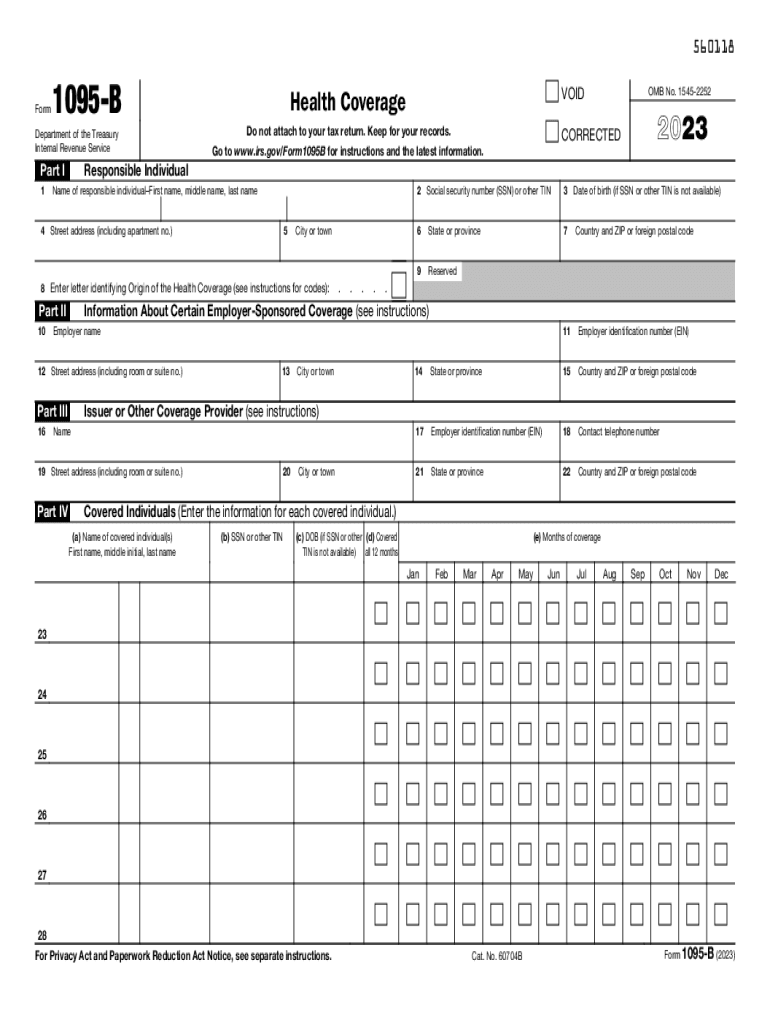

What is the 1095-B form?

Form 1095-B ("Health Coverage") aims to report to the IRS details of taxpayers' and their family members' minimum essential health coverage. According to the Affordable Care Act, almost all American citizens must have minimum essential coverage. A taxpayer will have to consider information on IRS Form 1095-B when it is time to file a tax return, in particular, to check a box stating if a filer has insurance coverage. However, they should not attach it to their tax return report but keep it for their records.

Who should file the IRS 1095-B form 2023?

Every entity that provides health insurance coverage to an individual throughout the year must indicate the insured persons and report the amount of coverage. These entities include employers that offer certain types of health care coverage to their employees and their dependents, insurance companies outside the Marketplace, and government agencies.

The entities that must furnish this document to taxpayers can cover their employees' health insurance or insurance providers. The first case is more common, yet it is applicable only if a company employs less than 50 full-time workers. If 50 or more employees are working for an employer, you should use IRS Form 1095-C instead.

What information do you need when you file form 1095-b?

Form 1095-B consists of several blocks to fill out:

- Details about the responsible individual (employee) such as name, address, date of birth, SSN (or TIN)

- Employer-sponsored coverage information (employer), including EIN

- The issuer or other coverage providers' information (insurance company)

- List of all covered individuals from the employee's tax family (personal details, SSN or TIN, and the number of months they had coverage in 2023).

There are instructions for 1095-B form recipients included in the document.

How do I fill out the 1095 B form in 2024?

Employers and other health coverage providers can fill out and deliver the 1095-B form to their covered individuals on paper or electronically.

If you prefer a faster and more secure way of managing reports, you can use the powerful pdfFiller editor and take advantage of its extended file-sharing options. To fill out your form online, follow these steps:

- Click Get Form to upload it to the editor to fill it out.

- Complete your 1095-B form by checking the corresponding box for Void or Corrected document.

- Click Next to move to each fillable field and not miss any required data.

- Click Done when the document is ready.

- Download your 1095 b tax form, print it if needed, email it to the recipient, or use the USPS mailing service right inside the editor.

Please note that form 1095 b doesn't require any signatures.

Is the 1095 B form accompanied by other forms?

Even though the information provided on form 1095-B is referred to on the annual tax return, there is no need to attach it to the 1040 or an equivalent report. The completed Health Coverage Report should be kept in an individual's tax file.

When is the 1095 B form due?

The yearly deadline for health insurance providers and employers to send the 1095-b form to individuals with coverage is January 31st. In 2022, the IRS prolonged the due date for employers or insurance providers to furnish form 1095-B to individuals to March 2nd.

Where do I send form 1095-B?

Employers and health insurance providers must file a 1095-B form to each individual they provide health coverage. The insured person should not send out the received form 1095-B. Still, it is recommended to retain it in tax records.