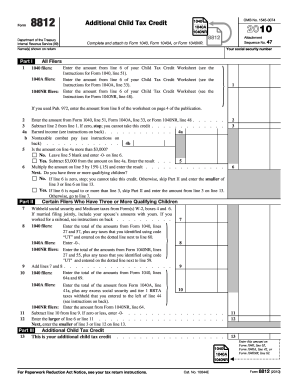

IRS 8812 2011-2024 free printable template

Get, Create, Make and Sign

Editing revenue treasury internal online

IRS 8812 Form Versions

How to fill out revenue treasury internal 2011-2024

Who needs internal service?

Video instructions and help with filling out and completing revenue treasury internal

Instructions and Help about child tax deduction form

Welcome to tax teach I hope you're all having a great day my name is Sean I'm a certified public accountant specializing in taxation today I want to talk about how to fill out schedule 8812 the child tax credit schedule now you need to fill out the schedule in order to receive the child tax credit which can be as high as 3 600 if you have children 5 and younger or if you have children that are older than 5 so 6 to 17 you can get up to 3 000 for the 2021 tax year so without further ado I'm going to get into how to fill out the child tax credit schedule 8812. All right here's schedule 8812 credits for qualifying children and other dependents and in this example I'm going to assume the taxpayer Jane Doe is a single mother of two children one child being the age of five and one child being the age of eight so with that fact pattern I'm going to go over how to fill out this schedule so let's get into it part one dash a child attachment other credit for other dependents line one enter the amount...

Fill 8812 online : Try Risk Free

People Also Ask about revenue treasury internal

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your revenue treasury internal 2011-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.