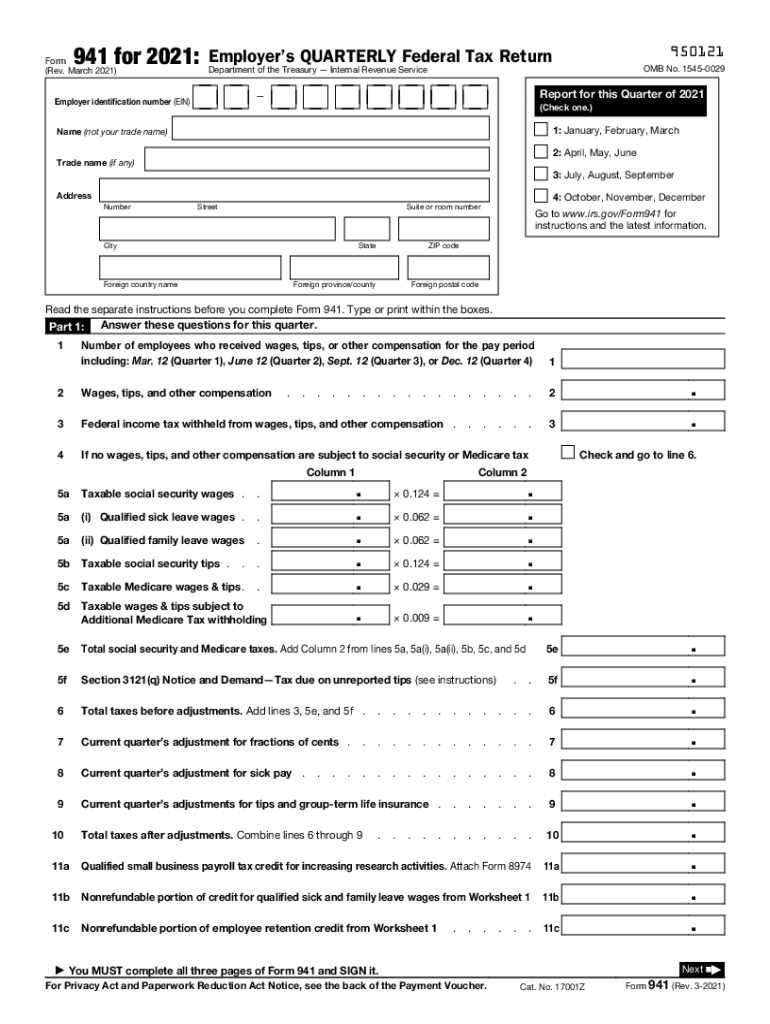

What is Form 941 2021?

The Employer's Quarterly Federal Tax Return is required to file the withheld taxes from the employer's wages to his employee. These taxes include federal income, social security, and Medicare taxes.

Who should file Form 941 2021?

This document is used by employers to report income taxes, social security tax, and Medicare tax withheld from employees' wages. The second part of the template is the Payment Voucher which must be completed if the employer makes a payment with this record. This record should not be used to report income tax withholding on pensions, annuities, or gambling winnings.

There are a few types of businesses that are not required to submit 941s:

- Companies that hire only farmworkers

- People who hire household employees

- Seasonal businesses for quarters when they do not hire people

What information do I need to file 941 form 2021?

The document requires the following details:

- Employer Identification Number

- Employer's name

- Trade name

- Address

- Reporting quarter (check the appropriate box)

Furthermore, the employer must answer all the questions and provide the required details and figures: number of employees, wages, tips, other compensation, deposit schedule, and tax liability. The employer also should make some calculations following the instructions provided.

The document should be dated and signed by the authorized person.

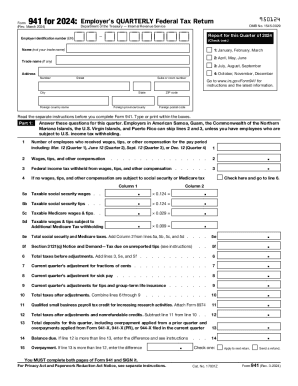

How do I file form 941 in 2022?

You can complete the record in less than an hour if you fill it out online with our robust PDF editor – pdfFiller. Follow the guidelines below to prepare the document faster:

- Select Get Form and wait for the editor to establish a secure connection.

- Indicate your Employer Identification Number, name, trade name, and address at the top of the template.

- Click the checkbox in the top-right corner of the first page to choose the reported quarter.

- Answer the questions in Part I-IV.

- Make sure you have provided your name and EIN at the top of each page.

- Click the Signature field to sign the document; add dates and your name.

- Go to page 5 and fill out the voucher.

- Select Done to close the editor and export your record in a suitable format.

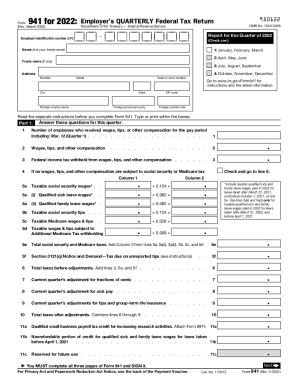

Is IRS form 941 accompanied by other forms?

This document must be accompanied by 941-V, which is attached to the template. If a filer deposits their payroll taxes on a semi-weekly schedule, they must also attach Schedule B.

When is the 941 form 2021 due?

The record must be submitted quarterly (for every three months of the 2021 year). There are four deadlines:

- April 30 for the first quarter (January-March)

- July 31 for the second quarter (April-June)

- October 31 for the third quarter (July-September)

- January 31 for the fourth quarter (October-December)

Where do I send the 941 form 2021 after its completion?

The address of the Internal Revenue Service depends on your state. Check the list on the IRS website to find the office that is responsible for checking your records.