IRS 7200 2021 free printable template

Show details

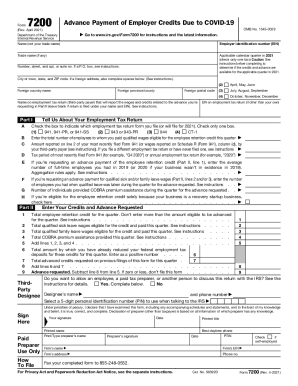

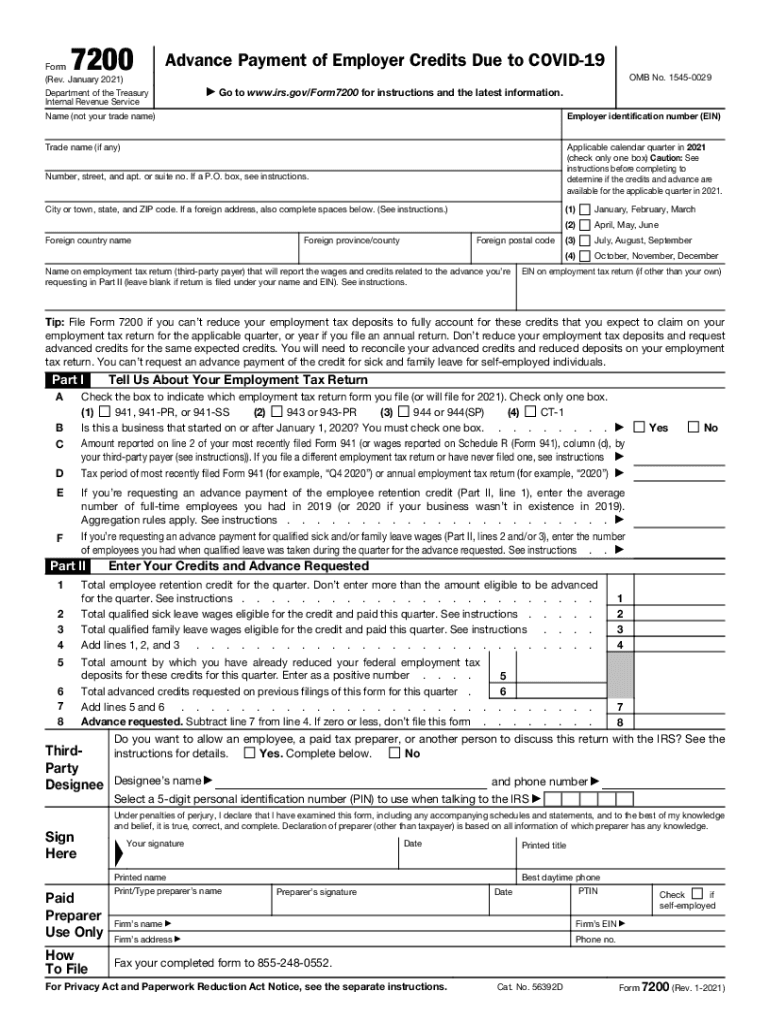

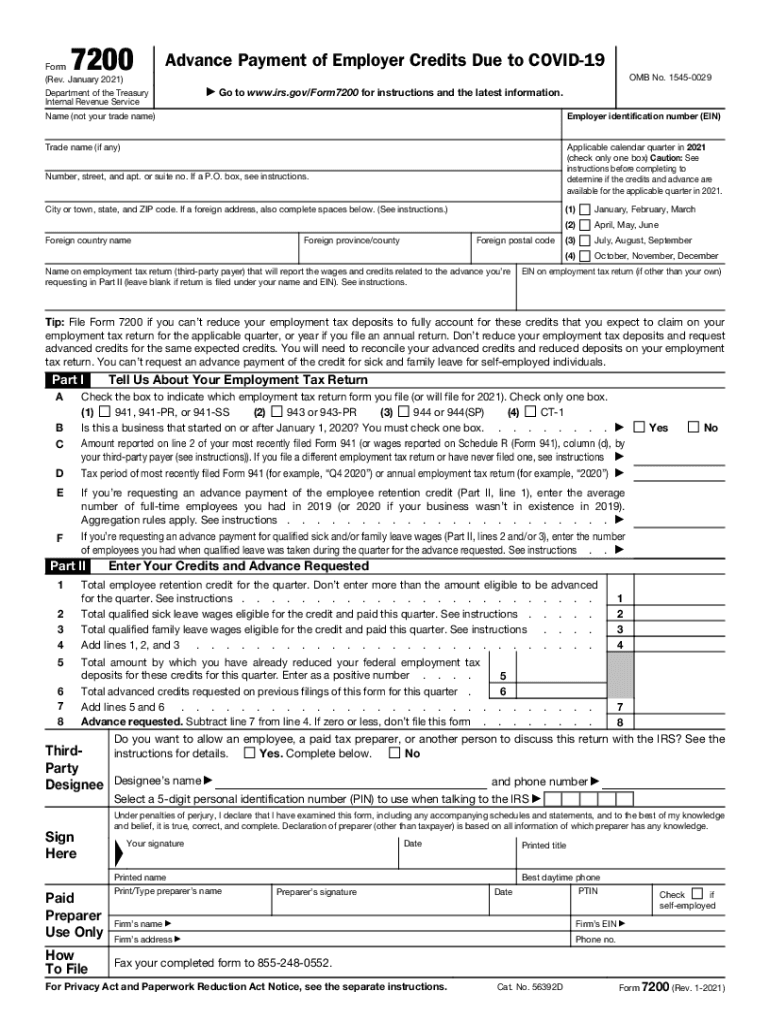

7200Form (Rev. January 2021) Department of the Treasury Internal Revenue ServiceAdvance Payment of Employer Credits Due to COVID-19 OMB No. 15450029 Go to www.irs.gov/Form7200 for instructions and

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your 7200 2021 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 7200 2021 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 7200 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 7200 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

IRS 7200 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 7200 2021 form

How to fill out 7200?

01

Gather all necessary information and documents required to complete the form.

02

Start by carefully reading through the instructions provided on the form.

03

Begin filling out the form by entering your personal information, such as your name, address, and contact details.

04

Follow the order of the sections on the form and fill in each section accurately and completely. Make sure to double-check your entries for any errors or missing information.

05

If there are any specific requirements or additional documents needed, make sure to attach them in the designated spaces or provide them separately as instructed.

06

Review the completed form to ensure all information is correct and legible.

07

Sign and date the form where necessary, following any additional instructions pertaining to signatures.

08

Make a copy of the completed form for your records before submitting it.

Who needs 7200?

01

Individuals who are required to report certain financial information, such as incomes, deductions, and credits, to the tax authorities.

02

Businesses or self-employed individuals who need to provide financial statements or income information to regulatory bodies or potential investors.

03

Organizations or institutions that are obligated to submit specific financial reports or data to government agencies or stakeholders.

Fill form 7200 fillable : Try Risk Free

People Also Ask about 7200

Is there a worksheet for the employee retention credit?

What is Form 7200 for dummies?

How long does it take IRS to process Form 7200?

How do you file Form 7200?

How do you calculate employee retention credit?

Can I file Form 7200 2022?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 7200?

7200 is a number that can refer to different things depending on the context. Please provide more details or specify what you are referring to.

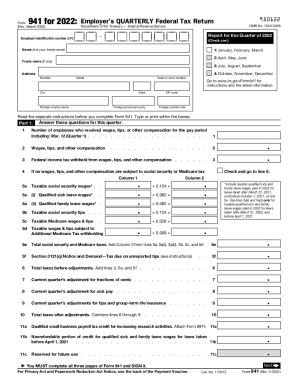

Who is required to file 7200?

Form 7200, also known as the Employer's Quarterly Federal Tax Return, is required to be filed by employers who withhold income, social security, or Medicare taxes from their employees' wages or who are required to pay the employer's portion of social security or Medicare tax. This form is typically filed by businesses with employees, including corporations, partnerships, sole proprietors, and non-profit organizations.

How to fill out 7200?

To fill out form 7200, you will need the following information:

1. Employer identification number (EIN)

2. Business name and address

3. Filing date

4. The total number of full-time equivalent employees and total number of employees for each month you are claiming the credit for.

5. The qualified wages and health plan expenses eligible for the credit for each month.

6. The number of hours each employee worked each month if calculating the credit based on a reduction in hours.

7. The total amount of refundable advance payments received for each quarter if applicable.

Here is a step-by-step guide on how to fill out form 7200:

1. Begin by entering your business name and address in Part I, line 1.

2. Enter the employer identification number (EIN) on line 2.

3. Fill in the applicable quarter or quarters you are claiming the credit in Part I, line 3.

4. In Part I, line 4, provide the total number of full-time equivalent employees each month. You will also enter this information for each quarter in Part II if applicable.

5. Fill in the total number of employees for each month on Part I, line 4b.

6. In Part I, line 5, input the qualified wages and health plan expenses for each month. If you are claiming the employee retention credit, you will need to break down the qualified wages by the various eligible categories (e.g., maximum credit per employee, qualified health plan expenses).

7. If you are claiming the credit based on a reduction in hours, fill in Part I, line 6 with the number of hours each employee worked in each month.

8. If you have received any refundable advance payments for the relevant quarter, enter the total in Part I, line 7.

9. Calculate the total refundable portion of the credits you claimed or intend to claim on your employment tax return (Form 941, 943, 944, or CT-1) and enter it in Part I, line 8.

10. Sign and date the form in Part II, line 9.

Once you have completed filling out the form, keep a copy for your records and submit it to the IRS according to their instructions and deadlines.

What is the purpose of 7200?

There are several possible interpretations for "7200," so here are some potential purposes associated with this number:

1. Time: 7200 seconds equal 2 hours, so it could refer to a duration or a specific time period.

2. Mathematical Calculation: 7200 could be used as a number in various calculations or equations depending on the context.

3. Networking and Internet: In the context of computer networking and internet, "7200" could refer to a widely-used router model, such as the Cisco 7200 Series.

4. Banking: 7200 can be the number of rotations per hour for certain types of banking equipment like ATMs or cash sorters.

5. Random Possibilities: "7200" might represent a code, a number assigned to something specific, or even a fictional element in a story.

As this question lacks context, it is difficult to determine the specific purpose of "7200" being referred to.

What information must be reported on 7200?

Form 7200, also known as the Advance Payment of Employer Credits Due to COVID-19, is used by employers to request an advance payment of tax credits for the qualified sick and family leave wages, employee retention credit, and COBRA premium assistance credit. The following information must be reported on Form 7200:

1. Employer Information: The name, address, and employer identification number (EIN) of the employer requesting the advance payment.

2. Quarterly Information: The quarter for which the advance payment is requested, which should correspond to the period for which the qualified wages were paid.

3. Total Employment Tax Liabilities: The total employment tax liabilities for the preceding calendar quarter, including federal income tax withheld, employee and employer share of social security and Medicare taxes, and any other federal employment taxes.

4. Refundable Credits: The amount of refundable credits the employer expects to claim and repay against the employment tax liabilities, including the qualified sick and family leave wages, employee retention credit, and COBRA premium assistance credit.

5. The Advance Payment Requested: The amount of advance payment requested by the employer, which is the anticipated amount of refundable credits that exceeds the employment tax liabilities reported.

6. Deposits and Refunds: Any federal employment tax deposits made, and the amounts requested as refunds, as reported on Form 941, Employer's Quarterly Federal Tax Return, or Form 944, Employer's Annual Federal Tax Return.

It's important to note that the specific instructions for Form 7200 may change based on updates from the Internal Revenue Service (IRS), so employers should consult the latest guidance and instructions provided by the IRS when filling out this form.

How do I make changes in 7200?

With pdfFiller, the editing process is straightforward. Open your 7200 form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my form 7200 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your advance employer credit and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I fill out advance credit form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your advance payment employer 7200 form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your 7200 2021 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 7200 is not the form you're looking for?Search for another form here.

Keywords relevant to employer credit form

Related to 7200 online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.