for each day of delay, up to a maximum of Rs.10,000.

How can I manage my challan 280 pdf editable directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your challan 280 in excel form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I make edits in challan excel format without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your challan 280 pdf, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit income tax challan 280 in excel format on an Android device?

You can make any changes to PDF files, such as challan format in excel, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your challan 280 pdf editable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Challan Excel Format is not the form you're looking for?Search for another form here.

Keywords relevant to challan 280 excel form

Related to challan form excel format

If you believe that this page should be taken down, please follow our DMCA take down process

here

.