A flexible approach to U.S. growth and income investing

Fundamental Investors®

INCEPTION DATE

August 01, 1978

IMPLEMENTATION

Consider for a large-cap core allocation

OBJECTIVE

Seeks to achieve long-term growth of capital and income

VEHICLE

Fundamental Investors

Fundamental Investors investment professionals use in-depth, bottom-up research to identify undervalued companies with attractive appreciation potential.

INVESTING IN GROWTH

Identifying the companies powering growth

Fundamental Investors makes investments in the companies powering economic growth and developing new products and services. Our investment professionals seek to identify overlooked companies with attractive prospects for capital appreciation, including those outside of traditional industries.

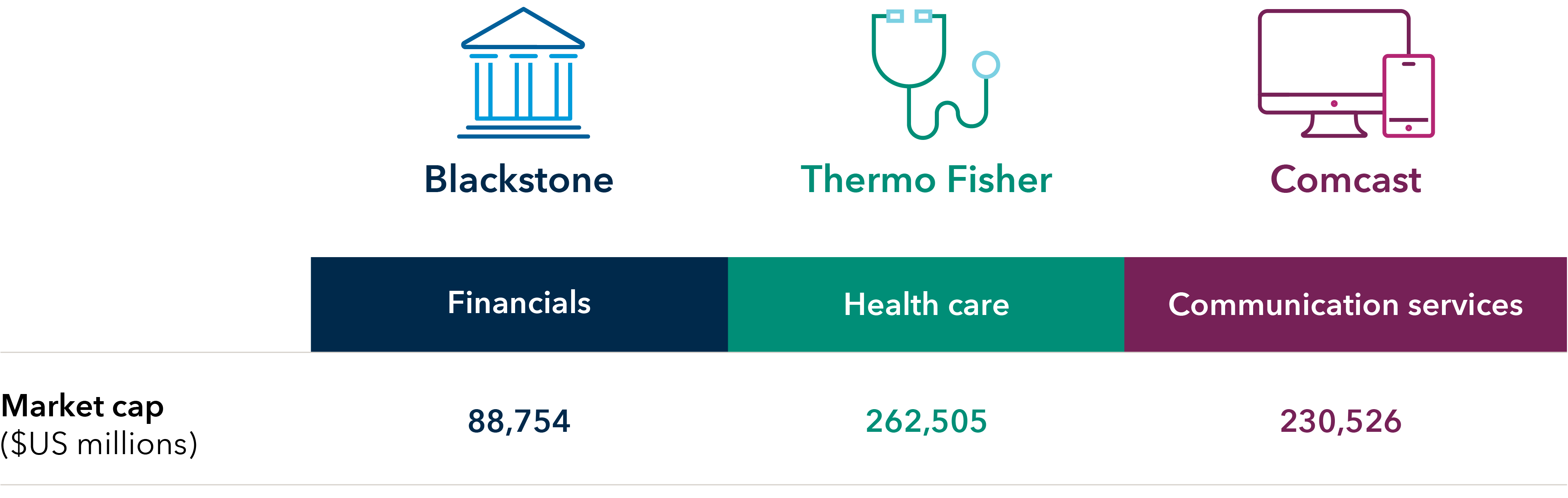

IDENTIFYING LONG-TERM LEADERS IN A BROAD RANGE OF SECTORS

Examples of top holdings in the portfolio (as of December 31, 2021)*

Investment thesis

Blackstone

- A U.S.-based alternative investment management company with approx. $620 billion in AUM. Strong industry reputation that allows company to retain top talent.

- Core and insurance business should allow Blackstone to scale while retaining capital flexibility.

- Strong growth prospects with a proven ability to incubate and scale new asset classes quickly.

Thermo Fisher

- The global leader in scientific equipment, instrumentation and services for the health care, research and diagnostics industries.

- With a level of global scale unmatched in the life sciences industry, the company has benefited from the worldwide growth in biopharma and health care spending.

- Through a series of acquisitions, management has enlarged Thermo Fisher’s footprint by expanding into new and growing markets.

Comcast

- Large media conglomerate with 24M U.S. pay TV customers and 31M broadband subscribers. A manageable balance sheet enables company to grow its dividend.

- Broadband business is strong and should remain robust in the coming years.

- The mix shift from video to broadband is marginally accretive. Capital intensity should come down with video to broadband shift.

*Companies shown are among the top 20 equity holdings by weight in Fundamental Investors as of 12/31/21. (Microsoft, Broadcom, Meta Platforms, Alphabet, Amazon, Philip Morris, UnitedHealth Group, Netflix, Comcast, Pfizer, Altria, Centene, Applied Materials, British American Tobacco, Blackstone, Micron Technology, Thermo Fisher, JPMorgan Chase, CSX, Apple).

Sources: FactSet, Capital Group, and Morningstar. As of December 31, 2021.