Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

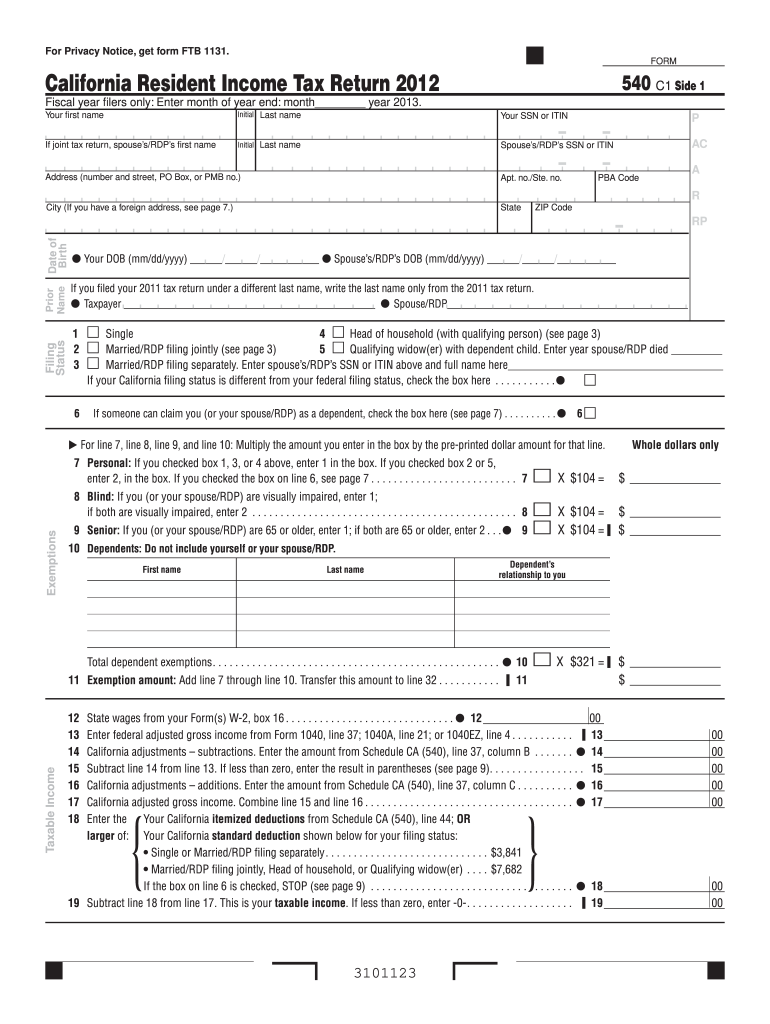

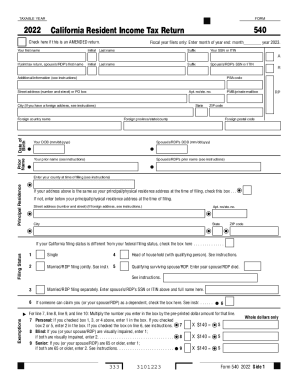

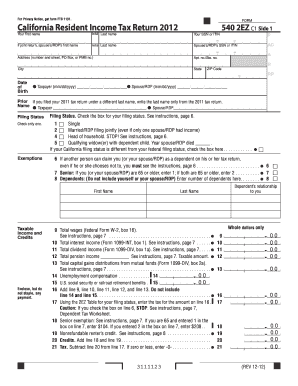

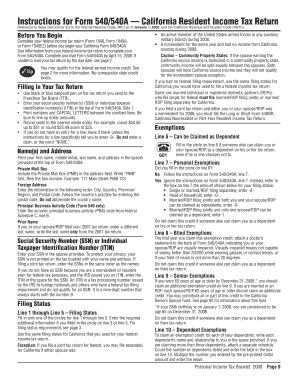

The 540 form refers to the California Resident Income Tax Return. It is used by individuals who are residents of California to report their income, deductions, and credits for state income tax purposes. This form is filed annually with the California Franchise Tax Board to determine the taxpayer's state income tax liability or refund.

Who is required to file 540 form?

The 540 form is a California Individual Income Tax Return, and it must be filed by residents of California who earned income in the state or nonresidents who earned income from California sources. Additionally, individuals with a filing requirement are required to file a 540 form, regardless of whether they owe additional taxes or are due a refund.

How to fill out 540 form?

To fill out a 540 form, follow these steps:

1. Download or obtain a copy of the California 540 form. You can find it on the official website of the California Franchise Tax Board (FTB).

2. Provide your personal information including your name, Social Security number, and the taxable year you are filing for.

3. Fill in your filing status in the appropriate section. You can choose between options such as single, married filing jointly, married filing separately, head of household, etc.

4. If you are claiming any dependents, enter their information including names and Social Security numbers.

5. Proceed to the income section. Report all your income sources, such as wages, salaries, tips, interest, dividends, rental income, etc. Use the provided lines and boxes to enter the relevant figures.

6. Deduct any adjustments to your income by filling out the corresponding lines. This may include items like student loan interest deduction, educator expenses, health savings account deductions, etc.

7. Calculate your taxable income by subtracting the adjustments from your total income. Transfer this figure to the appropriate line.

8. Move on to the tax and credits section. Calculate your California tax liability using the tax rate schedule provided in the form. Enter the amount in the designated space.

9. If you have any tax credits, such as child tax credits or educational credits, fill in the appropriate lines to apply these.

10. Determine your tax payments and any refunds or amounts due. Subtract your tax credits from your tax liability and add any estimated tax payments or taxes withheld from your wages. Enter the resulting amount.

11. If you owe additional tax, include your payment or choose to pay electronically through the FTB's online payment system.

12. Sign and date the form. If you are filing jointly, both spouses must sign.

13. Make a copy of the completed form, along with any required attachments such as W-2s or 1099s, for your records.

14. Mail the original form and attachments to the designated address provided on the form or file your taxes electronically using the FTB's e-file system if eligible.

Remember to review your form carefully before submitting it to ensure accuracy and avoid any potential issues.

What is the purpose of 540 form?

The purpose of Form 540 is to report and calculate a California resident individual's taxable income and determine the state income tax liability for the tax year. It is used by individuals who are residents of California for tax filing purposes. The form includes various sections where taxpayers report their income, deductions, credits, and exemptions, and calculate the final tax amount they owe or the refund they are entitled to receive.

What information must be reported on 540 form?

The 540 form, also known as the California Resident Income Tax Return, is used to report and pay personal income tax to the state of California. The information that must be reported on the 540 form includes:

1. Personal information: Including your name, Social Security number, and filing status.

2. Income: Report all sources of income, including wages, salaries, self-employment income, rental income, dividends, interest, and any other taxable income.

3. Adjustments to income: Identify any deductions or adjustments you may be eligible for, such as contributions to retirement plans or Health Savings Accounts.

4. California withholding: Report any state income tax withheld from your paychecks or other sources of income.

5. Credits: Report any tax credits, such as the California Earned Income Tax Credit or the California College Access Tax Credit, that you may be eligible for.

6. Payments: Report any estimated tax payments or any additional tax payments you made throughout the year.

7. California Use Tax: Report any purchases made from out-of-state retailers where California sales tax was not paid.

8. Other information: Report any other required information, such as dependent information, healthcare coverage information, and any other required supporting documentation.

It is important to note that this is just a general overview, and there may be additional forms or schedules that need to be filed depending on individual circumstances. It is always advisable to consult with a tax professional or refer to the California Franchise Tax Board for specific requirements.

When is the deadline to file 540 form in 2023?

The deadline to file Form 540 for the tax year 2023 is typically April 15, 2024. However, please note that tax deadlines can be subject to change, and it is advisable to verify the specific deadline with the California Franchise Tax Board or consult a tax professional.

What is the penalty for the late filing of 540 form?

The penalty for late filing of California Form 540 varies depending on how late the form is filed. The penalty is calculated as a percentage of the unpaid tax. The following are the penalties:

- 5% of the unpaid tax is charged if the form is filed within 60 days after the due date.

- An additional 5% of the unpaid tax is charged if the form is filed over 60 days late or if the taxpayer fails to respond to a notice from the Franchise Tax Board (FTB) within 60 days.

- The penalty increases to 15% if the return is filed over 120 days late or if the taxpayer fails to respond to an FTB notice within 120 days.

Note that interest is also charged on any unpaid tax from the due date until the tax is paid in full. It is important to file the form and pay any taxes owed as soon as possible to avoid further penalties and interest.

Where do I find 2012 540 form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific 2012 540 form and other forms. Find the template you need and change it using powerful tools.

How do I complete 2012 540 form online?

pdfFiller has made it easy to fill out and sign 2012 540 form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit 2012 540 form on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as 2012 540 form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.