USDA VS 9-3 2005-2024 free printable template

Show details

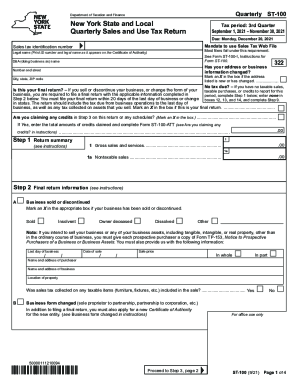

This report is required by certain states for the interstate shipment of poultry products. Failure to report may result in non-acceptance of shipment. REPORT NO. See reverse side for additional OMB

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your sales form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sales form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit report sales form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

How to fill out sales form

How to fill out sales form:

01

Gather all necessary information such as customer details, product or service information, and pricing.

02

Start by filling out the basic information section, including the date, company name, and contact details.

03

Specify the customer's details, including their name, address, phone number, and email.

04

Provide a clear and concise description of the product or service being sold, including any relevant specifications or features.

05

Include the quantity or units being sold, as well as the price per unit and the total amount.

06

If applicable, add any discounts, taxes, or additional charges to the sales form.

07

Calculate the subtotal by adding up the total amount and any additional charges.

08

Include any terms and conditions that apply to the sales transaction, such as payment methods, return policy, or warranties.

09

Add any necessary signatures and indicate the date of completion.

10

Review the completed sales form for accuracy and make any necessary corrections before finalizing.

Who needs sales form?

01

Sales representatives or sales teams who need to document their sales transactions for record-keeping and accountability.

02

Businesses or organizations that sell products or services to customers, as the sales form serves as a legal documentation of the transaction.

03

Customers who may require a sales form as proof of purchase or for reimbursement purposes

Fill vs9 3 : Try Risk Free

People Also Ask about sales form

How do I make an order form?

What is the sales form?

What is a sales request form?

What are four types of documents used in the selling process?

What is sales form content in QuickBooks?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sales form?

A sales form is a document that records the details of a sales transaction between a buyer and a seller. It typically includes information such as the parties involved, the products or services being purchased, the quantity, price, and terms of the sale, and any additional terms or conditions. Sales forms can be physical documents, such as invoices or sales receipts, or electronic documents used in online sales. They serve as a record of the transaction and may be used for accounting, taxation, and customer service purposes.

Who is required to file sales form?

Various individuals and entities may be required to file sales forms, depending on the jurisdiction and specific circumstances. Generally, businesses that engage in the sale of goods or services are required to file sales forms to report their sales and remit any applicable taxes. This includes retailers, wholesalers, manufacturers, and service providers. Additionally, individuals and businesses making sales in certain states or countries may be required to file sales forms, even if they do not have a physical presence there, due to economic nexus laws or other regulations. It is crucial to consult the applicable laws and regulations in the specific jurisdiction to determine who is required to file sales forms.

How to fill out sales form?

Filling out a sales form typically involves the following steps:

1. Begin by reviewing the form: Familiarize yourself with the different sections and fields required in the sales form.

2. Gather necessary information: Collect all the details related to the sale, such as the product or service being sold, quantity, price, customer information, and any other relevant information.

3. Start with customer details: Enter the customer's name, contact information, and any other required details. Provide accurate and complete information to ensure effective communication and follow-up.

4. Provide product or service details: Specify the items being sold, including the name, description, and any applicable product codes or references. Include details like size, color, and any available options.

5. Include pricing and payment information: Enter the unit price of each item, along with the quantity being purchased. Multiply the unit price by the quantity to calculate the total cost. Specify any applicable discounts, taxes, or shipping charges. Include the payment method and terms, such as whether it's cash, credit card, or any other agreed-upon arrangement.

6. Record additional notes or terms: If necessary, add any special instructions or terms related to the sale, such as warranties, returns policy, or delivery details. Ensure clarity and transparency to avoid any misunderstandings between you and the customer.

7. Review and validate: Before finalizing the form, double-check all the information filled out to ensure accuracy and completeness. Confirm that all required fields are filled out correctly.

8. Save and distribute: Save a copy of the completed sales form for your records. Send the form to the customer, accounting department, or any relevant parties involved in the sales process. You may send it electronically or in print, depending on the preferred method.

Remember, it's important to follow any specific instructions or guidelines provided by your company or the specific sales form you are using.

What is the purpose of sales form?

The purpose of a sales form is to document and record details of a sales transaction between a buyer and a seller. It serves as a legal document that outlines the agreement between the two parties, including the products or services being sold, their quantities, prices, payment terms, and any additional terms and conditions. Sales forms can be used as evidence of the transaction and help maintain accurate financial records for both the buyer and the seller.

What information must be reported on sales form?

The information that must be reported on a sales form typically includes:

1. Seller Information: Name, address, contact details, and the seller's Tax Identification Number (TIN) or Social Security Number (SSN).

2. Buyer Information: Name, address, contact details, and the buyer's TIN or SSN (if applicable).

3. Date of Sale: The specific date on which the sale transaction took place.

4. Description of Goods or Services: A detailed description of the goods or services sold, including quantity, unit price, and any applicable discounts or taxes.

5. Sales Price: The total amount charged to the buyer, including any applicable taxes or fees.

6. Sales Tax Information: The amount of sales tax charged, the applicable tax rate, and the jurisdiction to which the sales tax must be remitted (such as a state or local tax authority).

7. Payment Method: The payment method used by the buyer (e.g., cash, credit card, check, or electronic transfer).

8. Terms of Sale: Any specific terms or conditions agreed upon between the buyer and seller, such as warranties, return policies, or payment terms.

9. Signature and Date: The signature of the seller or their authorized representative affirming the accuracy of the information provided, along with the date of signing.

It's important to note that the specific information required on a sales form may vary depending on the legal and regulatory requirements of the jurisdiction in which the sale takes place.

What is the penalty for the late filing of sales form?

The penalty for the late filing of a sales form can vary depending on the specific country or jurisdiction. However, some common penalties may include:

1. Late filing fees: These are typically monetary penalties imposed for each day or month that the sales form is late. The fees may increase the longer the filing is delayed.

2. Interest charges: In addition to late filing fees, interest charges may be imposed on any outstanding tax liability resulting from the late filing. The interest rate is often calculated based on the amount owed and the number of days or months it remains unpaid.

3. Loss of deductions or credits: Failing to file sales forms on time may result in the loss or reduction of certain deductions or credits that could have been claimed on the submitted form.

4. Auditing or investigation: Late filing may increase the likelihood of being selected for a tax audit or investigation. This could result in further penalties and potential legal consequences if any non-compliance or fraud is discovered.

It is important to consult the specific tax laws and regulations applicable to your jurisdiction to understand the exact penalties for late filing of sales forms.

Can I create an electronic signature for the sales form in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your report sales form in seconds.

Can I create an eSignature for the 9 3 form in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your vs 9 3 and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I complete vs 9 3 form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your report sales form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your sales form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

9 3 Form is not the form you're looking for?Search for another form here.

Keywords relevant to vs3 form

Related to vs 9 3 report form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.